La Renta: How to find out if you're owed or owe money on your annual Spanish tax return

Before making and submitting your Spanish income tax return, you can find out how much you might have to pay or be paid back, by filling out an online simulator. Here's our step-by-step guide on how to do this.

The declaración de la renta is Spain’s annual income tax return, which anyone residing in Spain earning over €22,000 a year, is self-employed (autónomo), or moved here in the last year, must complete.

Find out more about who needs to fill out an income tax return in Spain here.

Filling out your tax return can be a complicated process and you may want to know ahead of time how much you may have to pay so that you can prepare. Now that the declaración de la renta campaign for 2021 is open (you can present your tax return from April 6th to June 30th 2022), you are able to use the Tax Agency's online simulator to find out.

READ ALSO - La Renta: The important income tax deadlines in Spain in 2022

How does it work?

The 2021 income simulator is an online version of the Agencia Tributaria portal that makes it possible to simulate the declaration without actually having to submit your data or having to validate your ID with a digital certificate. It doesn’t affect your tax return at all, so can it simply be used for your own purposes to find out how much you will have to pay or even if the Tax Agency will return some of the money you've already paid.

As it works simply as a simulator however, you are not able to transfer any of the data over into your real declaration and you will have to complete it all over again when the time comes.

How do I access and complete the simulated tax return?

Step 1:

The first step is to access the simulator which can be found on the Agencia Tributaria's website here. Click on the button that says 'Renta Web Open Simulador' to access it.

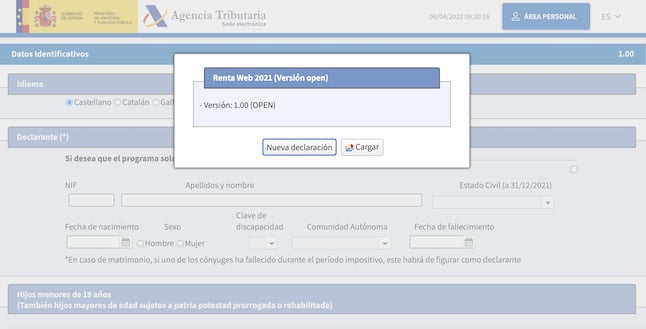

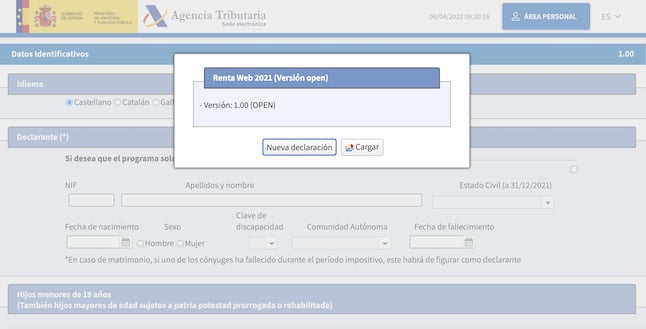

A window will open asking if you want to create a new simulated declaration or if you want to open one that you’ve already previously saved. If this is your first time accessing the simulator, simply click on the button that says ‘Nueva declaración'.

New simulated tax declaration. Photo: Agencia Tributaria

Step 2:

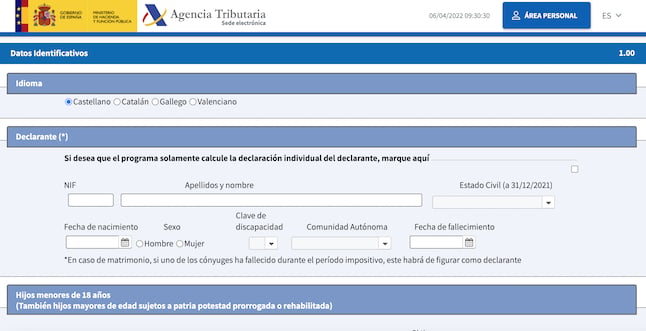

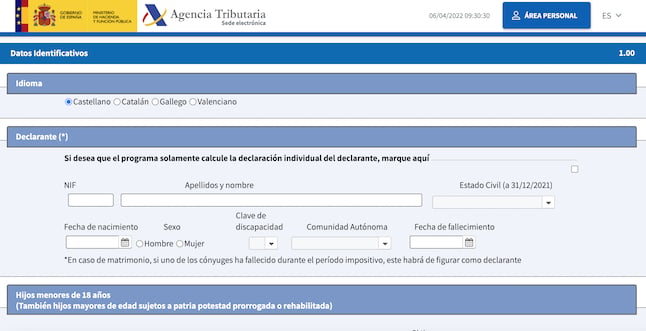

The simulator will then open up a new declaration page for you. You are able to choose between a few different languages spoken in Spain, but unfortunately English isn’t one of them.

Here, you need to fill out your personal details, such as name, NIF (número de identificación fiscal), marital status, any dependent children or dependent adults over 65 who are living with you. You will also need all details of your dependents such as ID numbers and birth dates.

When you have completed this page, click on ‘Aceptar’ at the bottom to continue.

Fill in your personal details on the first page. Photo: Agencia Tributaria.

Step 3:

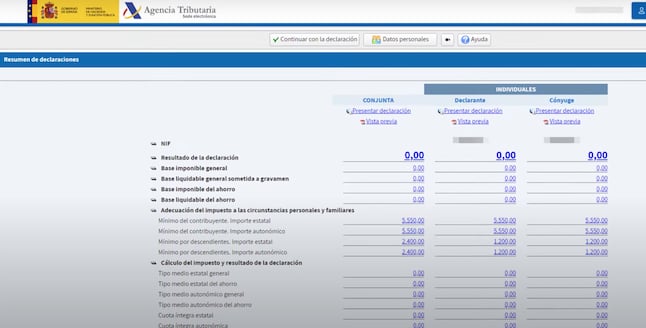

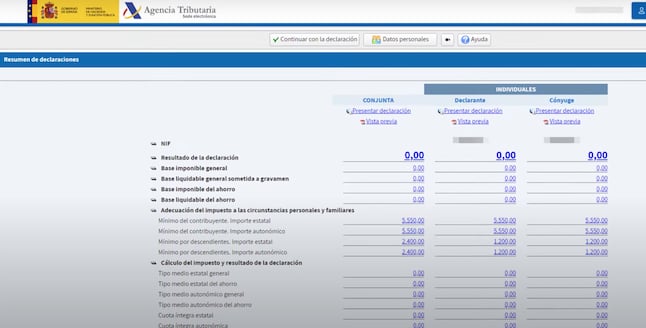

The next page will take you to the financial part of the simulator. Here, you will see lots of different sections and the corresponding amounts. You will also see a separate section detailing the amounts for your civil partner or spouse, if you have stated that you have one.

At first, everything will simply say €0,00, but you can click on any of the numbers to change them or fill out the details so that the program will work out the amount for you.

Spanish income tax simulator. Photo: Agencia Tributaria

Some of the numbers will open up new windows where you can fill out the information about details such as your salary or any compensation you received.

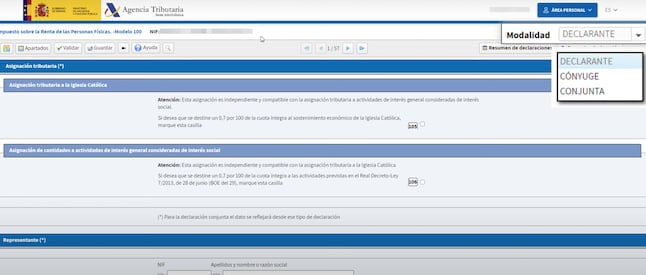

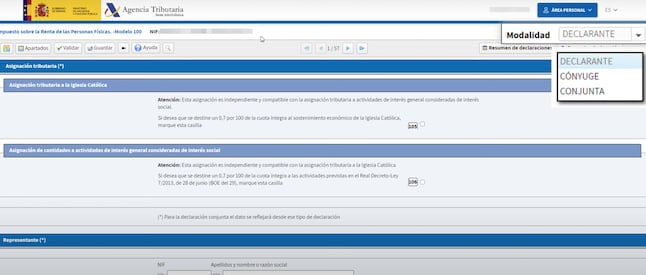

From this screen, you are only able to change the numbers in your section, but if you want to fill in details for your civil partner or spouse, click on the box that says ‘Modalidad’ in the top right-hand corner. From here, you’re able to select a different person. This may help you to work out whether it would be better financially to submit your real declaration with your partner or alone. Remember, you are not able to enter both sets of numbers on the same screen.

