How to renew your digital certificate in Spain

Spain's Digital Certificate is a must for anyone who wants to save time with official processes. However, if your Digital Certificate expires, it's not always a straightforward process to renew. Here are all the steps to follow.

A digital certificate (not to be confused by with a Covid Digital Certificate) is a software package that you can download onto your computer, allowing you to identify yourself during online administrative processes in Spain.

You will need it for procedures such as filing your taxes, paying fines, accessing your health records or logging onto the social security system.

Having this certificate means that you won’t always need to physically go into an office to complete all processes and can do it from your own home. For anyone who is familiar with Spanish bureaucracy, this is likely to save to plenty of time and headaches.

READ ALSO: Beat the queues - 25 official matters you can do online in Spain

If you don’t have a digital certificate and want to get one for the first time, click here to follow the steps.

In this article, we’ll focus on renewing your digital certificate when it’s about to expire, as people in Spain - not just foreigners - often run into issues with the renewal.

Tengo que renovar el certificado digital. pic.twitter.com/Y3fRyI5Vry

— Kevin R. Wittmann (@kr_wittmann) May 13, 2022

Your certificate is valid for four years and after this time, you’ll need to renew it, so you can continue using it.

In theory, you will get an e-mail from the Fábrica Nacional de Moneda y Timbre or FNMT, where you originally applied for your certificate, to let you know that your certificate is about to run out and that you’ll need to renew it soon.

However, in practice you don’t always get this e-mail, so how do you know if your certificate is about to expire?

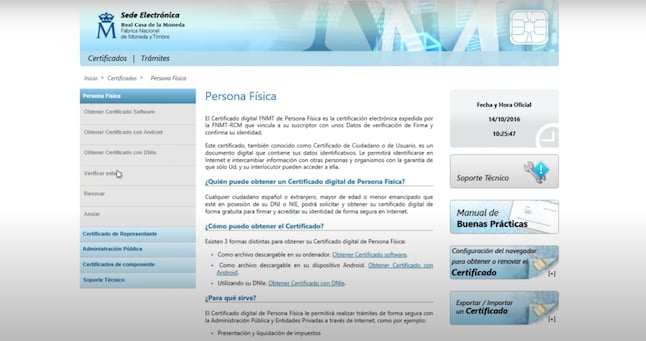

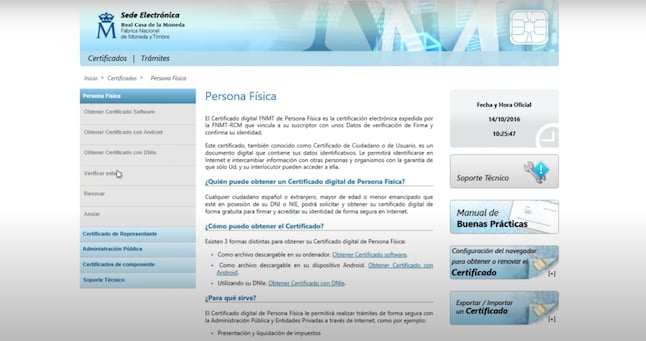

To find out, you can log on to the FNMT website and follow this link to get to the CERES certificates page. Here, you’ll need to click on the tab on the left-hand side which says 'Persona física', if you are looking for yourself. You’ll then click on ‘Verificar estado’ to find out the status of your certificate, followed by ‘Solicitar verificación’.

Find out if your digital certificate is still valid. Source: FNMT

If you have a valid digital certificate installed, it should now appear on your screen, including its validation and expiry dates. If you click on the certificate and then click ‘Aceptar’ you will see more information on the status of your certificate.

Remember that you will need to renew your digital certificate before the expiry date. If you let it expire, you will have to do the whole process of applying for a new digital certificate. It can be renewed up to two months before the expiry date.

READ ALSO: Spanish bureaucracy explained: Saving time through the online Cl@ve system

The Renewal process

Step 1:

After you have checked the expiry date on your certificate you will need to go back to the original page when you clicked on 'Persona Física' here.

Under the drop-down menu on the left-hand side, you’ll see a button that says ‘Renovar’ or renew. Click on this.

Be aware that if you have updated your operating system recently, it’s likely that this process won’t work for you and it will display an error message later on when you try to renew it. In this case, you’ll need to click on the tab at the bottom which says 'Soporte Técnico' or technical support. Next click on 'Descargas' or downloads and then 'Descargas de Software' (software downloads). Here you’ll find lots of technical support you need to find out if your operating system is compatible. You can also call the technical support number, found under the FAQs section, so someone can help you if you're still having problems. You can also get your gestor or accountant to help with this, although you'll probably be charged for it.

