How much money do Americans need to become residents in Spain in 2022?

If you're a US citizen who is looking to move to Spain but you’re wondering if not having a job will influence your chances of obtaining residency, here’s how much money you need to have saved up to be allowed to live in the country in 2022.

Michael Douglas, Ernest Hemingway and Ava Gardner are among the most famous Americans to have fallen in love with the Spanish lifestyle and made “España” their home away from home.

And while not everybody is lucky enough to have a Hollywood bank account, and immigration policies are stricter than they once were, US citizens can still obtain residency in Spain even if they’re not coming to work.

This article is therefore geared to US citizens who have either not landed a job in Spain yet, are not planning to work, study, do business or invest in the country and are not intending to obtain residency through having Spanish family roots or an EU partner.

The main focus will be the non-lucrative residency permit and any other option available to Americans for obtaining residency through financial means.

What is Spain’s non-lucrative residency permit?

A non-lucrative visa is an authorisation that allows non-EU foreigners to stay in Spain for a period of more than 90 days without working or carrying out professional activities, by demonstrating that they have sufficient financial means for themselves and, if applicable, their family.

In Spanish it’s called a “visado de residencia no lucrativa” and it’s often referred to as a retirement visa, as this is the best option for retirees from non-EU countries who want to move to Spain.

Photo: Juan Marroquin/Pixabay

Photo: Juan Marroquin/Pixabay

It is however available to third country nationals of all ages who can prove they have the financial means, and is also a good option for US citizens who want to first travel and get to know Spain better for a year before starting work, as it allows for an easy conversion to a work permit.

Spain’s non-lucrative residency permit is a temporary residence visa which lasts for one year.

The first and second residence renewals last for two years each, after which five years of residency will have been obtained and therefore the possibility of applying for long-term residency, which last for five years.

After ten years of residence in Spain, US citizens can obtain Spanish citizenship, although they will technically have to renounce their American nationality in the process.

READ ALSO: What you need to know about applying for Spain’s non-lucrative visa

How much money do US nationals need to show to get Spain’s non-lucrative visa?

This is a trickier question than it may seem as there are often discrepancies in what constitutes “sufficient financial means” between Spain’s regions, provinces and even the Spanish consulates and embassies from which foreigners apply for the visa (you apply from the US, not from Spain).

Spain’s Royal Decree states that sufficient financial means “will not exceed the level of resources by which social subsidies are granted to Spaniards or the amount of the minimum Social Security pension”.

The Spanish government is referring to the IPREM, an indicator that in 2022 will rise to €579.02 ($654 with the current exchange rate) per month, just under €20 more than in 2021 and €50 more than in 2020.

The standard financial requirement for non-lucrative visa applicants is 400 percent of the IPREM: €2,316 ($2,615) per month.

So for a US national wanting to apply for the non-lucrative residency permit for Spain for the first time (it lasts one year), the amount they need to prove is €27,792 ($31,390), more than €600 than for those who applied in 2021.

For every family member included in the residency application it’s an extra 100 percent of the IPREM you need to prove you have: €6,948 ($7,847) for the year.

So if an American couple is applying, it’s €34,740 ($39,237) annually in savings or a monthly income through investments, pensions or other assets or €2,895 ($3,269) a month.

For a US family of three it’s €41,724 ($47,126) of available income a year; for a family of four it’s €48,708 ($55,014) and so on, adding €6,948 ($7,847) for each family member.

If you’re renewing your non-lucrative visa for the first and second time, bear in mind that you will have to prove you have 800 percent of the IPREM as the renewed residence permit is valid for two years.

For an individual, that amounts to €55,584 ($62,780) that they can prove they’ll have available.

If you have that plenty of capital available, you may want to consider if Spain's golden visa is more suitable for you, and if you don't, consider Spain's business visa or new offering for startups, investors and digital nomads.

READ ALSO:

- Tax cuts and visas: Spain’s new law for startups, investors and digital nomads

- How Americans can live and work in Spain

Remember that the above figures are to be used as a reference, given the disparities in judgement of how much money constitutes ‘enough’ by the different immigration offices across Spain and Spanish embassies and consulates abroad.

