How much do I need to earn to get a mortgage in Spain?

Where in Spain can you get a mortgage approved with a low salary and where is it necessary to earn a lot for the banks to loan you the money? This breakdown of the situation across Spain's 50 provinces will help you know.

Maybe you already live in Spain, have been renting for a while and want to lay down some roots. Maybe you live abroad and want to relocate your life and family. Whatever your situation, if you're thinking about buying a property in Spain, unless you are going to pay all cash, up front, the chances are you'll need a mortgage.

But how much do you need to earn to get approved for a mortgage in Spain? And in which parts of the country do you need an above average salary to get one approved, and where can you get one with a lower salary?

The Local has put together a breakdown of the situation across Spain's most and least expensive provinces to help you with your house hunt and decide where's best for you to apply (and be approved) for a mortgage.

Getting a mortgage

As with anywhere in the world, there's a few things to consider before applying for a mortgage. The first is income, namely demonstrating you have a regular one that is sufficient to cover any potential monthly mortgage payments.

Experts recommend that household mortgage payments should not exceed 30 percent of income. So, if you make €2,000 net per month, your monthly mortgage payment should not be more than €600 per month.

Your savings also play a role in mortgage applications. Most banks in Spain offer 80 percent mortgages, so it would be necessary to have saved the remaining 20 percent to pay as a deposit.

READ ALSO:

- What non-residents should know about getting a mortgage

- How to get a 100% mortgage with Spain's new guarantee scheme

Obviously, by loaning you such a large amount of money, debt is also taken into account. For some banks, even missed payments on something as simple as a phone bill could harm your application.

How much do I need to earn to get a mortgage in Spain?