Click on 'modalidad' to access the amounts for your spouse. Photo: Agencia Tributaria

Step 4:

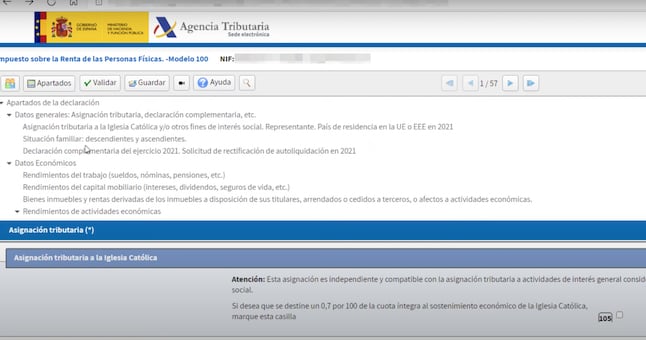

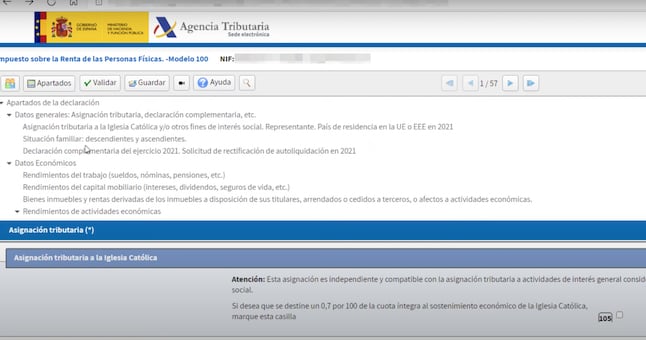

To access different parts of the declaration, click on the ‘Apartados’ button in the top left-hand corner of the screen. This will bring a drop-down menu of all the different sections of the tax return, so that you can access them directly, rather than having to scroll through each section.

Click on 'Apartados' to access different sections of the form directly. Photo: Agencia Tributaria

Step 5:

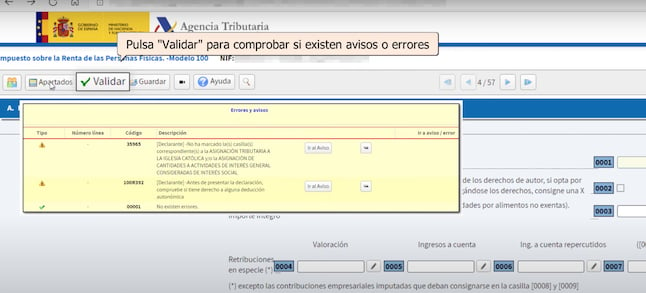

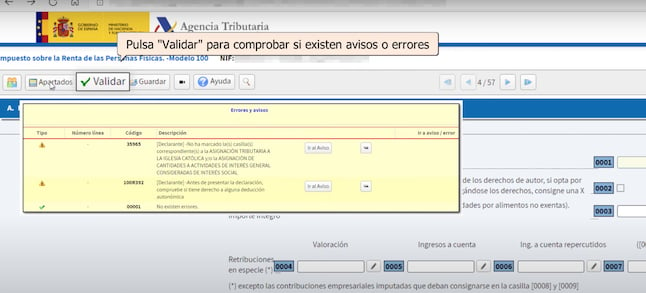

Before looking at your final calculation, click on the ‘Validar’ button next to ‘Apartados’ to see if there are any errors anywhere in your return. The program will advise you on what to do if there are.