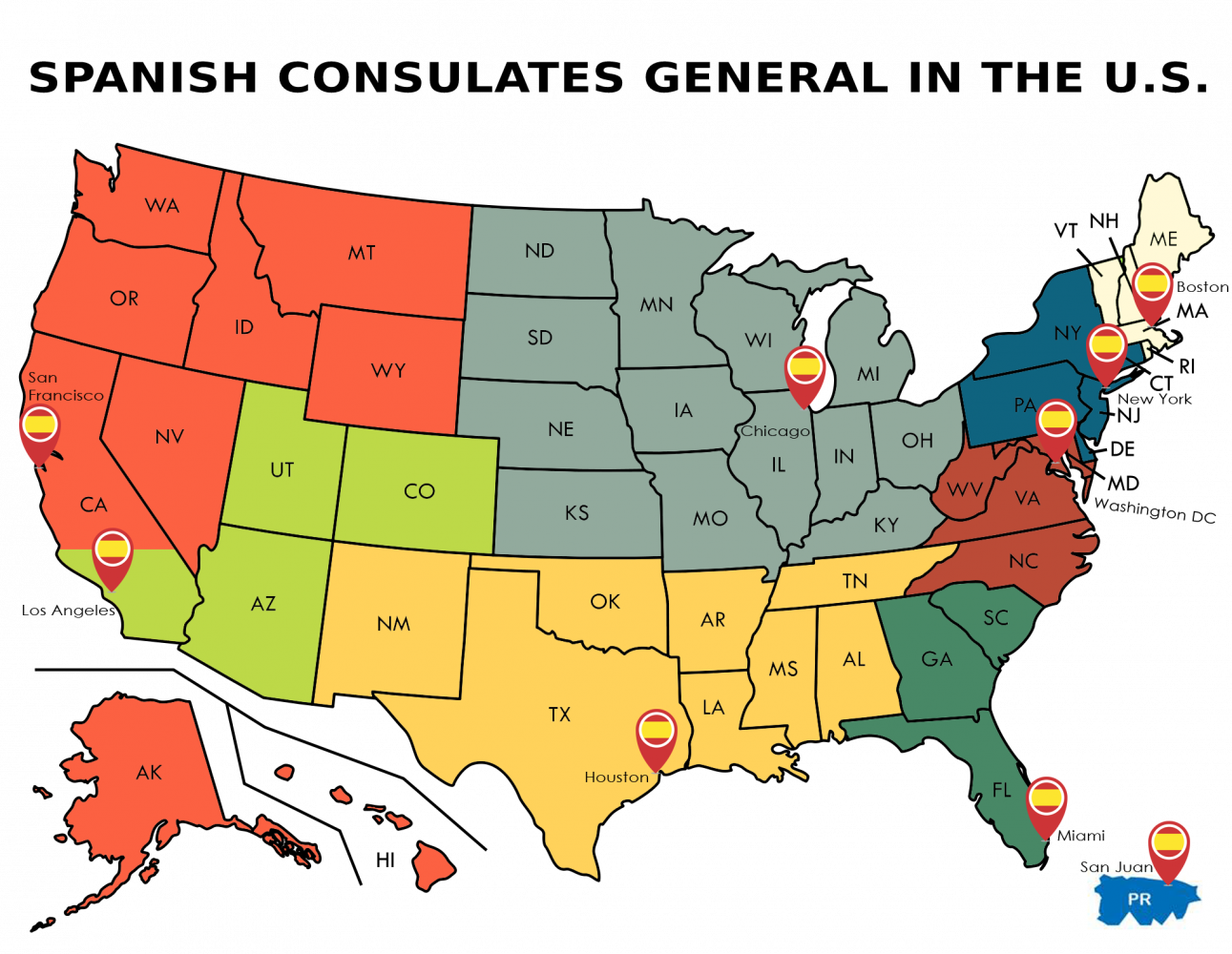

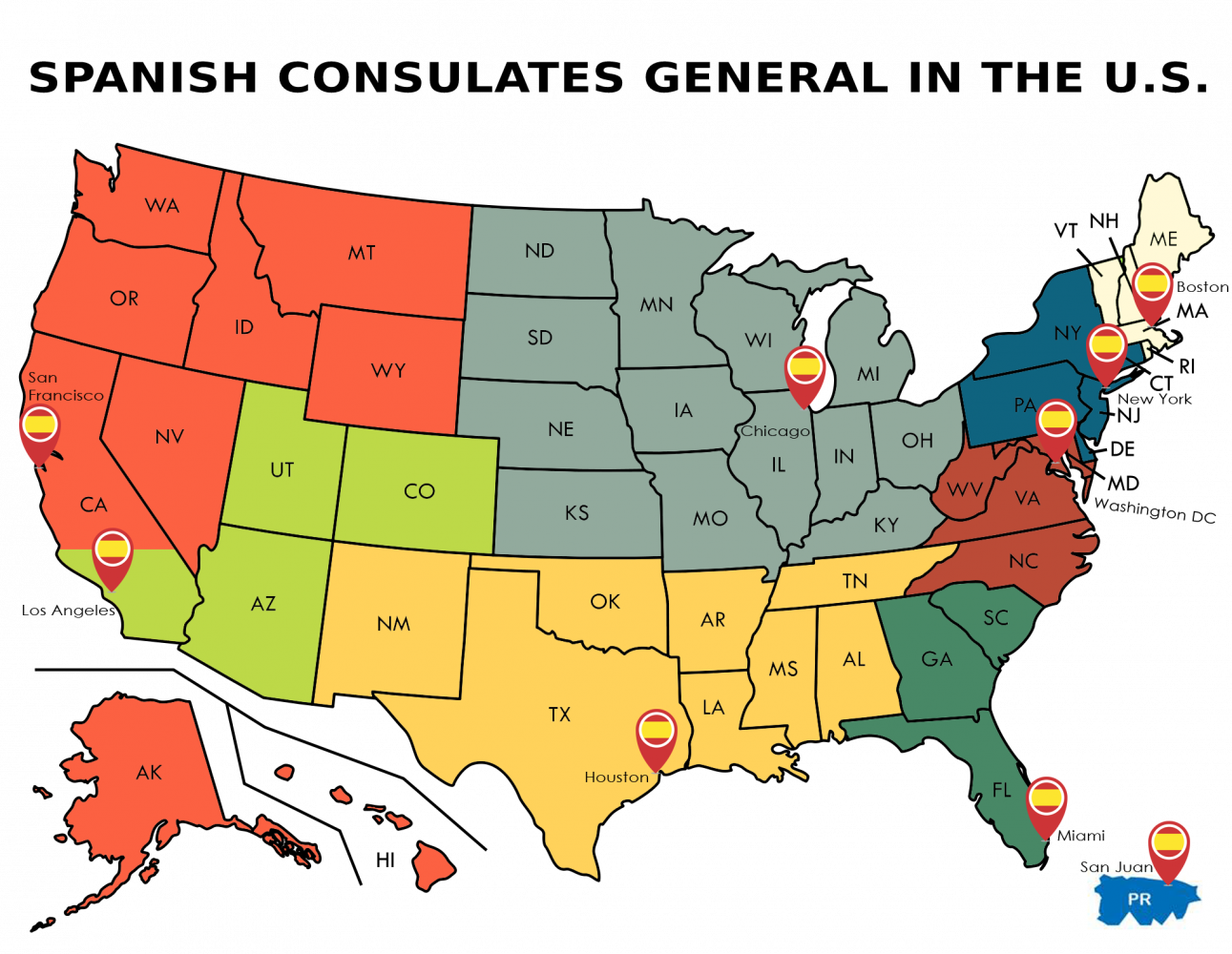

Photo: Spain's Foreign Ministry

Balcells Group, an immigration law firm based in Spain, states that “depending on which consulate you apply in (for example in Washington or Moscow), the minimum amount is much higher” as the initial visa application has to be done in the country of origin or where you currently reside.

“There isn't an exact amount given by Spanish authorities but from my experience it's upwards of €30,000, although the figure can vary,” Margaret Hauschild Rey, an immigration lawyer for Madrid-based English-speaking law firm Bennet&Rey, told The Local.

“Obviously the more assets you can prove the better.”

The documentation required as proof of income can also vary, but many consulates require a recent bank account certificate, statements from the past six months and on occasions credit cards or property values can also be presented.

READ ALSO:

- 11 burning questions for Americans wanting to move to Spain

- Where in Spain do all the Americans live?

Are there any other important factors Americans should be aware of?

Aside from being able to prove a reliable, ongoing source of income and substantial savings, keep in mind that you will have to take out comprehensive private health insurance which offers the same cover as Spain’s public healthcare system.

