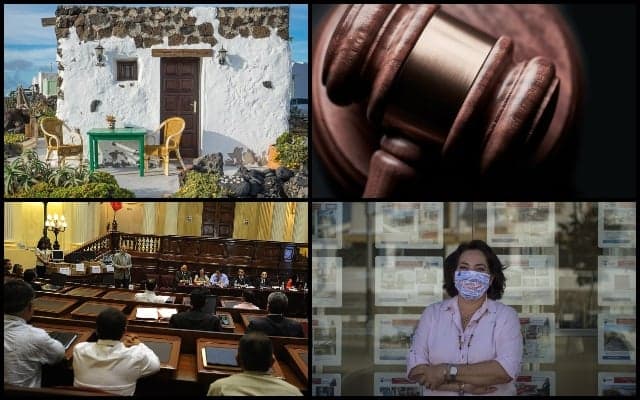

Property in Spain: The different ways to buy a home (and their pros and cons)

When it comes to buying a property in Spain, there are more purchase options available than doing it through a real estate agency or a private seller. Here we take look a the advantages and disadvantages of each way of buying a home in Spain, covering everything from costs to risks.

Estate Agency (inmobiliaria)

Pros:

Expertise

There’s nothing stopping you from taking care of every step of the property hunt yourself but realtors do it for a living and generally know their stuff.

They can save you time searching for properties, give you a heads up about potentially suitable ones before they are listed, they know market prices and all in all are more likely to help you find the best deal.

Assistance

Finding your dream home in Spain and putting in an offer is one thing, but getting through the purchase transaction can be challenging for those who aren’t familiar with the process.

Again, having seasoned professionals handling these somewhat complicated administrative processes, especially if you’re not fluent in in Spanish – let alone contractual Spanish jargon – can save you time, effort and a few headaches.

Cons:

Extra costs

The obvious disadvantage of buying a property through an agency is the added cost, with the average real estate fee in Spain usually between 2 and 5 percent of the price of the property.

Although in Spain the commission the agency takes must be shared between the seller and the buyer, the truth is that in many cases it falls solely to the buyer.

There are now more online estate agencies such as Housfy which are offering zero commission fees for both sellers and buyers.

Not all agencies can be trusted

Just like anywhere else in the world, there are fake estate agencies in Spain scamming prospective buyers out of thousands of euros.

There are also agencies that do exist but who put profit before reputation and don’t inform buyers of hidden fees and other costs beforehand.

Do your homework and combine your online search with personal recommendations if possible.

Two organisations that provide a list of real estate agencies in Spain that abide by the correct code of ethics are:

- Aegi (asociación de empresarios de gestión inmobiliaria)

- Coapi (colegio oficial de agentes de la propiedad inmobiliaria)

Private seller (vendedor particular)

Pros:

It’s cheaper

Cut out the middleman when buying a home in Spain and you can save between 2 to 5 percent on the value of the property by avoiding estate agency fees.

According to a 2018 study by Spanish consumer group OCU, 26 percent of homebuyers who used an agency to buy a home were unsatisfied with the services rendered.

It can be faster

If you’re reaching a direct deal with the seller, there can be less toing and froing between the agency which can save you time and effort.

Cons:

Scam risk

Although most purchases through private sellers in Spain (representing 45 percent of home sales ) go ahead as planned , there are scammers who can exploit novice buyers’ lack of expertise on the process to sell them a house that’s not theirs, among other cons.

Absence of guarantees

Buying a home in Spain is a complex process for which it is recommended to have a professional at hand to help with the property purchase.

Although the transaction will include a visit to the registry and your local notary, there is room for mishaps if you don’t have someone going over the contract with a fine-tooth comb.

For example, a buyer could find out there’s a problem with the house after the purchase, only to not be able to sue the seller because there’s no clause in the contract which deals with this.

Property developer (Promotora)

Pros:

Completely new

Obviously, a brand-new building should mean that the buyer doesn’t have to worry about renovations or any other major fixes in the property.

There’s also a much higher chance that the property will have been constructed with better building materials that are more energy efficient and save on costs over time.

Customisation

You might not be able to choose every single detail that you want for your home, but “promotoras” will likely offer you the chance to decide on key decoration elements : wall paint colours, flooring types, window fittings, kitchen cabinets etc

After-sales service and financing

Many property developers in Spain have a network of professionals at their disposal to help new homeowners set up shop at their new property: from getting electricity and water, to fixing any problems with the new build.