Click on 'Validar' to see if you've made any mistakes. Photo: Agencia Tributaria

Step 6:

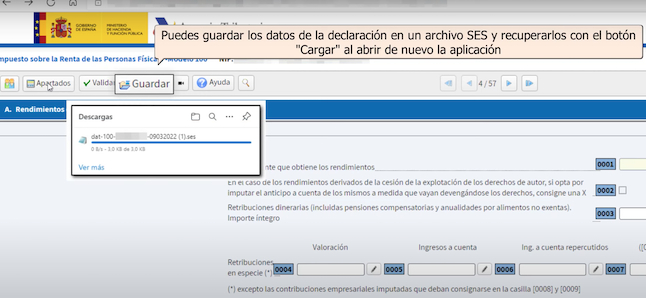

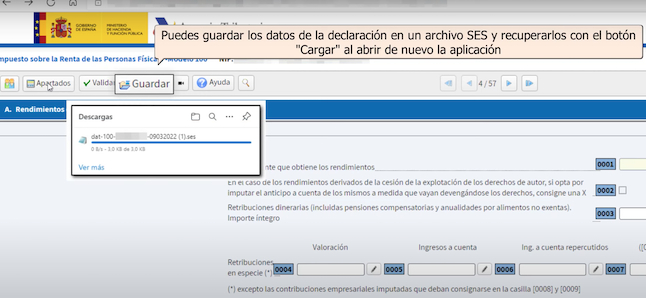

To save your simulated return so that you can complete it later, just click on ‘Guardar’ or save at the top.

Save your simulated return at any time by clicking on 'Guardar'. Photo: Agencia Tributaria

Step 7:

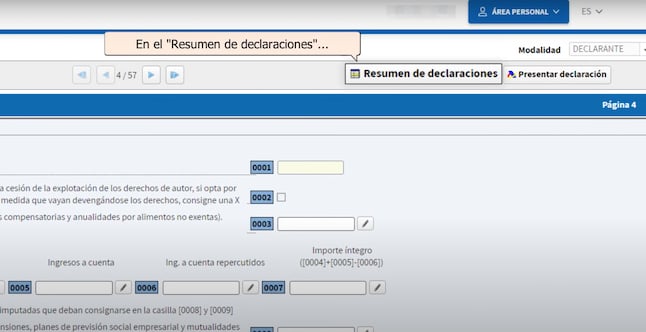

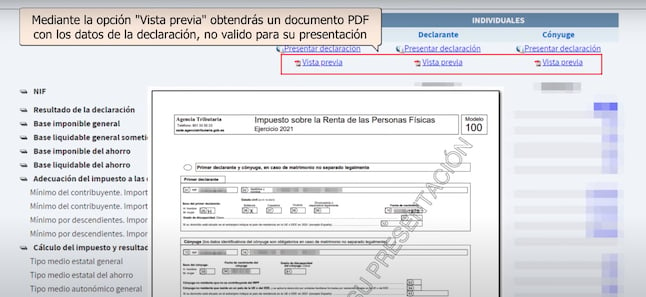

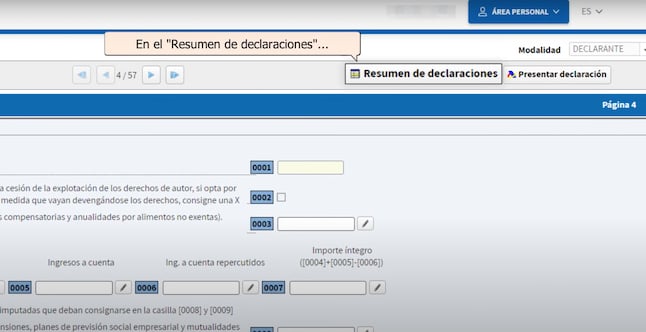

When you have completed each section, checked for errors and are happy with everything, click on ‘Resumen de declaraciónes’. This will take you back to the original screen with all the numbers and amounts on, where you can now see your final result at the top.