READ ALSO: What does a ‘gestor’ do in Spain and why you’ll need one

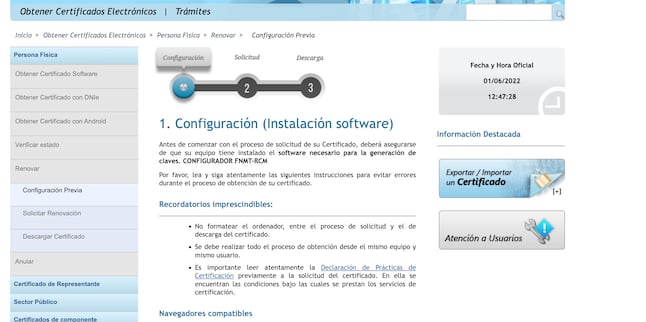

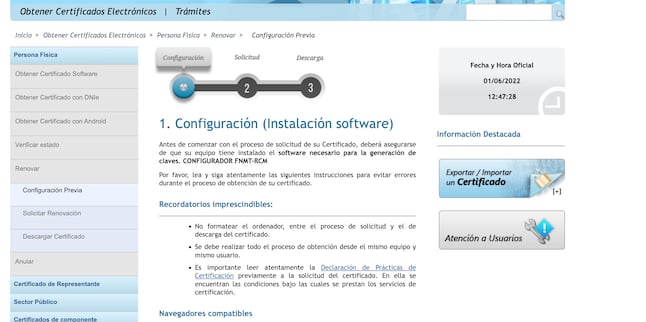

If you haven’t updated your operating system recently, you can continue with the process. In order to do this, you’ll first need to download a piece of software on your computer in order for the renovation process to work. Click on ''Configuración previa', under the renewal section. The website will give you a list of operating systems the software is compatible with. Next, click the button which says 'Área de Descarga de Configurador FNMT'. This will give you a list of all the different types of operating systems and links to download the software for each one. Download and install the software.

Download the software onto your computer. Source: FNMT

Step 2:

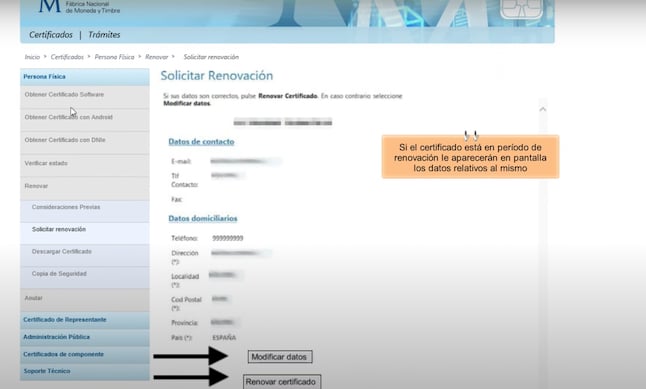

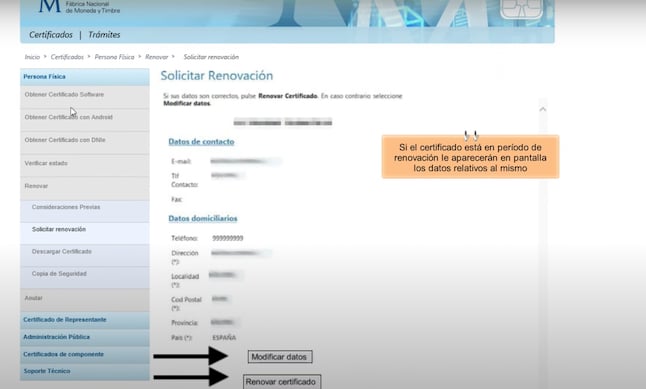

Once you’ve downloaded and installed the correct software, click on 'Solicitar renovación' in order to request your renewal, under the 'Renovar' or renewal dropdown tab.

Click on the link it provides. This will take you to a page with all the personal details associated with your digital certificate. If everything is correct, click on 'Renovar Certificado' at the bottom of the page to renew it. If not, click on ‘Modificar datos’ to update your details.

