GUIDE: How to register with Spain's social security system

If you want to be able to work in Spain, whether as an employee or self-employed, you will need to register with the country's social security system. Find out the step-by-step process and the documents you'll need to do it.

Registering with Spain's social security is one of the first things you have to do after arriving in España if you plan on working here.

In fact, you need your social security certificate to even apply for your TIE or foreigner identity card during your first month in the country.

In essence, you pay taxes into Spain's welfare system and in return get access to one of the best public healthcare systems in the world, as well as other benefits from parental leave to unemployment benefits.

If you’re employed by a company, they will be responsible for registering you with social security, but if you are self-employed, you will have to do it yourself.

What do I need in order to register?

Remember, if you’re from a non-EU country, you will need to show that you have a valid work permit to authorise you to work in Spain in order to register.

You will also need your social security number, which you will apply for first, as part of the process.

How to get your social security number

Step one is to get your social security number. You can do this if you have a digital certificate or you have been issued with an NIE or foreign identity number (this can be found on your TIE card or green EU residency card).

Go to the social security website and click on the ‘Trabajadores’ option at the top, then click on Afiliación y Número de la Seguridad Social. This will take you to the link to apply for it online using your digital certificate. If you don’t have your certificate, there are instructions on how to send a text message in order to get a security code to apply for it instead.

