Remote working: the jobs in Spain you'll be able to do from home after the pandemic

The pandemic has shown millions of workers in Spain the benefits of remote working, although many employers are now asking staff to return to their workplaces. Here are some of the most in-demand jobs in Spain where remote working will be allowed once Covid restrictions end.

As September begins, many companies across Spain are calling their workers back into the office and putting an end to the remote working practices that became so common during the pandemic.

The return to the office in Spain isn't at pre-pandemic levels yet, with Google Mobility data for late August showing that commuting flows are 42 percent lower than normal in Madrid and 34 percent lower than pre-Covid standards in Barcelona.

A lot of employers are considering a hybrid work model of part office time and part remote working, what 80 percent of employees in Spain called for in a April 2021 survey by real estate consultancy company CBRE (three days a week working from home).

On the other hand, 83 percent of Spanish CEOs surveyed said they preferred a full five-day return to the office for their staff, which suggests that once Covid infection rates and restrictions become a thing of the past, many bosses will change their stance on the hybrid model.

READ ALSO:

- Coronavirus: Do I have the right to refuse to return to my workplace in Spain?

- Will remote working become the norm in Spain after the Covid-19 pandemic?

Nonetheless, some Spanish jefes (bosses) do now recognise the long-term benefits of remote working and are actively recruiting workers to carry out their job responsibilities from home, now and in the future.

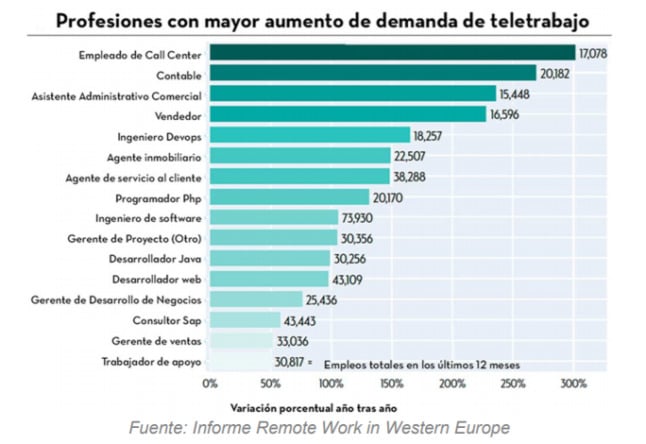

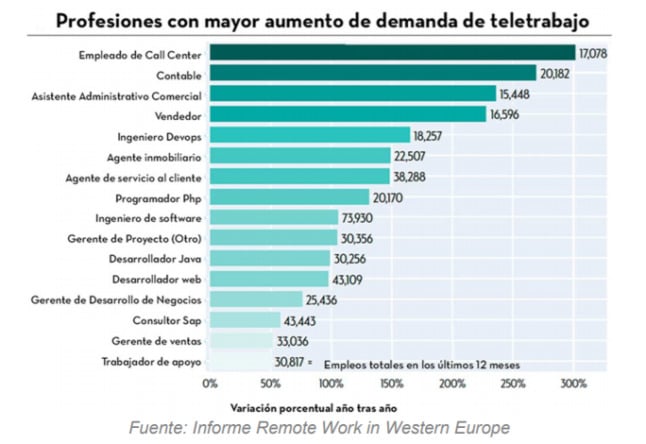

In fact, the number of job vacancies in Spain which involve working from home has risen by more than 200 percent.

According to a new study by the Spanish branch of international HR giants Adecco, there has been a big increase in remote job ads for administrative business assistants (up by 237 percent), accountants (up by 301 percent), telemarketers (up by 302 percent), Development Ops engineers (up by 166 percent) and a real estate agents (up by 150 percent).

Despite these big rises in Spanish job vacancies offering remote working options, they still only represent 0.3 percent of the total jobs available in Spain.

Here are some of the most in-demand remote working jobs in Spain you can try and get if you want to continue working remotely:

Digital marketer

Jobs in digital marketing have increased by 61 percent during the pandemic as more and more companies decide to dedicate more resources to online activities. These types of digital marketing jobs could include social media coordinator, digital marketing consultant or marketing expert. You will find many of these types of jobs being advertised on Linkedin.

Customer service specialist

According to Adecco, a customer support job that you can do over the telephone is the position which offers the most remote working opportunities. These include positions related to customer or technical support, such as a customer service specialist, contact centre specialist, customer contact representative and a technical support advisor. Two of the largest companies that have recently been recruiting for these types of positions in Spain are Amazon and Webhelp.

Digital content creator

During the pandemic in particular, demand for digital content has increased rapidly. In fact, according to data from Linkedin, digital content increased by 63 percent in 2020. This means that there is an increase in the need for digital content creators. This could include jobs such as copywriters, content writers, social media executives, and image and video content creators.

Remember that there are fewer full-time digital content creator gigs going and many more short-term projects, so it's more than likely that you'll need to sign up to be an autónomo or freelancer to be able to invoice companies for these types of jobs.

