How to see if you have any notifications from the Spanish tax office

The Spanish tax system can seem a little daunting, but one way to simplify things and keep your mind at ease is to stay on top of your online notifications from the tax office. Here's how to do it online.

Spanish administration is, to say the least, a little laborious. Infamous for its longwinded, time-consuming processes and systems, even completing the most rudimentary of administrative tasks can become an ordeal and take an entire morning or afternoon as you head between the town hall (ayuntamiento) and bank and police station, and probably back again.

The Spanish tax system is no different, and the various rules and regulations can be particularly confusing. If you're new in Spain or don't speak the language, registering yourself, paying taxes and keeping on top of all the various documents and deadlines can be a bit daunting.

READ ALSO: Will you pay more under Spain’s new social security rates for self-employed?

Many people choose to get a 'gestor', which is like an all-in-one accountant and financial advisor that should, in theory, arrange everything for you. This is particularly common among self-employed people in Spain, as the tax system is even more convoluted for autónomos, as they're known in Spanish.

They are the first port of call in Spain for the endless bureaucratic processes that come with anything official here; intermediaries between you and the often-complicated government departments.

READ ALSO: What does a ‘gestor’ do in Spain and why you’ll need one

Despite the complicated system of tax returns, fortunately, Spain's tax office also has a safety net to help you keep on top of your tax obligations.

Even if you have a gestor, they could miss something and it's a good idea to be able to check your own notifications.

f you're registered as a taxpayer in Spain, you'll be able to check any notifications and obligations you have from them online.

Here's how to do it.

How to see if you have any notifications from the tax office in Spain

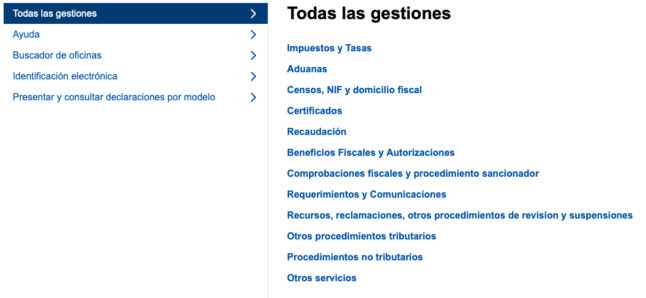

- The first step is going to the tax office website, which you can access here. From there, you need to click on the 'Todas las gestiones' button at the right of the blue banner at the top of the page.

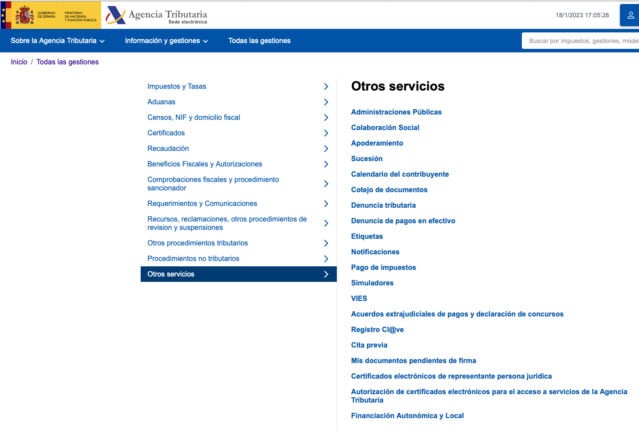

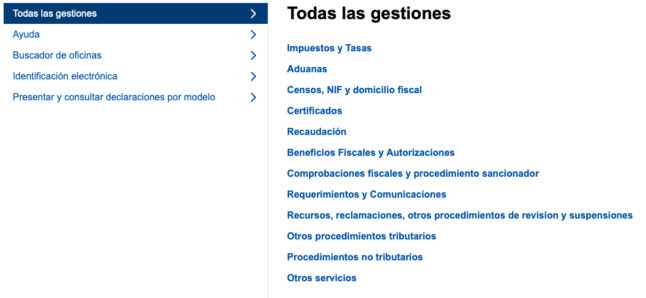

2. Once you've done that you'll see another page that looks like the one below. From there: click 'otros servicios', which is the option at the bottom of the page.