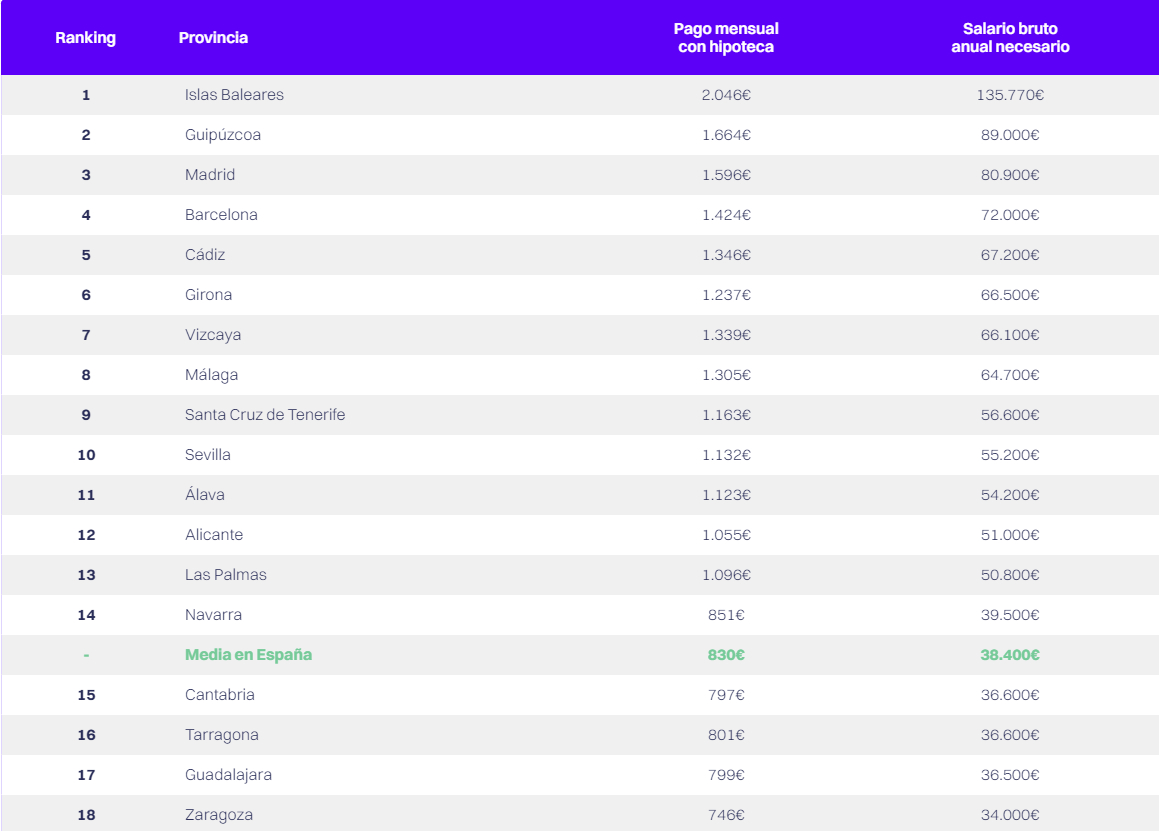

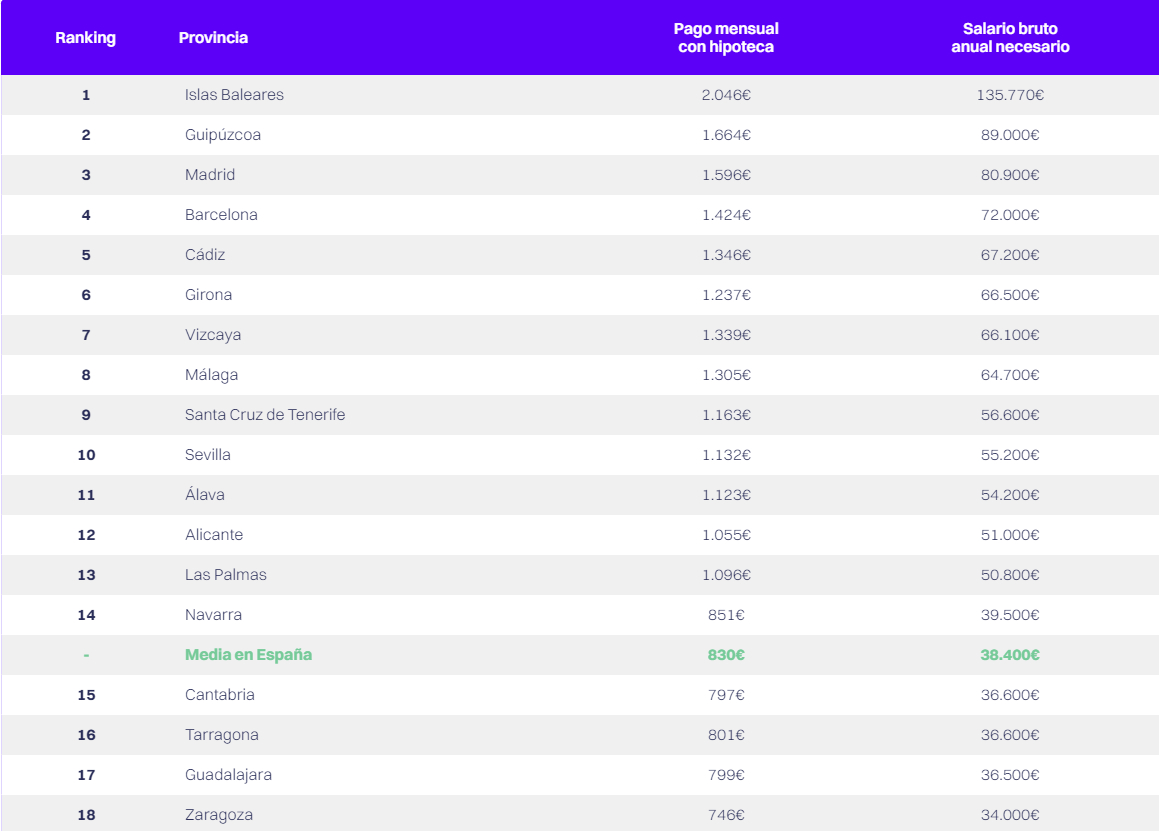

According to a study by HelloSafe.es, a financial comparison and telecoms website, €38,400 is the average annual gross salary necessary to get a mortgage to buy a house or apartment of 100m² in Spain in 2023.

