Brexit: How Brits can properly plan their 90 out of 180 days in Spain and Schengen Area

British second home owners and other UK nationals in Spain who aren’t residents in the country now have to plan their time carefully to not fall foul of the law whilst making the most of their new non-EU rights. Here are some ways to do it successfully.

Know the rules

As you probably know, since the start of 2021 non-resident Brits can stay 90 days in any 180-day period within the Schengen Area, including Spain.

The date of entry is considered as the first day of stay in the Schengen territory and the date of exit is considered as the last day of stay in the Schengen territory.

However, it is possible to leave and re-enter the Schengen Area over that six-month period.

“The 180-day reference period is not fixed,” as the EU explains, “it is a moving window, based on the approach of looking backwards”.

That means taking a calendar and highlighting all the time spent in Spain and other Schengen countries already over the past 180 days.

There are also Schengen calculators that do the job for you.

If police or border officials ever question how long you’ve been in the EU, this will be how they calculate if you’ve overstayed or not.

It's worth stressing as well that the Schengen rule doesn't work with the calendar year, it's always a case of counting back 180 days.

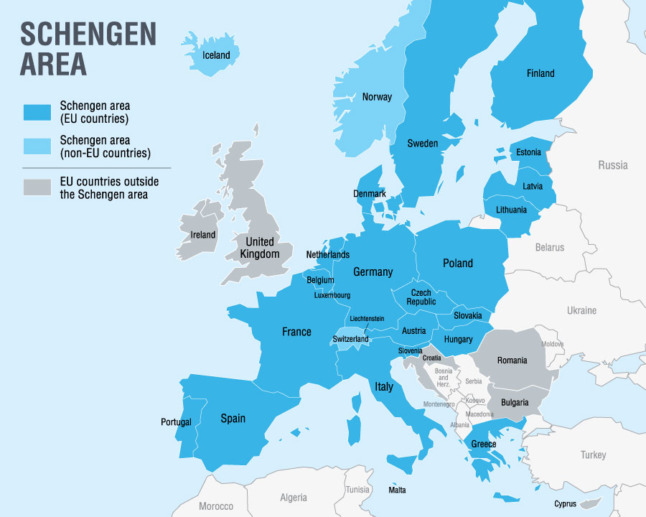

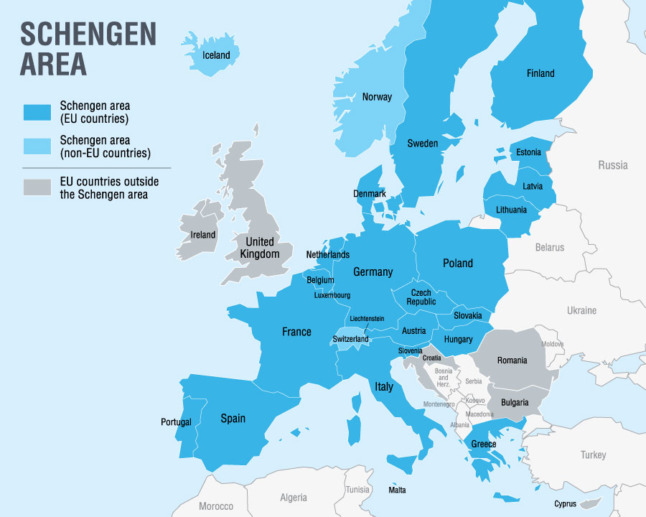

Schengen countries are Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Iceland, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

Time spent in Spain or the Schengen Area authorised under a residence permit or a long-stay visa are not taken into account in the calculation of the duration of the 90-day visa-free stay.

Map: European Travel Information & Authorization System

Accept that you’ll probably have to spend some time away from Spain

Whatever your preferences or calculations for your time spent in Spain and other Schengen countries, if you exhaust the 90 days in 180 day-period all in one go, you will have to spend 90 days outside of the Schengen Area.