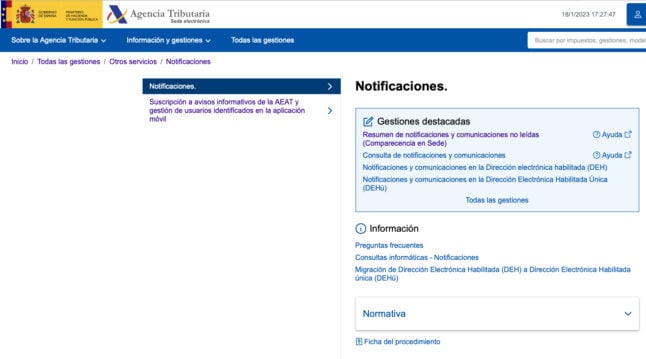

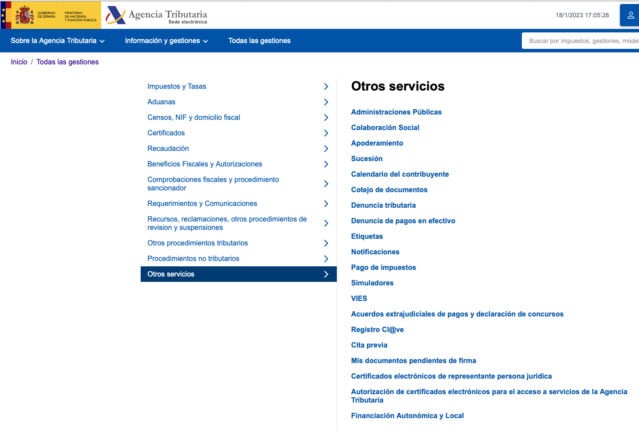

3. Next, you click on 'Notificaciones,' which is halfway down the menu.

READ ALSO: Spanish tax returns: A handy guide for foreigners

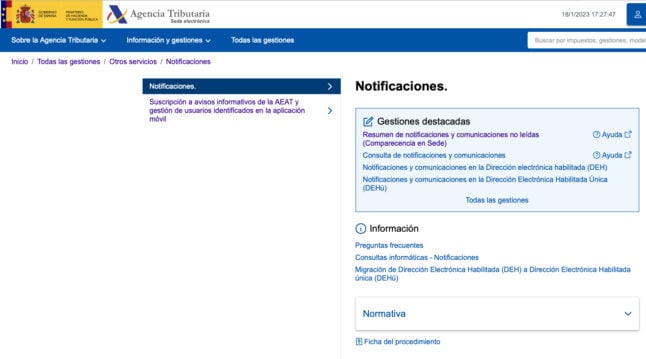

4. That will take you to the following screen, where you need to click 'Consulta de notificaciones y comunicaciones.'

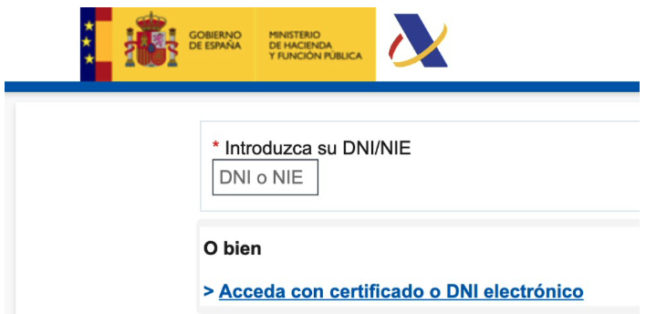

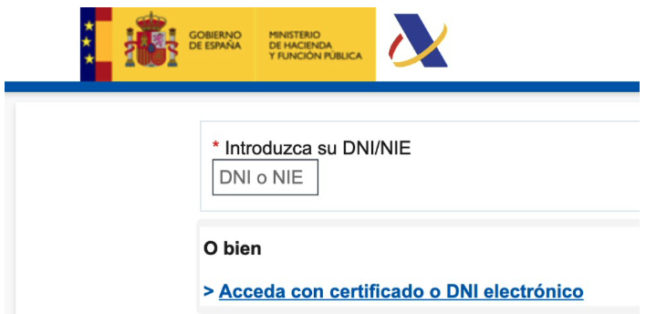

5. You'll then be prompted to log-in, so you can check your notifications, on a screen like the one below. You can do this with your NIE, digital certificate or Cl@ve PIN.

A digital certificate is a piece of software in Spain that you can download on your computer, allowing you to identify yourself during administrative processes. Spain is notorious for its overly laborious bureaucratic systems, but the digital certificate can save you a lot of hassle and allow you to complete many processes online, without having to go in person to the various offices and agencies.