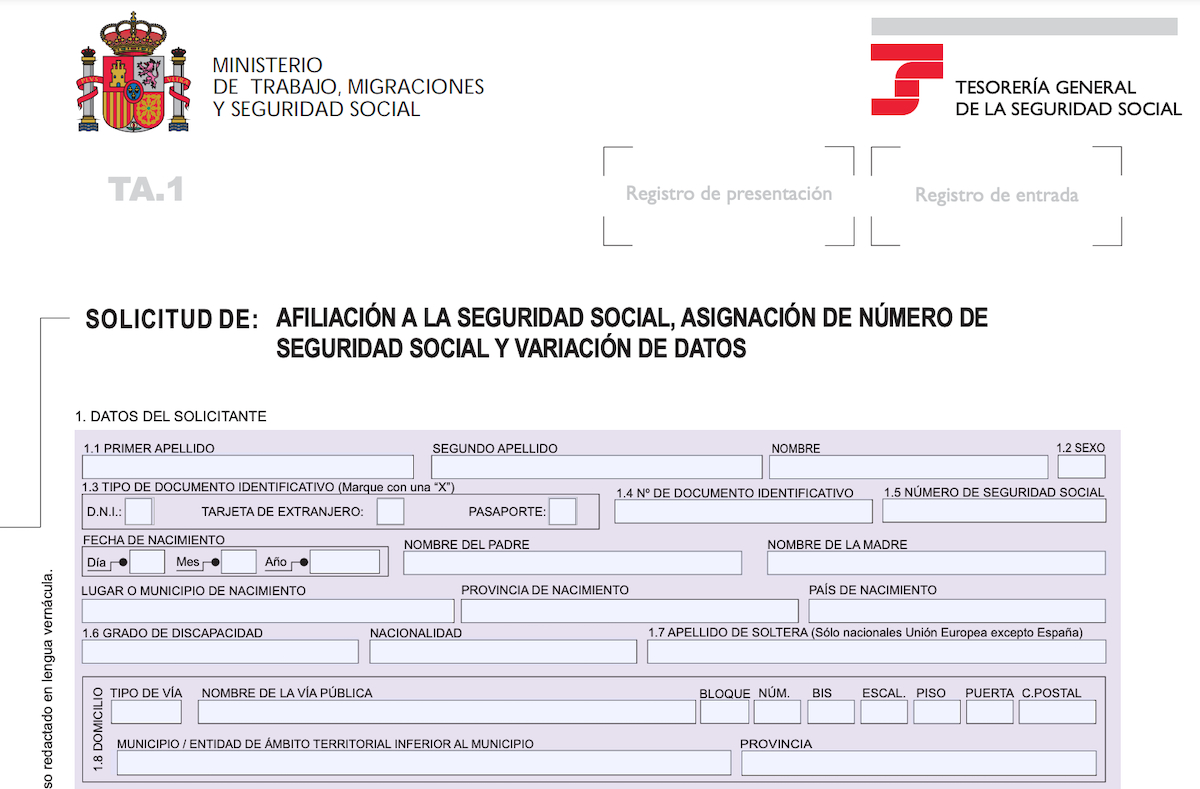

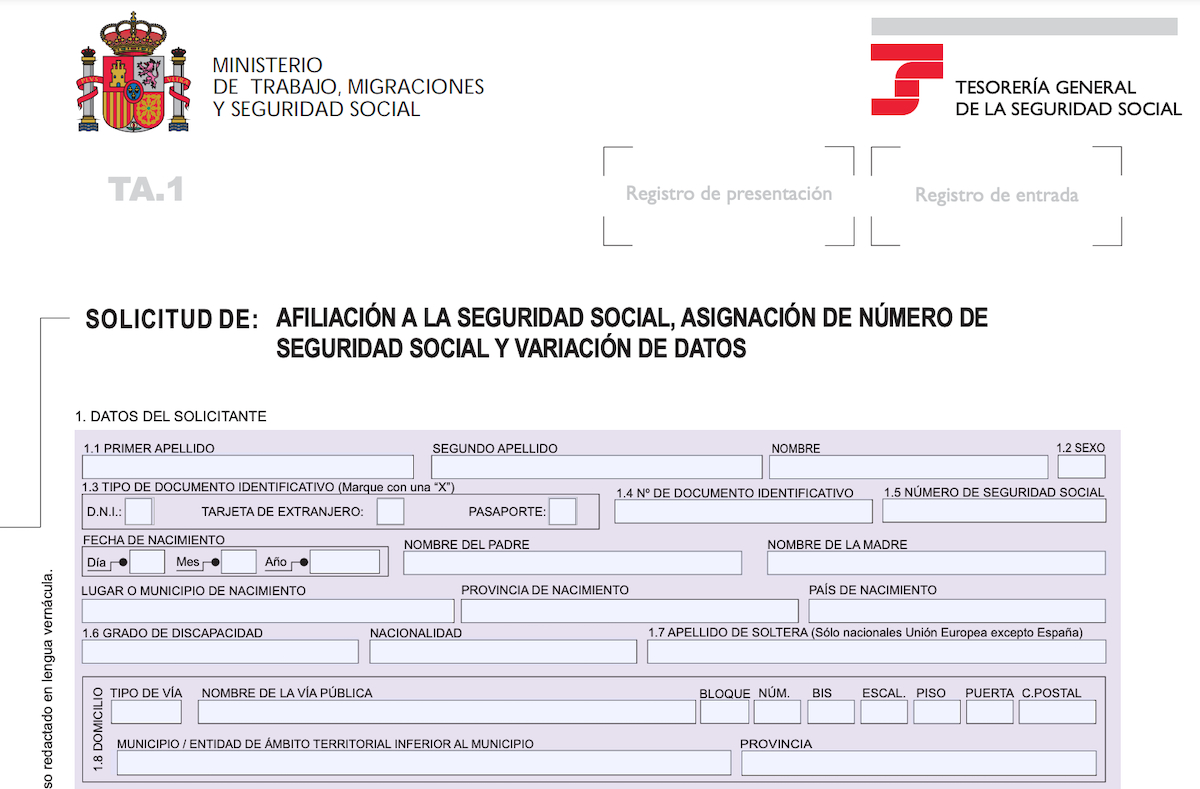

You will fill out the TA1 form, completing all the boxes with your personal information such as name, date of birth and address. You will also check the box indicating your reason for completing the form - in this case - AFILIACIÓN A LA SEGURIDAD SOCIAL.

You need to fill out this form to get your social security number in Spain. Source: Seguridad Social

Once this is done, you will receive your NUSS or social security number.

How to register?

Even though you have a social security number, you will still need to register with Social Security before you start working.

There are two different ways to register, the first is online and the second is by going in person to your nearest office.

Online

Go to the social security website and select Alta de Trabajo Autónomos. You can identify yourself online with your digital certificate, cl@ve pin or via text message as above.