Click on Resumen de declaraciónes to see your final calculation. Photo: Agencia Tributaria

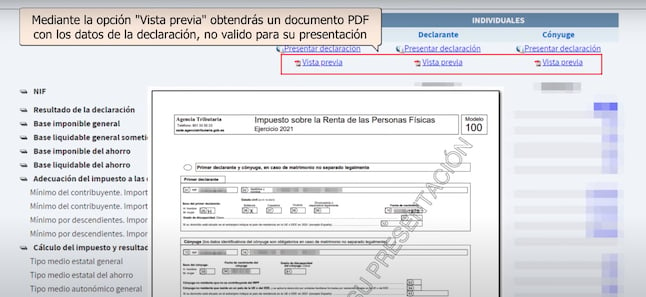

Click on 'Vista Pevia' to be able to download your simulated tax return as a PDF. You can then use this PDF and the amounts to help you fill out the real tax return later.

Click on 'Vista Previa' to download a PDF of your results. Photo: Agencia Tributaria

Click on 'Vista Previa' to download a PDF of your results. Photo: Agencia Tributaria

Comments

See Also

The declaración de la renta is Spain’s annual income tax return, which anyone residing in Spain earning over €22,000 a year, is self-employed (autónomo), or moved here in the last year, must complete.

Find out more about who needs to fill out an income tax return in Spain here.

Filling out your tax return can be a complicated process and you may want to know ahead of time how much you may have to pay so that you can prepare. Now that the declaración de la renta campaign for 2021 is open (you can present your tax return from April 6th to June 30th 2022), you are able to use the Tax Agency's online simulator to find out.

READ ALSO - La Renta: The important income tax deadlines in Spain in 2022

How does it work?

The 2021 income simulator is an online version of the Agencia Tributaria portal that makes it possible to simulate the declaration without actually having to submit your data or having to validate your ID with a digital certificate. It doesn’t affect your tax return at all, so can it simply be used for your own purposes to find out how much you will have to pay or even if the Tax Agency will return some of the money you've already paid.

As it works simply as a simulator however, you are not able to transfer any of the data over into your real declaration and you will have to complete it all over again when the time comes.

How do I access and complete the simulated tax return?

Step 1:

The first step is to access the simulator which can be found on the Agencia Tributaria's website here. Click on the button that says 'Renta Web Open Simulador' to access it.

A window will open asking if you want to create a new simulated declaration or if you want to open one that you’ve already previously saved. If this is your first time accessing the simulator, simply click on the button that says ‘Nueva declaración'.

Step 2:

The simulator will then open up a new declaration page for you. You are able to choose between a few different languages spoken in Spain, but unfortunately English isn’t one of them.

Here, you need to fill out your personal details, such as name, NIF (número de identificación fiscal), marital status, any dependent children or dependent adults over 65 who are living with you. You will also need all details of your dependents such as ID numbers and birth dates.

When you have completed this page, click on ‘Aceptar’ at the bottom to continue.

Step 3:

The next page will take you to the financial part of the simulator. Here, you will see lots of different sections and the corresponding amounts. You will also see a separate section detailing the amounts for your civil partner or spouse, if you have stated that you have one.

At first, everything will simply say €0,00, but you can click on any of the numbers to change them or fill out the details so that the program will work out the amount for you.

Some of the numbers will open up new windows where you can fill out the information about details such as your salary or any compensation you received.

From this screen, you are only able to change the numbers in your section, but if you want to fill in details for your civil partner or spouse, click on the box that says ‘Modalidad’ in the top right-hand corner. From here, you’re able to select a different person. This may help you to work out whether it would be better financially to submit your real declaration with your partner or alone. Remember, you are not able to enter both sets of numbers on the same screen.

Step 4:

To access different parts of the declaration, click on the ‘Apartados’ button in the top left-hand corner of the screen. This will bring a drop-down menu of all the different sections of the tax return, so that you can access them directly, rather than having to scroll through each section.

Step 5:

Before looking at your final calculation, click on the ‘Validar’ button next to ‘Apartados’ to see if there are any errors anywhere in your return. The program will advise you on what to do if there are.

Step 6:

To save your simulated return so that you can complete it later, just click on ‘Guardar’ or save at the top.

Step 7:

When you have completed each section, checked for errors and are happy with everything, click on ‘Resumen de declaraciónes’. This will take you back to the original screen with all the numbers and amounts on, where you can now see your final result at the top.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.