As the europa.eu website puts it, “an absence for an uninterrupted period of 90 days allows for a new stay for up to 90 days”.

So when that happens, know that 90 full days outside of the Schengen Area and Spain will give you a new period of 90 days.

Plan ahead to make sure this absence from the Schengen Area doesn’t fall at a time when you want to be in Spain.

However, remember that you are always counting back the last 180 days, so if you have not exhausted the 90-day limit over the past six months, you will not have to leave the Schengen Area until that's the case.

Plan for winter in the sun

If you kickstart your 90 out of 180 day period during the summer in Spain, it will mean that the six-month window will end in winter, and you won’t be able to enter the Schengen Area for the next three months.

For many Brits in this situation it will mean spending the coldest, darkest and wettest months of the year back in 'Blighty', which is often exactly what they don’t want.

In order to enjoy warmer winters in Spain and mild summers in the UK, try to avoid starting your 180-day Schengen window in summer and wait instead until at least October or November to enjoy three months of winter sunshine for the following six months.

Photo: JOSE JORDAN / AFP

Photo: JOSE JORDAN / AFP

Consider neighbouring countries outside Schengen

If you have to leave Spain but you don’t want to return to the UK, consider spending some time in countries outside of the Schengen Area that aren’t too distant.

Morocco, Cyprus and Turkey are three options with more temperate climates and affordable prices.

It’s worth highlighting that time spent in other Schengen countries counts too, so factor this in if you’re planning on travelling around Europe.

Split your time in Spain into several trips

Over a period of 180 days, you can spend four three-week holidays (22.5 days each) in Spain, and alternate it with three-week periods in the UK or outside the Schengen Area.

You can also break the three months you have available into six-week periods. For example, if you arrive at the beginning of November in Spain, spend six weeks there till the middle of December, then return to the UK to spend Christmas and New Year in the UK, then go back to Spain in the middle of January until the end of February.

The UK’s Covid-19 travel restrictions and testing requirements mean this isn’t as affordable or practical at the moment, but in normal times there are countless low-cost airlines operating between both countries to make it a feasible option.

This way you’ll be able to spread out your time in Spain over a six-month period.

REMINDER: What are the rules for travel between Spain and the UK in September 2021?

Play by the rules

It is possible for third-country nationals such as Britons to get a short-stay visa extension which would allow them to spend more than 90 in 180 days in Spain.

But as Spanish authorities point out, you have to prove “exceptional reasons” for this extension to be accepted - usually force majeure reasons- and all the trouble you’ll go to process the paperwork (including proof of financial resources) isn’t worth it for the few extra weeks you’ll get.

Needless to say, spending time in your Spanish home doesn’t count as an exceptional reason.

Then there’s the matter of overstaying. Spain hasn’t given unregistered Brits already in the country before 2021 a date by which to register, although the advice for months from the UK embassy has been to become residents as soon as possible.

READ MORE: When is the deadline for Brits to apply for residency in Spain?

Needless to say, overstaying your time in Spain is not a good idea. There is no clear mention in Spanish government sources regarding fines, deportations or travel bans from the Schengen Area for overstayers.

But the likelihood of there being a record of this is high. Some sources say there are consequences, others that there aren’t, but the risk isn’t worth it if you intend to keep travelling back and forth between Spain and the UK for the foreseeable future.

Comments

See Also

Know the rules

As you probably know, since the start of 2021 non-resident Brits can stay 90 days in any 180-day period within the Schengen Area, including Spain.

The date of entry is considered as the first day of stay in the Schengen territory and the date of exit is considered as the last day of stay in the Schengen territory.

However, it is possible to leave and re-enter the Schengen Area over that six-month period.

“The 180-day reference period is not fixed,” as the EU explains, “it is a moving window, based on the approach of looking backwards”.

That means taking a calendar and highlighting all the time spent in Spain and other Schengen countries already over the past 180 days.

There are also Schengen calculators that do the job for you.

If police or border officials ever question how long you’ve been in the EU, this will be how they calculate if you’ve overstayed or not.