When you have downloaded the software, you can renew your certificate. Source: FNMT

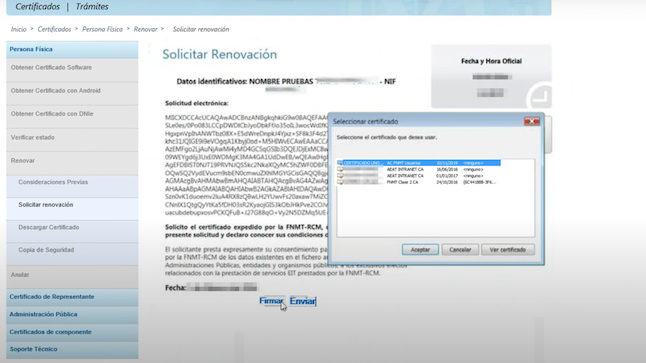

On the next page, click the large button that says ‘Generar Solicitud electrónica’ to generate your renewal request.

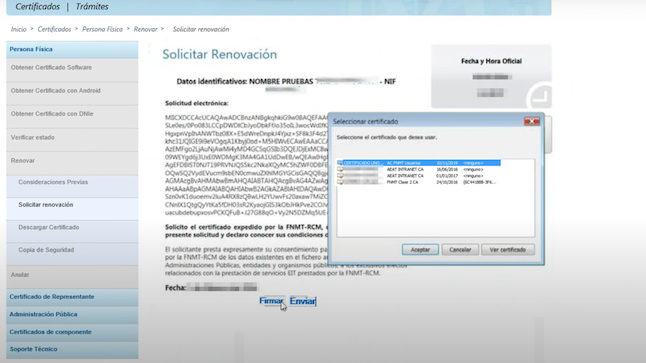

A pop-up box will appear listing your certificates. Click on your digital certificate, the one you want to renew, and then click on ‘Firmar’ followed by ‘Enviar’ to sign and send your application.

Sign and send your application. Source: FNMT

Sign and send your application. Source: FNMT

Step 3:

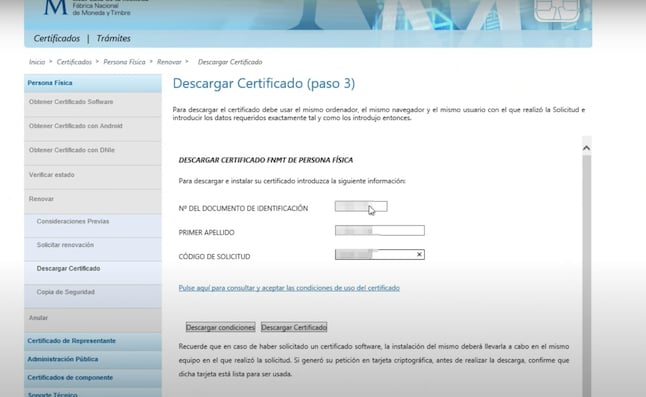

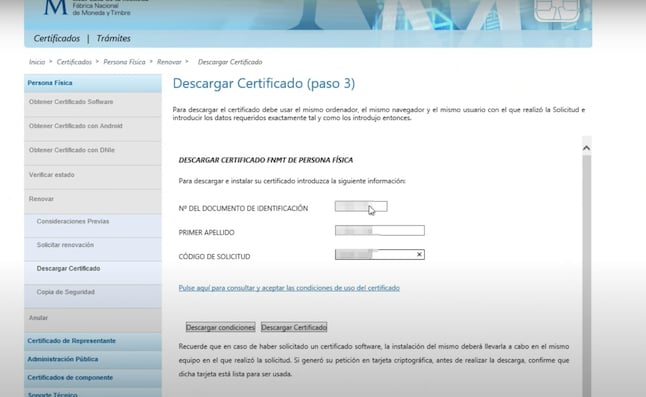

You should get a message when your certificate has been renewed. You’ll then need to download it onto your computer. To do this, click on 'Descargar Certificado' under the same dropdown menu on the left-hand side of the screen you were previously on.

Introduce your details such as your TIE/NIE number, your name, and the renewal code you were given in the message, then click on ‘Descargar Certificado’ to download your certificate.

Download your new certificate. Source: FNMT

It’s also recommended that you make a copy of your certificate. To do this, click on ‘Copia de Seguridad’ on the left-hand side. Here you will find instructions on how to export a copy of your certificate as well as instructions on how to request your digital certificate on a physical card if you wish, although this is not necessary.

Your digital certificate has now been renewed and you can continue using it like before for all of your online processes.

Comments

See Also

A digital certificate (not to be confused by with a Covid Digital Certificate) is a software package that you can download onto your computer, allowing you to identify yourself during online administrative processes in Spain.