READ MORE: What are the fines and prison sentences for tax evasion in Spain?

If you haven't got a digital certificate, you can find out how to get one here.

READ ALSO: Access all areas: how to get a digital certificate in Spain to aid online processes

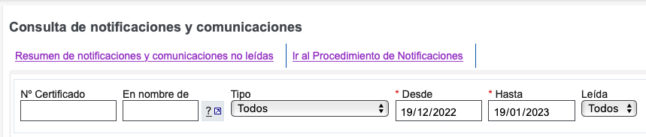

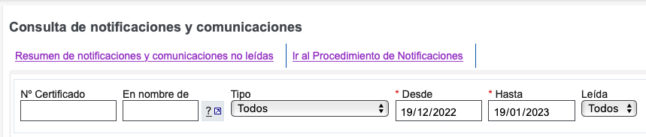

6. Once you've done that and logged in, you'll be taken to the following screen, which is like a sort of notification inbox. Any unread or outstanding notifications or messages you've got from the tax office will be in there, and you're able to search for past documents by number, name, type, date, and whether or not you've read them before.

Or, alternatively, once you're logged in with the digital certificate, you'll be able to see if you have any unread notifications from the little blue button with your name that shows in the top right-hand corner of the page.

Comments

See Also

Spanish administration is, to say the least, a little laborious. Infamous for its longwinded, time-consuming processes and systems, even completing the most rudimentary of administrative tasks can become an ordeal and take an entire morning or afternoon as you head between the town hall (ayuntamiento) and bank and police station, and probably back again.

The Spanish tax system is no different, and the various rules and regulations can be particularly confusing. If you're new in Spain or don't speak the language, registering yourself, paying taxes and keeping on top of all the various documents and deadlines can be a bit daunting.

READ ALSO: Will you pay more under Spain’s new social security rates for self-employed?

Many people choose to get a 'gestor', which is like an all-in-one accountant and financial advisor that should, in theory, arrange everything for you. This is particularly common among self-employed people in Spain, as the tax system is even more convoluted for autónomos, as they're known in Spanish.

They are the first port of call in Spain for the endless bureaucratic processes that come with anything official here; intermediaries between you and the often-complicated government departments.

READ ALSO: What does a ‘gestor’ do in Spain and why you’ll need one

Despite the complicated system of tax returns, fortunately, Spain's tax office also has a safety net to help you keep on top of your tax obligations.

Even if you have a gestor, they could miss something and it's a good idea to be able to check your own notifications.

f you're registered as a taxpayer in Spain, you'll be able to check any notifications and obligations you have from them online.

Here's how to do it.

How to see if you have any notifications from the tax office in Spain

- The first step is going to the tax office website, which you can access here. From there, you need to click on the 'Todas las gestiones' button at the right of the blue banner at the top of the page.

2. Once you've done that you'll see another page that looks like the one below. From there: click 'otros servicios', which is the option at the bottom of the page.

3. Next, you click on 'Notificaciones,' which is halfway down the menu.

READ ALSO: Spanish tax returns: A handy guide for foreigners

4. That will take you to the following screen, where you need to click 'Consulta de notificaciones y comunicaciones.'

5. You'll then be prompted to log-in, so you can check your notifications, on a screen like the one below. You can do this with your NIE, digital certificate or Cl@ve PIN.

A digital certificate is a piece of software in Spain that you can download on your computer, allowing you to identify yourself during administrative processes. Spain is notorious for its overly laborious bureaucratic systems, but the digital certificate can save you a lot of hassle and allow you to complete many processes online, without having to go in person to the various offices and agencies.

READ MORE: What are the fines and prison sentences for tax evasion in Spain?

If you haven't got a digital certificate, you can find out how to get one here.

READ ALSO: Access all areas: how to get a digital certificate in Spain to aid online processes

6. Once you've done that and logged in, you'll be taken to the following screen, which is like a sort of notification inbox. Any unread or outstanding notifications or messages you've got from the tax office will be in there, and you're able to search for past documents by number, name, type, date, and whether or not you've read them before.

Or, alternatively, once you're logged in with the digital certificate, you'll be able to see if you have any unread notifications from the little blue button with your name that shows in the top right-hand corner of the page.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.