This is not something that buyers have at their disposal if the purchase is done from a private owner or through other means.

In many cases, it is possible that the property developer can act as a subrogated creditor, offering more favourable mortgage terms than a bank , although they will need to prove that they are solvent.

Photo: Ennio Dybeli/Unsplash

Photo: Ennio Dybeli/Unsplash

Cons:

Risk of losing deposit

A fairly common problem homeowners have with “promotoras” is that they are asked to put down around 10 percent of the property price before construction starts.

This is either paid to the property developer, the landowner or agency, but on some occasions one party commits fraud and disappears with the funds.

There also cases when the project is held back for years due to problems with permits, planning permissions etc and budding homeowners can retrieve the money they invested.

There are many old half-built buildings in Spain that are testament to this.

Costs generally higher

New builds tend to have a higher price/sqm rate than second-hand homes. As they are increasingly equipped with better community installation, there can also be higher fees for this than with older residential buildings.

Furthermore, the VAT (10 percent IVA) is higher on new builds when compared to the ITP transfer tax for on existing buildings (7 percent on average, decided by regions).

READ MORE:

- Spanish mortgages: Ten things foreigners should know before getting one

- Buying a property in Spain: What to do and what to avoid

Banks

Pros:

Better financing

You can get 100 percent financing for mortgages on properties repossessed by the bank and generally lower interest rates than for other mortgages on properties.

Save on other costs

If you buy a property from the bank in Spain you usually don’t have to pay for a home appraisal (tasación) as they cover this.

If you found the property through an agency, their fee will often be lower for the buyer as the bank takes on some of these costs.

Unlisted properties

Often properties that banks own aren’t initially listed on the usual property websites, so you can have first dibs on a property if you have a good relationship with the staff at your Spanish bank and ask them to let you know if any new properties emerge.

This is important as there tends to be lot of people interested in these properties, which means that your bargaining power will be diminished once the property is listed.

Cons:

Damaged goods

Properties owned by the bank often tend to be in poor state and require refurbishing.

It’s also worth checking that these properties don’t have any outstanding debt - as is often the case with repossessed homes – so you need to do a due diligence check of the property and contact solicitor for help.

Limited selection and prices

Property prices aren’t always as great as one might expect on embargoed properties owned by Spanish banks.

They tend to price them however it suits them and bargaining usually depends on the bank’s situation as well as the global market.

Here is a list of websites offering repossessed properties in Spain:

BNP Paribas: https://www.realestate.bnpparibas.es/bnppre/es/pagina-principal-cfo4_8960.html

CajaSur: http://www.cajasurinmobiliaria.com

Casaktua: https://www.casaktua.com

Escogecasa: http://www.escogecasa.es

CR Navarra – Ruralvia: http://crnavarra.ruralvia.com

Holapisos (La Caixa): http://www.holapisos.com

Ibercaja: https://portalinmobiliario.ibercaja.es/

Servihabitat: https://www.servihabitat.com/en/

Solvia: http://www.solvia.es

Unicaja: http://www.unicajainmuebles.com

Haya: https://www.haya.es/

Aliseda Inmobiliaria (Banco Popular): https://www.alisedainmobiliaria.com/

Altamira: https://www.altamirainmuebles.com/

Banca March: https://www.bancamarch.es/es/oferta-inmobiliaria/

Banco Primus: http://www.bancoprimus.es/immuebles-en-venta.aspx

Bankinter: https://www.bankinter.com/www/es-es/cgi/ebk+inmuebles+home

State auctions (subastas públicas)

Pros

Many bargains

The main advantage of buying a property at a public auction in Spain is that the prices are usually lower than the market average. In some cases, these discounts can be considerable.

For example, if the debt that the creditor has is small or if the auction rate established in the mortgage deed is very low, as the starting price has nothing to do with the market value, but with the fee established in the mortgage.

If the mortgage was set up 20 or 30 years ago, the price could be much lower.

Those taking part in an auction may be required to pay a percentage of the property's value to take part in the bid, a sum which is paid back if the property isn’t bought.

Photo: Bill Oxford/Unsplash

Photo: Bill Oxford/Unsplash

Cons

Lack of information

Usually homebuyers at public auctions won’t be be able to see the property’s interior before bidding, which is risky by any account.