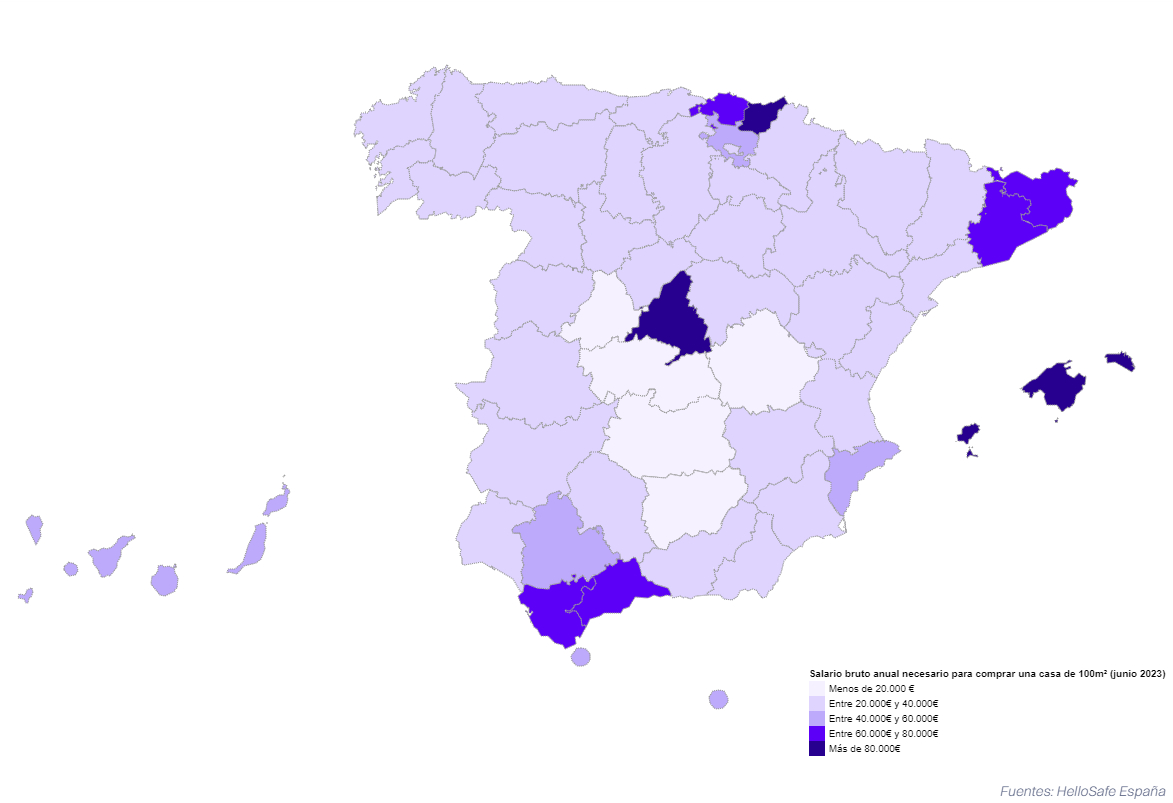

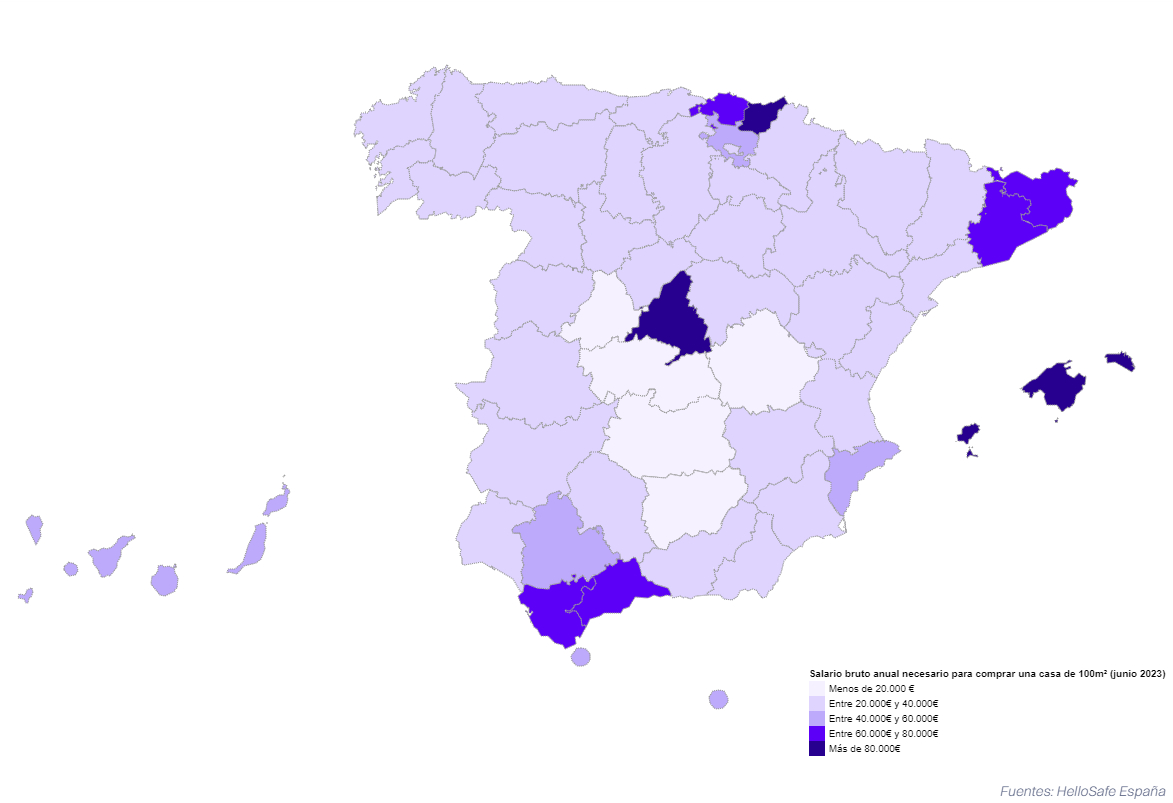

However, as with most things in Spain, there are some seriously stark geographical differences at play and where exactly in Spain you want to purchase a house (and therefore get a mortgage) can make a huge difference as to whether you'd be likely to get one or not.

According to the survey, the difference between the most expensive province to get a mortgage in Spain (Balearic Islands) and the cheapest (Ciudad Real) is a whopping €121,270. In the Balearic Islands, to get a mortgage you'd need an annual gross salary of €135,770, whereas in Ciudad Real it's just €14,500.

Where you need to earn most in Spain to get a mortgage:

According to the HelloSafe study, the parts of Spain where you need the highest salaries to get a mortgage are as follows.

Balearic Islands (€2,466/month and annual gross of €135,770)

Guipúzcoa (€1,664/month and annual gross of €89,000)

Madrid (€1,596/month and annual gross of €80,900)

Barcelona (€1,424/month and annual gross €72,000)

Cádiz (€1,346/month and annual gross €67,200)

Girona (€1,237/month and annual gross €66,500)

Vizcaya (€1,339/month and annual gross €66.100)

Málaga (€1.305/month and annual gross €64.700)

Santa Cruz de Tenerife (€1,163/month and annual gross €56.600)

Seville (€1,132/month and €55,200)