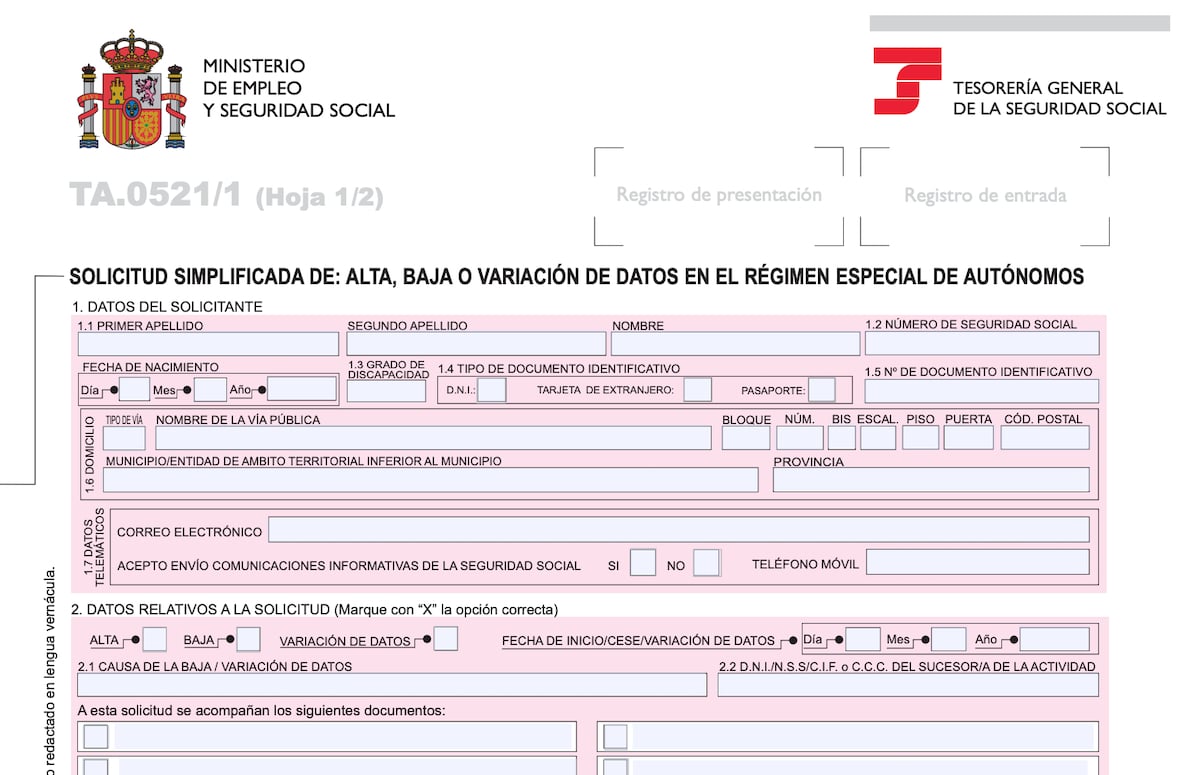

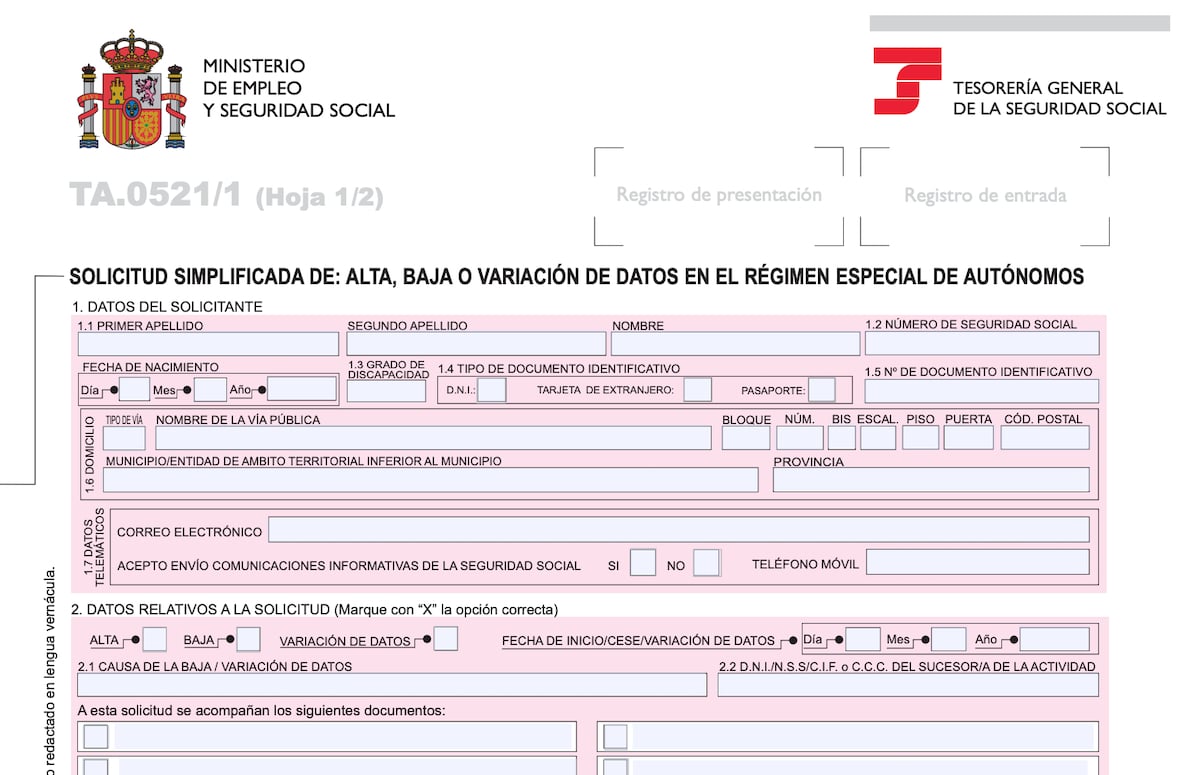

Once, identified you will have to fill out the form TA.0521.

Complete form TA.0521 to register with social security in Spain. Source: Seguridad Social

You will need all your personal details again, as well as the social security number you just applied for.

In Part 2 you’ll select your reason for filling out the form. If you’re registering for social security because you want to start work, you’ll check the box that says ‘alta’.

Part 3 of the form will ask you all about your profession and what industry you intend to work in. You will have to register for a particular one, if you want to work in more than one, the process is slightly different.

READ ALSO: Self-employed in Spain: What are the tax rules if you do two or more jobs?