Although the Spanish government’s auction website publishes all the registration information, you can’t see if someone is occupying the property, if they have outstanding debts with the neighbourhood community, or if the price is adjusted to market rates.

You’ll need to do some true investigative work on your own if you want to find out more before bidding.

It’s worth talking to neighbours to gather intel about the state of the property, as you won’t get prior access legally, as well as comparing the price of the property to that of the other properties in the area to establish a maximum bid.

Also request extra information from the registry to verify that there are no outstanding charges for non-payment of the IBI property tax or the community of owners' fee (these can be cancelled by the court if informed of them).

Inflexible payment and lending

Another added problem of buying a property at auction is that you have to complete the payment of the remaining value of the property within the time frame set by the court and, in the event that you need financing from the bank, this process is not necessarily immediate and can put you under a lot of pressure.

Nor can you apply for a mortgage beforehand as these aren’t usually granted on an asset that’s subject to public bidding. Although it is legally possible, it’s a complex process and banks usually don’t want the risks that it entails.

READ MORE:

- The real cost of buying a house in Spain as a foreigner

- How not to buy a house in Spain: The top five pitfalls to avoid

- What's the process for buying a property in Spain?

Comments

See Also

Estate Agency (inmobiliaria)

Pros:

Expertise

There’s nothing stopping you from taking care of every step of the property hunt yourself but realtors do it for a living and generally know their stuff.

They can save you time searching for properties, give you a heads up about potentially suitable ones before they are listed, they know market prices and all in all are more likely to help you find the best deal.

Assistance

Finding your dream home in Spain and putting in an offer is one thing, but getting through the purchase transaction can be challenging for those who aren’t familiar with the process.

Again, having seasoned professionals handling these somewhat complicated administrative processes, especially if you’re not fluent in in Spanish – let alone contractual Spanish jargon – can save you time, effort and a few headaches.

Cons:

Extra costs

The obvious disadvantage of buying a property through an agency is the added cost, with the average real estate fee in Spain usually between 2 and 5 percent of the price of the property.

Although in Spain the commission the agency takes must be shared between the seller and the buyer, the truth is that in many cases it falls solely to the buyer.

There are now more online estate agencies such as Housfy which are offering zero commission fees for both sellers and buyers.

Not all agencies can be trusted

Just like anywhere else in the world, there are fake estate agencies in Spain scamming prospective buyers out of thousands of euros.

There are also agencies that do exist but who put profit before reputation and don’t inform buyers of hidden fees and other costs beforehand.

Do your homework and combine your online search with personal recommendations if possible.

Two organisations that provide a list of real estate agencies in Spain that abide by the correct code of ethics are:

- Aegi (asociación de empresarios de gestión inmobiliaria)

- Coapi (colegio oficial de agentes de la propiedad inmobiliaria)

Private seller (vendedor particular)

Pros:

It’s cheaper

Cut out the middleman when buying a home in Spain and you can save between 2 to 5 percent on the value of the property by avoiding estate agency fees.

According to a 2018 study by Spanish consumer group OCU, 26 percent of homebuyers who used an agency to buy a home were unsatisfied with the services rendered.

It can be faster

If you’re reaching a direct deal with the seller, there can be less toing and froing between the agency which can save you time and effort.

Cons:

Scam risk

Although most purchases through private sellers in Spain (representing 45 percent of home sales ) go ahead as planned , there are scammers who can exploit novice buyers’ lack of expertise on the process to sell them a house that’s not theirs, among other cons.

Absence of guarantees

Buying a home in Spain is a complex process for which it is recommended to have a professional at hand to help with the property purchase.

Although the transaction will include a visit to the registry and your local notary, there is room for mishaps if you don’t have someone going over the contract with a fine-tooth comb.

For example, a buyer could find out there’s a problem with the house after the purchase, only to not be able to sue the seller because there’s no clause in the contract which deals with this.

Property developer (Promotora)

Pros:

Completely new

Obviously, a brand-new building should mean that the buyer doesn’t have to worry about renovations or any other major fixes in the property.

There’s also a much higher chance that the property will have been constructed with better building materials that are more energy efficient and save on costs over time.