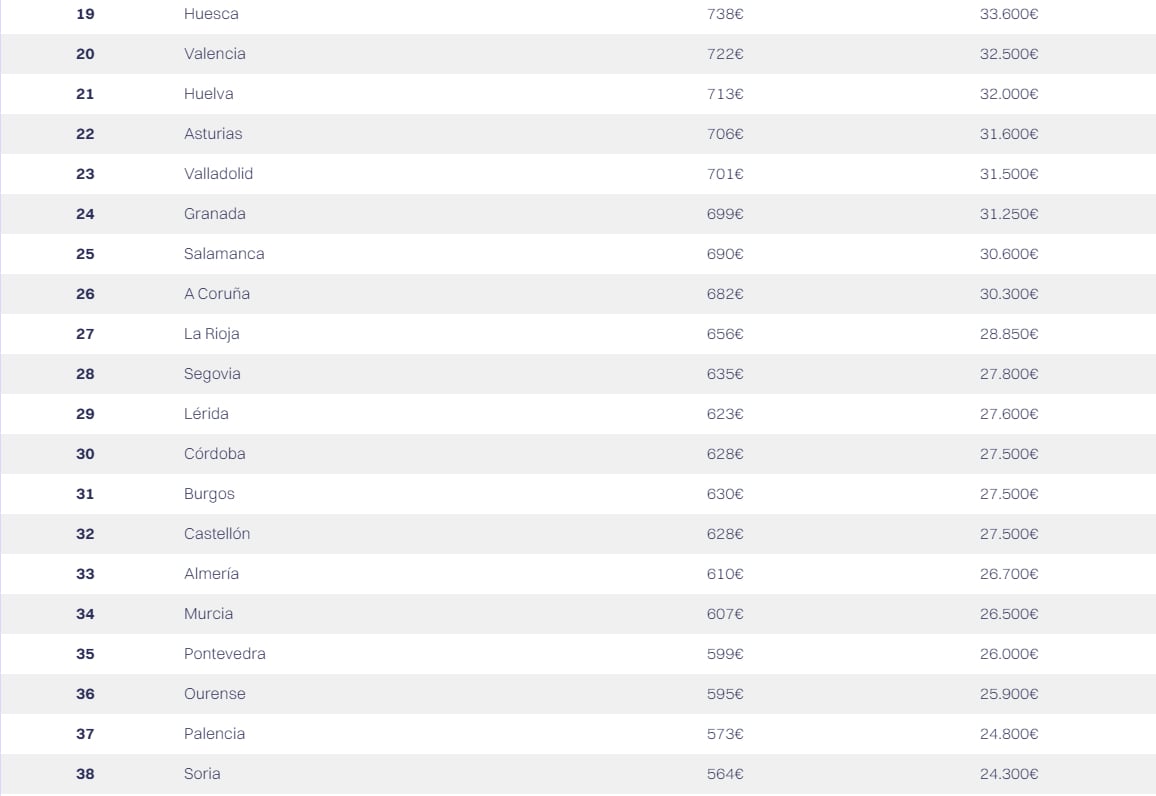

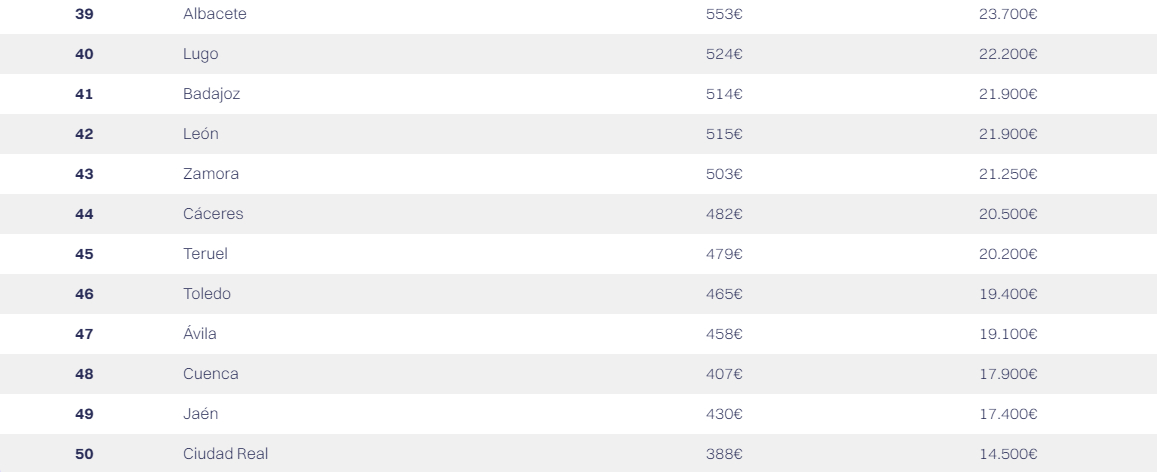

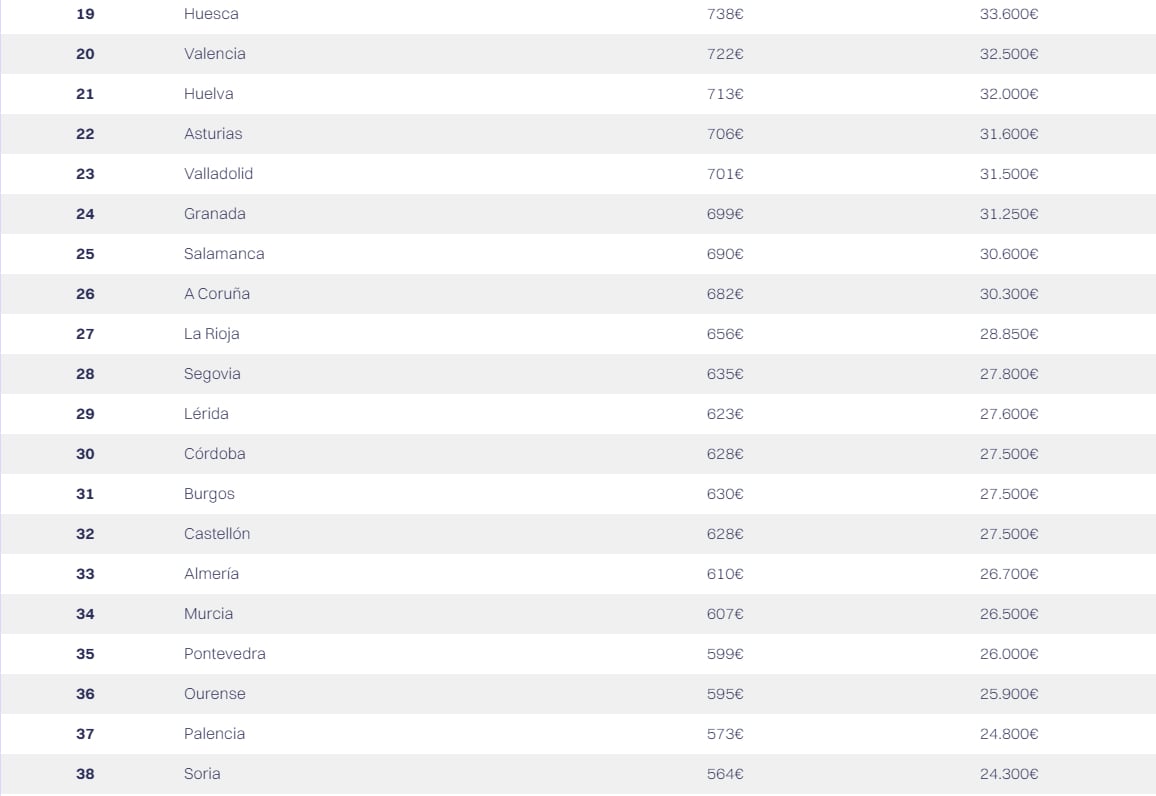