“What they haven't always necessarily factored in before committing to residency in Spain is how difficult it can be to obtain private health cover that's well-priced or even available, especially for seniors or those with pre-existing health conditions,” Hauschild Rey told The Local.

This must be with a Spanish medical insurance company, be at least one year long and offer full coverage with no co-payments.

READ ALSO: What are the best private health insurance options in Spain for foreigners?

“Many foreigners are also unaware of the tax implications that come with spending long periods of time in Spain,” Hauschild Rey added.

“Spanish authorities consider you to be a tax resident if you spend more than 180 days a year in the country.

“Our advice is to speak to a fiscal adviser who is familiar with the tax systems of both Spain and the US - whenever possible - if they want to get a full picture of how taxes and fiscal responsibilities compare.

Although you can’t work in Spain with a non-lucrative visa, you will be able to invest in shares or businesses in Spain as an extra means of income, but remember these will be subject to capital gains tax.

Obtaining Spanish residency through this permit also allows Americans to visit all other Schengen countries in Europe without the need for a visa.

There is one other way that Americans can obtain residency in Spain through having sufficient financial means: buying a property worth €500,000 through the scheme called “Residencia por adquisición de bienes inmuebles en España” known in English as the Golden Visa scheme.

For more information on requirements and documentation for the non-lucrative visa for Americans, click here for consular advice from Washington and here for Los Angeles, but check the consulates map above to find out which one you should process the application through.

Keep in mind that each Spanish consulate in the US could have its own set of requirements (apart from different markers for what constitutes sufficient financial means), so make sure you find out before beginning the application.

READ ALSO:

- How Americans can retire in Spain

- Can I be a non-resident for tax purposes with Spain’s non-lucrative visa?

- READ ALSO: What foreigners should be aware of before becoming residents in Spain

Comments (1)

See Also

Michael Douglas, Ernest Hemingway and Ava Gardner are among the most famous Americans to have fallen in love with the Spanish lifestyle and made “España” their home away from home.

And while not everybody is lucky enough to have a Hollywood bank account, and immigration policies are stricter than they once were, US citizens can still obtain residency in Spain even if they’re not coming to work.

This article is therefore geared to US citizens who have either not landed a job in Spain yet, are not planning to work, study, do business or invest in the country and are not intending to obtain residency through having Spanish family roots or an EU partner.

The main focus will be the non-lucrative residency permit and any other option available to Americans for obtaining residency through financial means.

What is Spain’s non-lucrative residency permit?

A non-lucrative visa is an authorisation that allows non-EU foreigners to stay in Spain for a period of more than 90 days without working or carrying out professional activities, by demonstrating that they have sufficient financial means for themselves and, if applicable, their family.

In Spanish it’s called a “visado de residencia no lucrativa” and it’s often referred to as a retirement visa, as this is the best option for retirees from non-EU countries who want to move to Spain.

Photo: Juan Marroquin/Pixabay

Photo: Juan Marroquin/Pixabay

It is however available to third country nationals of all ages who can prove they have the financial means, and is also a good option for US citizens who want to first travel and get to know Spain better for a year before starting work, as it allows for an easy conversion to a work permit.

Spain’s non-lucrative residency permit is a temporary residence visa which lasts for one year.

The first and second residence renewals last for two years each, after which five years of residency will have been obtained and therefore the possibility of applying for long-term residency, which last for five years.

After ten years of residence in Spain, US citizens can obtain Spanish citizenship, although they will technically have to renounce their American nationality in the process.

READ ALSO: What you need to know about applying for Spain’s non-lucrative visa

How much money do US nationals need to show to get Spain’s non-lucrative visa?

This is a trickier question than it may seem as there are often discrepancies in what constitutes “sufficient financial means” between Spain’s regions, provinces and even the Spanish consulates and embassies from which foreigners apply for the visa (you apply from the US, not from Spain).

Spain’s Royal Decree states that sufficient financial means “will not exceed the level of resources by which social subsidies are granted to Spaniards or the amount of the minimum Social Security pension”.

The Spanish government is referring to the IPREM, an indicator that in 2022 will rise to €579.02 ($654 with the current exchange rate) per month, just under €20 more than in 2021 and €50 more than in 2020.