READ ALSO: Self-employed in Spain: What you should know about being ‘autónomo’

Web and app developer

The rise of big tech companies has in turn seen an increase in jobs for web and app developers across all types of industries. These types of jobs are ideal for doing remotely or from home, and include positions such as back-end developer, game developer, cloud systems architect and game designer.

According to Spanish finance website El Economista, 85 percent of all hires of web and app developers in 2020 were men with an average age of 26 years, however just because you may not fit into those categories doesn't mean you can't get a job in this field. As long as you have the right qualifications and experience in this area, these remote jobs are available.

Estate agent

Jobs for real estate agents have increased by 150 percent during the pandemic and are a great option for those who want to work remotely. You will of course have to travel to show your clients around the properties, but the majority of the admin and advertising work can be done from home. According to online Spanish property giants Fotocasa, 70 percent of real estate agents were able to operate remotely during the pandemic.

Accountant

An accountant is another position that can easily be done remotely and doesn't require you to commute to an office. According to Adecco, remote accounting jobs were up by 301 percent during the pandemic. This is another job where you may need to register as an autónomo or freelancer unless you are employed by one company rather than several clients.

READ ALSO - Not just English teaching: The jobs you can do in Spain without speaking Spanish

Comments

See Also

As September begins, many companies across Spain are calling their workers back into the office and putting an end to the remote working practices that became so common during the pandemic.

The return to the office in Spain isn't at pre-pandemic levels yet, with Google Mobility data for late August showing that commuting flows are 42 percent lower than normal in Madrid and 34 percent lower than pre-Covid standards in Barcelona.

A lot of employers are considering a hybrid work model of part office time and part remote working, what 80 percent of employees in Spain called for in a April 2021 survey by real estate consultancy company CBRE (three days a week working from home).

On the other hand, 83 percent of Spanish CEOs surveyed said they preferred a full five-day return to the office for their staff, which suggests that once Covid infection rates and restrictions become a thing of the past, many bosses will change their stance on the hybrid model.

READ ALSO:

- Coronavirus: Do I have the right to refuse to return to my workplace in Spain?

- Will remote working become the norm in Spain after the Covid-19 pandemic?

Nonetheless, some Spanish jefes (bosses) do now recognise the long-term benefits of remote working and are actively recruiting workers to carry out their job responsibilities from home, now and in the future.

In fact, the number of job vacancies in Spain which involve working from home has risen by more than 200 percent.

According to a new study by the Spanish branch of international HR giants Adecco, there has been a big increase in remote job ads for administrative business assistants (up by 237 percent), accountants (up by 301 percent), telemarketers (up by 302 percent), Development Ops engineers (up by 166 percent) and a real estate agents (up by 150 percent).

Despite these big rises in Spanish job vacancies offering remote working options, they still only represent 0.3 percent of the total jobs available in Spain.

Here are some of the most in-demand remote working jobs in Spain you can try and get if you want to continue working remotely:

Digital marketer

Jobs in digital marketing have increased by 61 percent during the pandemic as more and more companies decide to dedicate more resources to online activities. These types of digital marketing jobs could include social media coordinator, digital marketing consultant or marketing expert. You will find many of these types of jobs being advertised on Linkedin.

Customer service specialist

According to Adecco, a customer support job that you can do over the telephone is the position which offers the most remote working opportunities. These include positions related to customer or technical support, such as a customer service specialist, contact centre specialist, customer contact representative and a technical support advisor. Two of the largest companies that have recently been recruiting for these types of positions in Spain are Amazon and Webhelp.

Digital content creator

During the pandemic in particular, demand for digital content has increased rapidly. In fact, according to data from Linkedin, digital content increased by 63 percent in 2020. This means that there is an increase in the need for digital content creators. This could include jobs such as copywriters, content writers, social media executives, and image and video content creators.

Remember that there are fewer full-time digital content creator gigs going and many more short-term projects, so it's more than likely that you'll need to sign up to be an autónomo or freelancer to be able to invoice companies for these types of jobs.

READ ALSO: Self-employed in Spain: What you should know about being ‘autónomo’

Web and app developer

The rise of big tech companies has in turn seen an increase in jobs for web and app developers across all types of industries. These types of jobs are ideal for doing remotely or from home, and include positions such as back-end developer, game developer, cloud systems architect and game designer.

According to Spanish finance website El Economista, 85 percent of all hires of web and app developers in 2020 were men with an average age of 26 years, however just because you may not fit into those categories doesn't mean you can't get a job in this field. As long as you have the right qualifications and experience in this area, these remote jobs are available.

Estate agent

Jobs for real estate agents have increased by 150 percent during the pandemic and are a great option for those who want to work remotely. You will of course have to travel to show your clients around the properties, but the majority of the admin and advertising work can be done from home. According to online Spanish property giants Fotocasa, 70 percent of real estate agents were able to operate remotely during the pandemic.

Accountant

An accountant is another position that can easily be done remotely and doesn't require you to commute to an office. According to Adecco, remote accounting jobs were up by 301 percent during the pandemic. This is another job where you may need to register as an autónomo or freelancer unless you are employed by one company rather than several clients.

READ ALSO - Not just English teaching: The jobs you can do in Spain without speaking Spanish

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.