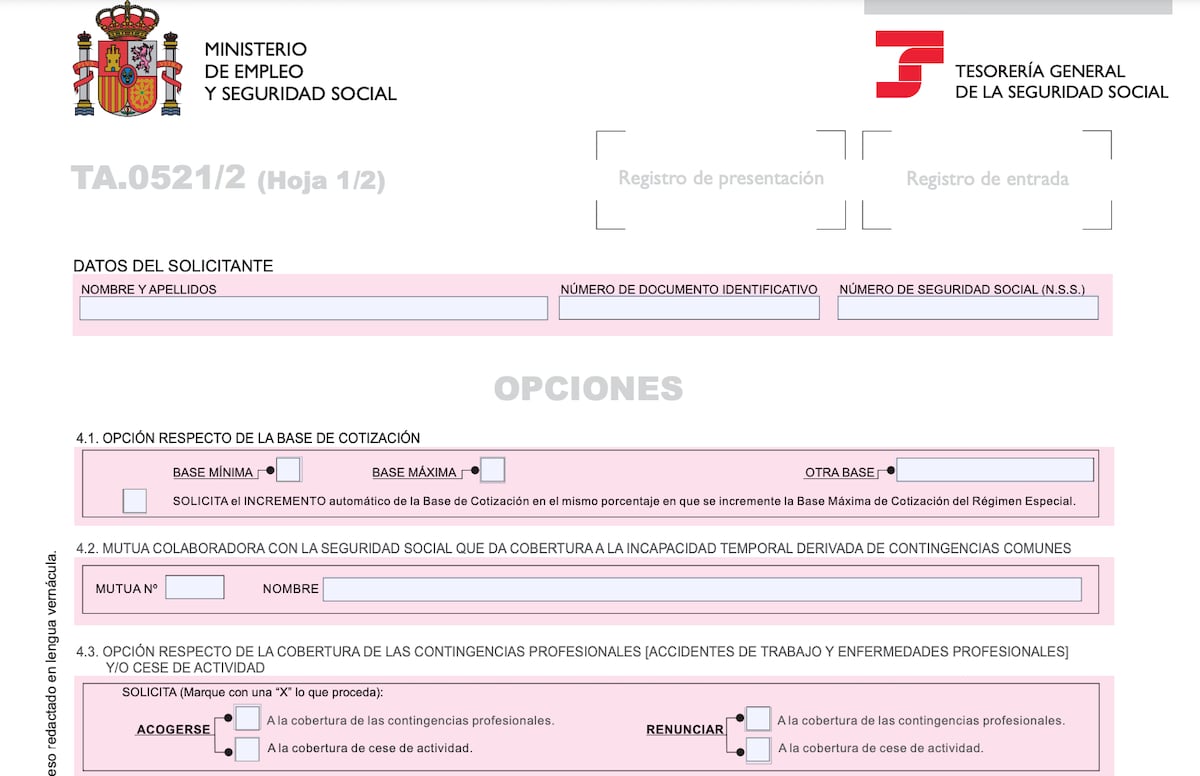

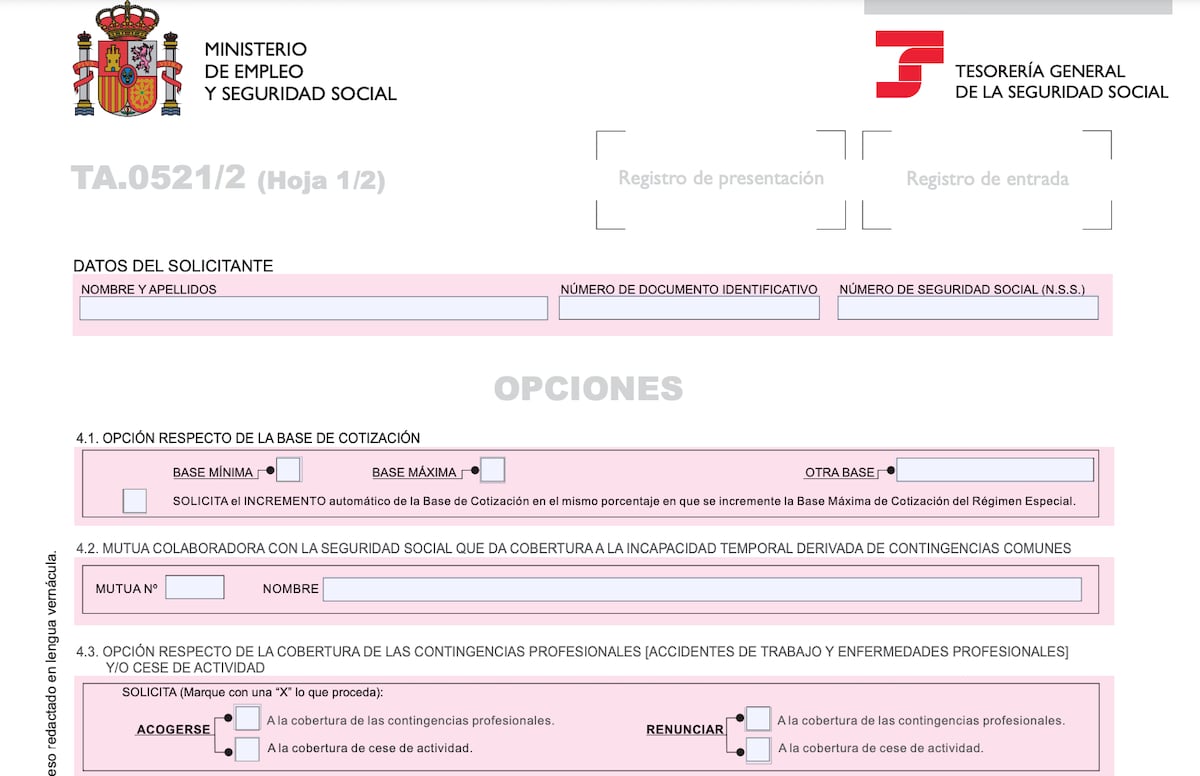

The final part asks you to select the base cover for your social security fees, whether that’s the minimum, maximum or somewhere in between. This will cover you against various situations such as an accident at work, maternity or paternity pay and healthcare.

