How to understand your payslip in Spain

If you’re an employee for a company in Spain, each month you should receive a payslip from your employer, detailing how much you earn, deductions and plenty more. Here's how to read and understand your Spanish payslip properly.

It can sometimes be confusing working for a company in another country. Even if you work in English, your payslip, or nómina as it's called here, can be hard to understand.

According to the salary platform EMT, more than 50 percent of people in Spain don’t know how to read everything on their payslip and don’t fully understand all the numbers on there.

It's important to be able to understand everything about the amount you're getting paid and what's being deducted from that amount each month so that you can stay on top of your finances. Read on for our handy guide to help you out.

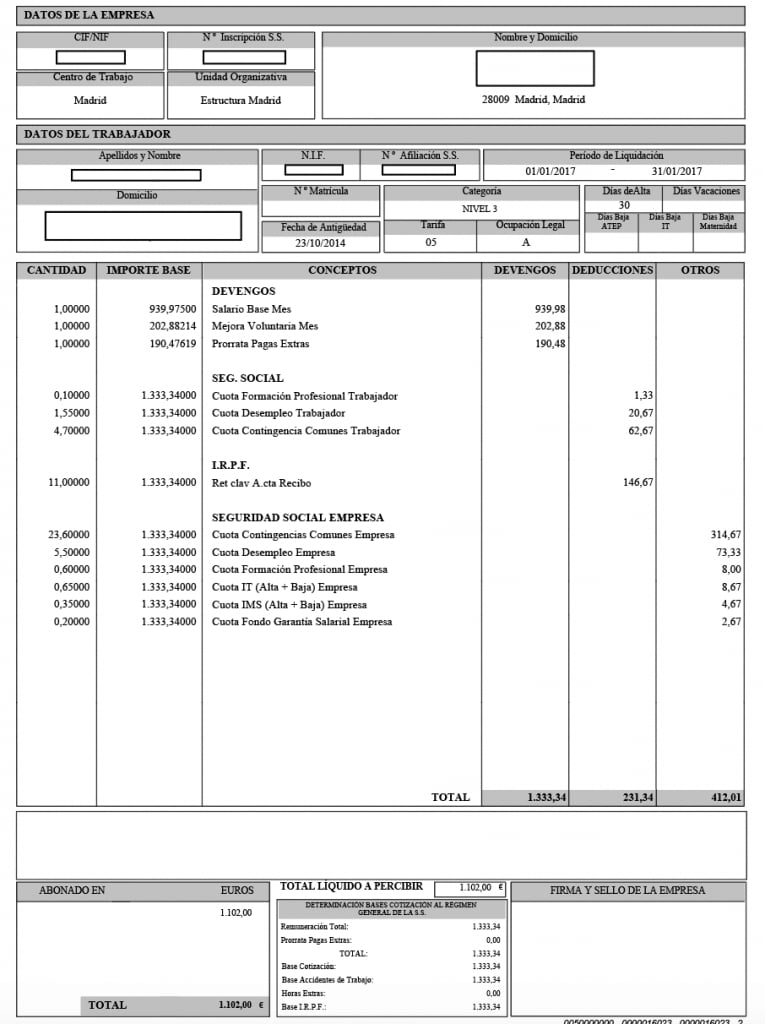

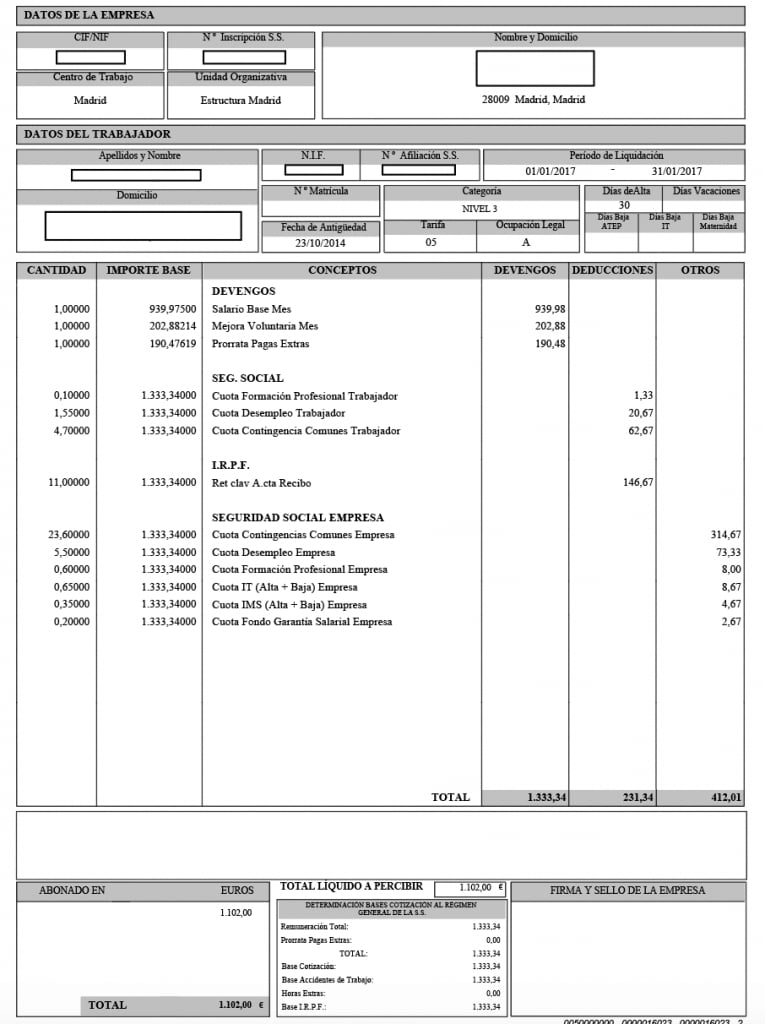

There are essentially three sections to your payslip, which include the header, the middle section detailing your earnings and deductions and the footer, where you’ll see the rates applied for your calculations.

Here's an example of what a nómina or Spanish payslip usually looks like.

Header

According to Spanish law, each payslip must have a header that identifies both the worker and the company. It should include:

Information about the company

Name of the company

Registered office of the company

Tax Identification Code (NIF)

Social Security Registration number

Information about you (the employee)

Full name

Your DNI, NIE or TIE

Your social security number

Position with the company

Professional group

Seniority level

Date you started working for the company

Middle section

Settlement period or Periodo de liquidación

A payslip is in fact similar to an invoice, so it should include a settlement period where it states the number of days worked for the payment being received. This is typically one month or 30 working days.

Revenues and expenses/accruals or Devengos

The revenues and expenses part of your payslip will state the gross amount of income that you have earned for a particular period worked. It will include your base salary, as well as bonuses and extra non-salary payments that are not taxed as part of your salary. These include compensation or payments for redundancy and must not exceed 30 percent of your salary payments.

Base salary or Salario base

Your base salary is the minimum amount you get each month. This will be at least €1,000 which is the minimum wage or SMI set for 2022, if you are working a full day of at least 40 hours per week.

This section will also include:

Supplements or Plus Convenio

This will detail any extra amounts received in relation to your work, such as extra shifts covered, working overtime and payments for extra training.