It's worth stressing as well that the Schengen rule doesn't work with the calendar year, it's always a case of counting back 180 days.

Schengen countries are Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Iceland, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

Time spent in Spain or the Schengen Area authorised under a residence permit or a long-stay visa are not taken into account in the calculation of the duration of the 90-day visa-free stay.

Map: European Travel Information & Authorization System

Accept that you’ll probably have to spend some time away from Spain

Whatever your preferences or calculations for your time spent in Spain and other Schengen countries, if you exhaust the 90 days in 180 day-period all in one go, you will have to spend 90 days outside of the Schengen Area.

As the europa.eu website puts it, “an absence for an uninterrupted period of 90 days allows for a new stay for up to 90 days”.

So when that happens, know that 90 full days outside of the Schengen Area and Spain will give you a new period of 90 days.

Plan ahead to make sure this absence from the Schengen Area doesn’t fall at a time when you want to be in Spain.

However, remember that you are always counting back the last 180 days, so if you have not exhausted the 90-day limit over the past six months, you will not have to leave the Schengen Area until that's the case.

Plan for winter in the sun

If you kickstart your 90 out of 180 day period during the summer in Spain, it will mean that the six-month window will end in winter, and you won’t be able to enter the Schengen Area for the next three months.

For many Brits in this situation it will mean spending the coldest, darkest and wettest months of the year back in 'Blighty', which is often exactly what they don’t want.

In order to enjoy warmer winters in Spain and mild summers in the UK, try to avoid starting your 180-day Schengen window in summer and wait instead until at least October or November to enjoy three months of winter sunshine for the following six months.

Photo: JOSE JORDAN / AFP

Photo: JOSE JORDAN / AFP

Consider neighbouring countries outside Schengen

If you have to leave Spain but you don’t want to return to the UK, consider spending some time in countries outside of the Schengen Area that aren’t too distant.

Morocco, Cyprus and Turkey are three options with more temperate climates and affordable prices.

It’s worth highlighting that time spent in other Schengen countries counts too, so factor this in if you’re planning on travelling around Europe.

Split your time in Spain into several trips

Over a period of 180 days, you can spend four three-week holidays (22.5 days each) in Spain, and alternate it with three-week periods in the UK or outside the Schengen Area.

You can also break the three months you have available into six-week periods. For example, if you arrive at the beginning of November in Spain, spend six weeks there till the middle of December, then return to the UK to spend Christmas and New Year in the UK, then go back to Spain in the middle of January until the end of February.

The UK’s Covid-19 travel restrictions and testing requirements mean this isn’t as affordable or practical at the moment, but in normal times there are countless low-cost airlines operating between both countries to make it a feasible option.

This way you’ll be able to spread out your time in Spain over a six-month period.

REMINDER: What are the rules for travel between Spain and the UK in September 2021?

Play by the rules

It is possible for third-country nationals such as Britons to get a short-stay visa extension which would allow them to spend more than 90 in 180 days in Spain.

But as Spanish authorities point out, you have to prove “exceptional reasons” for this extension to be accepted - usually force majeure reasons- and all the trouble you’ll go to process the paperwork (including proof of financial resources) isn’t worth it for the few extra weeks you’ll get.

Needless to say, spending time in your Spanish home doesn’t count as an exceptional reason.

Then there’s the matter of overstaying. Spain hasn’t given unregistered Brits already in the country before 2021 a date by which to register, although the advice for months from the UK embassy has been to become residents as soon as possible.

READ MORE: When is the deadline for Brits to apply for residency in Spain?

Needless to say, overstaying your time in Spain is not a good idea. There is no clear mention in Spanish government sources regarding fines, deportations or travel bans from the Schengen Area for overstayers.

But the likelihood of there being a record of this is high. Some sources say there are consequences, others that there aren’t, but the risk isn’t worth it if you intend to keep travelling back and forth between Spain and the UK for the foreseeable future.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.