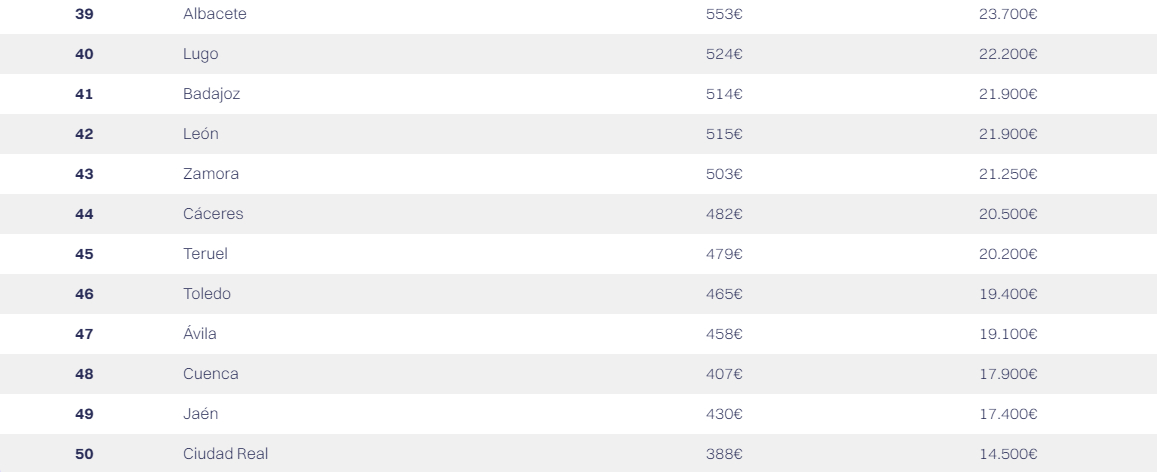

Where you can get a mortgage on a lower salary in Spain:

The areas of Spain where you need to earn the least to get a mortgage are:

Ciudad Real (€388/month and gross annual €14,500)

Jaén (€430/month and gross annual €17,400)

Cuenca (€407/month and gross annual €17,900)

Ávila (€458/month and gross annual €19,100)

Toledo (€465/month and gross annual €19,400)

Teruel (€479/month and gross annual €20,200)

Cáceres (€482/month and gross annual €20.500)

Zamora (€503/month and gross annual €21.250)

León (€515/month and gross annual €21,900)

Badajoz (€514/month and gross annual €22,200)

Methodology

To calculate the annual gross salary needed to buy a house or apartment in Spain, Hello Safe took the the value per m2 across the different provinces of Spain (as of June 2023) multiplied by 100 to achieve the average price of a property of 100m².

Then, they calculated the monthly average to be paid with a mortgage according to an amortisation table that considers a personal contribution of 15 percent, a payment term of 25 years and a fixed rate of 3.48 percent; which according to the Bank of Spain is the current average interest rate of mortgages.

READ ALSO: What an Euribor rise means for property buyers in Spain

Price per m2

The enormous disparity in purchasing power in Spain, particularly when it comes to minimum salaries necessary for mortgages, can mostly be explained by the differences in price per m2 of properties around Spain. Understanding where you'll pay more per m2 is important for your house hunt and, crucially, getting approved for a mortgage.

The average price per m2 of a property in Spain (as of June 2023) is €1,564. Yet the average price per m2 of a property in the Balearic Islands is €3,954/m2, which is 4 times more expensive than in Ciudad Real, where it's just €750/m2.

Visita HelloSafe para encontrar más herramientas.

Most expensive provinces per square metre of property

The top ten most expensive provinces per m2 in Spain are:

Balearic Islands - €3,954/m2

Guipúzcoa - €3,394/m2

Madrid - €3,142/m2

Vizcaya - €2,728/m2

Barcelona - €2,695/m2

Cádiz - €2,596/m2

Málaga - €2,516/m2

Girona - €2,339/m2

Santa Cruz de Tenerife - €2,307/m2

Álava - €2,284

Cheapest provinces per square metre of property

The ten cheapest provinces per m2 in Spain are:

Ciudad Real - €750/m2

Cuenca - €786/m2

Jaén - €825/m2

Toledo - €849/m2

Ávila - €870/m2

Teruel - €912/m2

Cáceres - €918/m2

Zamora - €958/m2

León - €979/m2

Badajoz - €982/m2

Below is the full ranking of the necessary gross yearly earning needed for a mortgage to be approved across Spain's 50 provinces.

Comments

See Also

Maybe you already live in Spain, have been renting for a while and want to lay down some roots. Maybe you live abroad and want to relocate your life and family. Whatever your situation, if you're thinking about buying a property in Spain, unless you are going to pay all cash, up front, the chances are you'll need a mortgage.

But how much do you need to earn to get approved for a mortgage in Spain? And in which parts of the country do you need an above average salary to get one approved, and where can you get one with a lower salary?

The Local has put together a breakdown of the situation across Spain's most and least expensive provinces to help you with your house hunt and decide where's best for you to apply (and be approved) for a mortgage.

Getting a mortgage

As with anywhere in the world, there's a few things to consider before applying for a mortgage. The first is income, namely demonstrating you have a regular one that is sufficient to cover any potential monthly mortgage payments.

Experts recommend that household mortgage payments should not exceed 30 percent of income. So, if you make €2,000 net per month, your monthly mortgage payment should not be more than €600 per month.

Your savings also play a role in mortgage applications. Most banks in Spain offer 80 percent mortgages, so it would be necessary to have saved the remaining 20 percent to pay as a deposit.

READ ALSO:

- What non-residents should know about getting a mortgage

- How to get a 100% mortgage with Spain's new guarantee scheme

Obviously, by loaning you such a large amount of money, debt is also taken into account. For some banks, even missed payments on something as simple as a phone bill could harm your application.