Extraordinary bonuses or Gratificaciones extraordinarias

If you work in sales, you may regularly get bonuses, but you may also get extra ones at Christmas for example. You may actually receive 14 payments but will receive them 12 times a year or once per month.

Remuneration

This part refers to extra payments to which income tax can be applied such as payments for private medical insurance, petrol for a company car or restaurant coupons to use when you’re working away.

Expenses

This refers the expenses you have incurred in order to carry out your job. It could be the cost of material or transportation if these have previously been agreed upon with your employer.

Social security and benefits or Prestaciones e indemnizaciones de la Seguridad Social

There may also be added benefits for suspensions or dismissals, as well as expenses assumed by the company, such as disability or unemployment benefits.

At the end of all of this, with everything added together, you will see your total gross salary. It’s important to remember though that this isn’t the amount you will get in your bank account each month as there will be several deductions to take into account first.

Deductions or Deducciones

This section of your payslip includes all amounts taken away from your total gross salary in relation to income tax and social security payments. These will include:

Social security or Seguridad Social

Your social security covers for healthcare, sick pay, accidents at work, maternity or paternity pay or temporary disability, and although your employer pays this, you will be responsible for paying 4.70 percent, which will be taken away from your total.

Unemployment or Desempleo

This is the amount that will cover you for potential unemployment or redundancy should the situation arise and varies according to the type of contract you have. It could be anything from 1.55 percent for a fixed-term contract to 1.60 percent for a full-time contract.

Overtime due to force majeure or Horas extraordinarias por fuerza mayor

This will include any extra hours that you worked involuntarily.

Overtime without force majeure or Horas extraordinarias sin fuerza mayor

These are the extra hours you worked voluntarily and can incur withholdings up to 4.7 percent.

Personal income tax or Impuesto sobre la renta de la personas físicas

Your income tax or IRPF will also be taken away from your total gross salary before it appears in your bank account. The percentage that you are charged will vary depending on how much you earn as well as your personal situation, your family (including if you're married and have children) and the type of contract you have.

Salary advances or Salario Anticipo

If you are allowed to get any advances on your salary, this will also be reflected in your payslip and deducted here.