The form you need to complete to register with social security in Spain. Source: Seguridad Social

You will also include your work address, if it’s different from your home address.

Other documents you will need to upload include:

- An identity document such as TIE, green residency card or passport

- Documentation attesting to registration with the Tax Office – this is the other part of registering to become self-employed.

In-person

First, you’ll need to apply for an appointment at your nearest social security office. When you get your appointment you will take all the same forms and documents as above. Remember to have photocopies of everything.

READ ALSO: Will you pay more under Spain's new social security rates for self-employed?

How long do I have to wait for it to be processed?

Once you register, you can start work immediately. You will be charged a monthly social security fee once you do. This changes depending on how much your net earnings are per month.

Over the next few years, the fee will go progressively down to €200 a month for lower earners and progressively higher - up to €590 a month - for higher earners.

Comments

See Also

Registering with Spain's social security is one of the first things you have to do after arriving in España if you plan on working here.

In fact, you need your social security certificate to even apply for your TIE or foreigner identity card during your first month in the country.

In essence, you pay taxes into Spain's welfare system and in return get access to one of the best public healthcare systems in the world, as well as other benefits from parental leave to unemployment benefits.

If you’re employed by a company, they will be responsible for registering you with social security, but if you are self-employed, you will have to do it yourself.

What do I need in order to register?

Remember, if you’re from a non-EU country, you will need to show that you have a valid work permit to authorise you to work in Spain in order to register.

You will also need your social security number, which you will apply for first, as part of the process.

How to get your social security number

Step one is to get your social security number. You can do this if you have a digital certificate or you have been issued with an NIE or foreign identity number (this can be found on your TIE card or green EU residency card).

Go to the social security website and click on the ‘Trabajadores’ option at the top, then click on Afiliación y Número de la Seguridad Social. This will take you to the link to apply for it online using your digital certificate. If you don’t have your certificate, there are instructions on how to send a text message in order to get a security code to apply for it instead.

You will fill out the TA1 form, completing all the boxes with your personal information such as name, date of birth and address. You will also check the box indicating your reason for completing the form - in this case - AFILIACIÓN A LA SEGURIDAD SOCIAL.

Once this is done, you will receive your NUSS or social security number.

How to register?

Even though you have a social security number, you will still need to register with Social Security before you start working.

There are two different ways to register, the first is online and the second is by going in person to your nearest office.

Online

Go to the social security website and select Alta de Trabajo Autónomos. You can identify yourself online with your digital certificate, cl@ve pin or via text message as above.

Once, identified you will have to fill out the form TA.0521.

You will need all your personal details again, as well as the social security number you just applied for.

In Part 2 you’ll select your reason for filling out the form. If you’re registering for social security because you want to start work, you’ll check the box that says ‘alta’.

Part 3 of the form will ask you all about your profession and what industry you intend to work in. You will have to register for a particular one, if you want to work in more than one, the process is slightly different.

READ ALSO: Self-employed in Spain: What are the tax rules if you do two or more jobs?

The final part asks you to select the base cover for your social security fees, whether that’s the minimum, maximum or somewhere in between. This will cover you against various situations such as an accident at work, maternity or paternity pay and healthcare.

You will also include your work address, if it’s different from your home address.

Other documents you will need to upload include:

- An identity document such as TIE, green residency card or passport

- Documentation attesting to registration with the Tax Office – this is the other part of registering to become self-employed.

In-person

First, you’ll need to apply for an appointment at your nearest social security office. When you get your appointment you will take all the same forms and documents as above. Remember to have photocopies of everything.

READ ALSO: Will you pay more under Spain's new social security rates for self-employed?

How long do I have to wait for it to be processed?

Once you register, you can start work immediately. You will be charged a monthly social security fee once you do. This changes depending on how much your net earnings are per month.

Over the next few years, the fee will go progressively down to €200 a month for lower earners and progressively higher - up to €590 a month - for higher earners.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.