The standard financial requirement for non-lucrative visa applicants is 400 percent of the IPREM: €2,316 ($2,615) per month.

So for a US national wanting to apply for the non-lucrative residency permit for Spain for the first time (it lasts one year), the amount they need to prove is €27,792 ($31,390), more than €600 than for those who applied in 2021.

For every family member included in the residency application it’s an extra 100 percent of the IPREM you need to prove you have: €6,948 ($7,847) for the year.

So if an American couple is applying, it’s €34,740 ($39,237) annually in savings or a monthly income through investments, pensions or other assets or €2,895 ($3,269) a month.

For a US family of three it’s €41,724 ($47,126) of available income a year; for a family of four it’s €48,708 ($55,014) and so on, adding €6,948 ($7,847) for each family member.

If you’re renewing your non-lucrative visa for the first and second time, bear in mind that you will have to prove you have 800 percent of the IPREM as the renewed residence permit is valid for two years.

For an individual, that amounts to €55,584 ($62,780) that they can prove they’ll have available.

If you have that plenty of capital available, you may want to consider if Spain's golden visa is more suitable for you, and if you don't, consider Spain's business visa or new offering for startups, investors and digital nomads.

READ ALSO:

- Tax cuts and visas: Spain’s new law for startups, investors and digital nomads

- How Americans can live and work in Spain

Remember that the above figures are to be used as a reference, given the disparities in judgement of how much money constitutes ‘enough’ by the different immigration offices across Spain and Spanish embassies and consulates abroad.

Photo: Spain's Foreign Ministry

Balcells Group, an immigration law firm based in Spain, states that “depending on which consulate you apply in (for example in Washington or Moscow), the minimum amount is much higher” as the initial visa application has to be done in the country of origin or where you currently reside.

“There isn't an exact amount given by Spanish authorities but from my experience it's upwards of €30,000, although the figure can vary,” Margaret Hauschild Rey, an immigration lawyer for Madrid-based English-speaking law firm Bennet&Rey, told The Local.

“Obviously the more assets you can prove the better.”

The documentation required as proof of income can also vary, but many consulates require a recent bank account certificate, statements from the past six months and on occasions credit cards or property values can also be presented.

READ ALSO:

- 11 burning questions for Americans wanting to move to Spain

- Where in Spain do all the Americans live?

Are there any other important factors Americans should be aware of?

Aside from being able to prove a reliable, ongoing source of income and substantial savings, keep in mind that you will have to take out comprehensive private health insurance which offers the same cover as Spain’s public healthcare system.

“What they haven't always necessarily factored in before committing to residency in Spain is how difficult it can be to obtain private health cover that's well-priced or even available, especially for seniors or those with pre-existing health conditions,” Hauschild Rey told The Local.

This must be with a Spanish medical insurance company, be at least one year long and offer full coverage with no co-payments.

READ ALSO: What are the best private health insurance options in Spain for foreigners?

“Many foreigners are also unaware of the tax implications that come with spending long periods of time in Spain,” Hauschild Rey added.

“Spanish authorities consider you to be a tax resident if you spend more than 180 days a year in the country.

“Our advice is to speak to a fiscal adviser who is familiar with the tax systems of both Spain and the US - whenever possible - if they want to get a full picture of how taxes and fiscal responsibilities compare.

Although you can’t work in Spain with a non-lucrative visa, you will be able to invest in shares or businesses in Spain as an extra means of income, but remember these will be subject to capital gains tax.

Obtaining Spanish residency through this permit also allows Americans to visit all other Schengen countries in Europe without the need for a visa.

There is one other way that Americans can obtain residency in Spain through having sufficient financial means: buying a property worth €500,000 through the scheme called “Residencia por adquisición de bienes inmuebles en España” known in English as the Golden Visa scheme.

For more information on requirements and documentation for the non-lucrative visa for Americans, click here for consular advice from Washington and here for Los Angeles, but check the consulates map above to find out which one you should process the application through.

Keep in mind that each Spanish consulate in the US could have its own set of requirements (apart from different markers for what constitutes sufficient financial means), so make sure you find out before beginning the application.

READ ALSO:

- How Americans can retire in Spain

- Can I be a non-resident for tax purposes with Spain’s non-lucrative visa?

- READ ALSO: What foreigners should be aware of before becoming residents in Spain

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.