How much do I need to earn to get a mortgage in Spain?

According to a study by HelloSafe.es, a financial comparison and telecoms website, €38,400 is the average annual gross salary necessary to get a mortgage to buy a house or apartment of 100m² in Spain in 2023.

However, as with most things in Spain, there are some seriously stark geographical differences at play and where exactly in Spain you want to purchase a house (and therefore get a mortgage) can make a huge difference as to whether you'd be likely to get one or not.

According to the survey, the difference between the most expensive province to get a mortgage in Spain (Balearic Islands) and the cheapest (Ciudad Real) is a whopping €121,270. In the Balearic Islands, to get a mortgage you'd need an annual gross salary of €135,770, whereas in Ciudad Real it's just €14,500.

Where you need to earn most in Spain to get a mortgage:

According to the HelloSafe study, the parts of Spain where you need the highest salaries to get a mortgage are as follows.

Balearic Islands (€2,466/month and annual gross of €135,770)

Guipúzcoa (€1,664/month and annual gross of €89,000)

Madrid (€1,596/month and annual gross of €80,900)

Barcelona (€1,424/month and annual gross €72,000)

Cádiz (€1,346/month and annual gross €67,200)

Girona (€1,237/month and annual gross €66,500)

Vizcaya (€1,339/month and annual gross €66.100)

Málaga (€1.305/month and annual gross €64.700)

Santa Cruz de Tenerife (€1,163/month and annual gross €56.600)

Seville (€1,132/month and €55,200)

Where you can get a mortgage on a lower salary in Spain:

The areas of Spain where you need to earn the least to get a mortgage are:

Ciudad Real (€388/month and gross annual €14,500)

Jaén (€430/month and gross annual €17,400)

Cuenca (€407/month and gross annual €17,900)

Ávila (€458/month and gross annual €19,100)

Toledo (€465/month and gross annual €19,400)

Teruel (€479/month and gross annual €20,200)

Cáceres (€482/month and gross annual €20.500)

Zamora (€503/month and gross annual €21.250)

León (€515/month and gross annual €21,900)

Badajoz (€514/month and gross annual €22,200)

Methodology

To calculate the annual gross salary needed to buy a house or apartment in Spain, Hello Safe took the the value per m2 across the different provinces of Spain (as of June 2023) multiplied by 100 to achieve the average price of a property of 100m².

Then, they calculated the monthly average to be paid with a mortgage according to an amortisation table that considers a personal contribution of 15 percent, a payment term of 25 years and a fixed rate of 3.48 percent; which according to the Bank of Spain is the current average interest rate of mortgages.

READ ALSO: What an Euribor rise means for property buyers in Spain

Price per m2

The enormous disparity in purchasing power in Spain, particularly when it comes to minimum salaries necessary for mortgages, can mostly be explained by the differences in price per m2 of properties around Spain. Understanding where you'll pay more per m2 is important for your house hunt and, crucially, getting approved for a mortgage.

The average price per m2 of a property in Spain (as of June 2023) is €1,564. Yet the average price per m2 of a property in the Balearic Islands is €3,954/m2, which is 4 times more expensive than in Ciudad Real, where it's just €750/m2.

Visita HelloSafe para encontrar más herramientas.

Most expensive provinces per square metre of property

The top ten most expensive provinces per m2 in Spain are:

Balearic Islands - €3,954/m2

Guipúzcoa - €3,394/m2

Madrid - €3,142/m2

Vizcaya - €2,728/m2

Barcelona - €2,695/m2

Cádiz - €2,596/m2

Málaga - €2,516/m2

Girona - €2,339/m2

Santa Cruz de Tenerife - €2,307/m2

Álava - €2,284

Cheapest provinces per square metre of property

The ten cheapest provinces per m2 in Spain are:

Ciudad Real - €750/m2

Cuenca - €786/m2

Jaén - €825/m2

Toledo - €849/m2

Ávila - €870/m2

Teruel - €912/m2

Cáceres - €918/m2

Zamora - €958/m2

León - €979/m2

Badajoz - €982/m2

Below is the full ranking of the necessary gross yearly earning needed for a mortgage to be approved across Spain's 50 provinces.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.