You will need it for procedures such as filing your taxes, paying fines, accessing your health records or logging onto the social security system.

Having this certificate means that you won’t always need to physically go into an office to complete all processes and can do it from your own home. For anyone who is familiar with Spanish bureaucracy, this is likely to save to plenty of time and headaches.

READ ALSO: Beat the queues - 25 official matters you can do online in Spain

If you don’t have a digital certificate and want to get one for the first time, click here to follow the steps.

In this article, we’ll focus on renewing your digital certificate when it’s about to expire, as people in Spain - not just foreigners - often run into issues with the renewal.

Tengo que renovar el certificado digital. pic.twitter.com/Y3fRyI5Vry

— Kevin R. Wittmann (@kr_wittmann) May 13, 2022

Your certificate is valid for four years and after this time, you’ll need to renew it, so you can continue using it.

In theory, you will get an e-mail from the Fábrica Nacional de Moneda y Timbre or FNMT, where you originally applied for your certificate, to let you know that your certificate is about to run out and that you’ll need to renew it soon.

However, in practice you don’t always get this e-mail, so how do you know if your certificate is about to expire?

To find out, you can log on to the FNMT website and follow this link to get to the CERES certificates page. Here, you’ll need to click on the tab on the left-hand side which says 'Persona física', if you are looking for yourself. You’ll then click on ‘Verificar estado’ to find out the status of your certificate, followed by ‘Solicitar verificación’.

If you have a valid digital certificate installed, it should now appear on your screen, including its validation and expiry dates. If you click on the certificate and then click ‘Aceptar’ you will see more information on the status of your certificate.

Remember that you will need to renew your digital certificate before the expiry date. If you let it expire, you will have to do the whole process of applying for a new digital certificate. It can be renewed up to two months before the expiry date.

READ ALSO: Spanish bureaucracy explained: Saving time through the online Cl@ve system

The Renewal process

Step 1:

After you have checked the expiry date on your certificate you will need to go back to the original page when you clicked on 'Persona Física' here.

Under the drop-down menu on the left-hand side, you’ll see a button that says ‘Renovar’ or renew. Click on this.

Be aware that if you have updated your operating system recently, it’s likely that this process won’t work for you and it will display an error message later on when you try to renew it. In this case, you’ll need to click on the tab at the bottom which says 'Soporte Técnico' or technical support. Next click on 'Descargas' or downloads and then 'Descargas de Software' (software downloads). Here you’ll find lots of technical support you need to find out if your operating system is compatible. You can also call the technical support number, found under the FAQs section, so someone can help you if you're still having problems. You can also get your gestor or accountant to help with this, although you'll probably be charged for it.

READ ALSO: What does a ‘gestor’ do in Spain and why you’ll need one

If you haven’t updated your operating system recently, you can continue with the process. In order to do this, you’ll first need to download a piece of software on your computer in order for the renovation process to work. Click on ''Configuración previa', under the renewal section. The website will give you a list of operating systems the software is compatible with. Next, click the button which says 'Área de Descarga de Configurador FNMT'. This will give you a list of all the different types of operating systems and links to download the software for each one. Download and install the software.

Step 2:

Once you’ve downloaded and installed the correct software, click on 'Solicitar renovación' in order to request your renewal, under the 'Renovar' or renewal dropdown tab.

Click on the link it provides. This will take you to a page with all the personal details associated with your digital certificate. If everything is correct, click on 'Renovar Certificado' at the bottom of the page to renew it. If not, click on ‘Modificar datos’ to update your details.

On the next page, click the large button that says ‘Generar Solicitud electrónica’ to generate your renewal request.

A pop-up box will appear listing your certificates. Click on your digital certificate, the one you want to renew, and then click on ‘Firmar’ followed by ‘Enviar’ to sign and send your application.

Step 3:

You should get a message when your certificate has been renewed. You’ll then need to download it onto your computer. To do this, click on 'Descargar Certificado' under the same dropdown menu on the left-hand side of the screen you were previously on.

Introduce your details such as your TIE/NIE number, your name, and the renewal code you were given in the message, then click on ‘Descargar Certificado’ to download your certificate.

It’s also recommended that you make a copy of your certificate. To do this, click on ‘Copia de Seguridad’ on the left-hand side. Here you will find instructions on how to export a copy of your certificate as well as instructions on how to request your digital certificate on a physical card if you wish, although this is not necessary.

Your digital certificate has now been renewed and you can continue using it like before for all of your online processes.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.