Value of products you received

This refers to the products and services you may get from your company received as wages, which are also subject to income tax.

Other deductions

Other deductions on your income tax may include union payments or loan repayments for example.

After all of this is calculated, you will be able to know the actual amount that you should finally receive. If you need to question anything, you can refer to the footer section, which will state the specific rates applied for your calculations

Comments

See Also

It can sometimes be confusing working for a company in another country. Even if you work in English, your payslip, or nómina as it's called here, can be hard to understand.

According to the salary platform EMT, more than 50 percent of people in Spain don’t know how to read everything on their payslip and don’t fully understand all the numbers on there.

It's important to be able to understand everything about the amount you're getting paid and what's being deducted from that amount each month so that you can stay on top of your finances. Read on for our handy guide to help you out.

There are essentially three sections to your payslip, which include the header, the middle section detailing your earnings and deductions and the footer, where you’ll see the rates applied for your calculations.

Here's an example of what a nómina or Spanish payslip usually looks like.

Header

According to Spanish law, each payslip must have a header that identifies both the worker and the company. It should include:

Information about the company

Name of the company

Registered office of the company

Tax Identification Code (NIF)

Social Security Registration number

Information about you (the employee)

Full name

Your DNI, NIE or TIE

Your social security number

Position with the company

Professional group

Seniority level

Date you started working for the company

Middle section

Settlement period or Periodo de liquidación

A payslip is in fact similar to an invoice, so it should include a settlement period where it states the number of days worked for the payment being received. This is typically one month or 30 working days.

Revenues and expenses/accruals or Devengos

The revenues and expenses part of your payslip will state the gross amount of income that you have earned for a particular period worked. It will include your base salary, as well as bonuses and extra non-salary payments that are not taxed as part of your salary. These include compensation or payments for redundancy and must not exceed 30 percent of your salary payments.

Base salary or Salario base

Your base salary is the minimum amount you get each month. This will be at least €1,000 which is the minimum wage or SMI set for 2022, if you are working a full day of at least 40 hours per week.

This section will also include:

Supplements or Plus Convenio

This will detail any extra amounts received in relation to your work, such as extra shifts covered, working overtime and payments for extra training.

Extraordinary bonuses or Gratificaciones extraordinarias

If you work in sales, you may regularly get bonuses, but you may also get extra ones at Christmas for example. You may actually receive 14 payments but will receive them 12 times a year or once per month.

Remuneration

This part refers to extra payments to which income tax can be applied such as payments for private medical insurance, petrol for a company car or restaurant coupons to use when you’re working away.

Expenses

This refers the expenses you have incurred in order to carry out your job. It could be the cost of material or transportation if these have previously been agreed upon with your employer.

Social security and benefits or Prestaciones e indemnizaciones de la Seguridad Social

There may also be added benefits for suspensions or dismissals, as well as expenses assumed by the company, such as disability or unemployment benefits.

At the end of all of this, with everything added together, you will see your total gross salary. It’s important to remember though that this isn’t the amount you will get in your bank account each month as there will be several deductions to take into account first.

Deductions or Deducciones

This section of your payslip includes all amounts taken away from your total gross salary in relation to income tax and social security payments. These will include:

Social security or Seguridad Social

Your social security covers for healthcare, sick pay, accidents at work, maternity or paternity pay or temporary disability, and although your employer pays this, you will be responsible for paying 4.70 percent, which will be taken away from your total.

Unemployment or Desempleo

This is the amount that will cover you for potential unemployment or redundancy should the situation arise and varies according to the type of contract you have. It could be anything from 1.55 percent for a fixed-term contract to 1.60 percent for a full-time contract.

Overtime due to force majeure or Horas extraordinarias por fuerza mayor

This will include any extra hours that you worked involuntarily.

Overtime without force majeure or Horas extraordinarias sin fuerza mayor

These are the extra hours you worked voluntarily and can incur withholdings up to 4.7 percent.

Personal income tax or Impuesto sobre la renta de la personas físicas

Your income tax or IRPF will also be taken away from your total gross salary before it appears in your bank account. The percentage that you are charged will vary depending on how much you earn as well as your personal situation, your family (including if you're married and have children) and the type of contract you have.

Salary advances or Salario Anticipo

If you are allowed to get any advances on your salary, this will also be reflected in your payslip and deducted here.

Value of products you received

This refers to the products and services you may get from your company received as wages, which are also subject to income tax.

Other deductions

Other deductions on your income tax may include union payments or loan repayments for example.

After all of this is calculated, you will be able to know the actual amount that you should finally receive. If you need to question anything, you can refer to the footer section, which will state the specific rates applied for your calculations

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.