Customisation

You might not be able to choose every single detail that you want for your home, but “promotoras” will likely offer you the chance to decide on key decoration elements : wall paint colours, flooring types, window fittings, kitchen cabinets etc

After-sales service and financing

Many property developers in Spain have a network of professionals at their disposal to help new homeowners set up shop at their new property: from getting electricity and water, to fixing any problems with the new build.

This is not something that buyers have at their disposal if the purchase is done from a private owner or through other means.

In many cases, it is possible that the property developer can act as a subrogated creditor, offering more favourable mortgage terms than a bank , although they will need to prove that they are solvent.

Photo: Ennio Dybeli/Unsplash

Photo: Ennio Dybeli/Unsplash

Cons:

Risk of losing deposit

A fairly common problem homeowners have with “promotoras” is that they are asked to put down around 10 percent of the property price before construction starts.

This is either paid to the property developer, the landowner or agency, but on some occasions one party commits fraud and disappears with the funds.

There also cases when the project is held back for years due to problems with permits, planning permissions etc and budding homeowners can retrieve the money they invested.

There are many old half-built buildings in Spain that are testament to this.

Costs generally higher

New builds tend to have a higher price/sqm rate than second-hand homes. As they are increasingly equipped with better community installation, there can also be higher fees for this than with older residential buildings.

Furthermore, the VAT (10 percent IVA) is higher on new builds when compared to the ITP transfer tax for on existing buildings (7 percent on average, decided by regions).

READ MORE:

- Spanish mortgages: Ten things foreigners should know before getting one

- Buying a property in Spain: What to do and what to avoid

Banks

Pros:

Better financing

You can get 100 percent financing for mortgages on properties repossessed by the bank and generally lower interest rates than for other mortgages on properties.

Save on other costs

If you buy a property from the bank in Spain you usually don’t have to pay for a home appraisal (tasación) as they cover this.

If you found the property through an agency, their fee will often be lower for the buyer as the bank takes on some of these costs.

Unlisted properties

Often properties that banks own aren’t initially listed on the usual property websites, so you can have first dibs on a property if you have a good relationship with the staff at your Spanish bank and ask them to let you know if any new properties emerge.

This is important as there tends to be lot of people interested in these properties, which means that your bargaining power will be diminished once the property is listed.

Cons:

Damaged goods

Properties owned by the bank often tend to be in poor state and require refurbishing.

It’s also worth checking that these properties don’t have any outstanding debt - as is often the case with repossessed homes – so you need to do a due diligence check of the property and contact solicitor for help.

Limited selection and prices

Property prices aren’t always as great as one might expect on embargoed properties owned by Spanish banks.

They tend to price them however it suits them and bargaining usually depends on the bank’s situation as well as the global market.

Here is a list of websites offering repossessed properties in Spain:

BNP Paribas: https://www.realestate.bnpparibas.es/bnppre/es/pagina-principal-cfo4_8960.html

CajaSur: http://www.cajasurinmobiliaria.com

Casaktua: https://www.casaktua.com

Escogecasa: http://www.escogecasa.es

CR Navarra – Ruralvia: http://crnavarra.ruralvia.com

Holapisos (La Caixa): http://www.holapisos.com

Ibercaja: https://portalinmobiliario.ibercaja.es/

Servihabitat: https://www.servihabitat.com/en/

Solvia: http://www.solvia.es

Unicaja: http://www.unicajainmuebles.com

Haya: https://www.haya.es/

Aliseda Inmobiliaria (Banco Popular): https://www.alisedainmobiliaria.com/

Altamira: https://www.altamirainmuebles.com/

Banca March: https://www.bancamarch.es/es/oferta-inmobiliaria/

Banco Primus: http://www.bancoprimus.es/immuebles-en-venta.aspx

Bankinter: https://www.bankinter.com/www/es-es/cgi/ebk+inmuebles+home

State auctions (subastas públicas)

Pros

Many bargains

The main advantage of buying a property at a public auction in Spain is that the prices are usually lower than the market average. In some cases, these discounts can be considerable.

For example, if the debt that the creditor has is small or if the auction rate established in the mortgage deed is very low, as the starting price has nothing to do with the market value, but with the fee established in the mortgage.

If the mortgage was set up 20 or 30 years ago, the price could be much lower.

Those taking part in an auction may be required to pay a percentage of the property's value to take part in the bid, a sum which is paid back if the property isn’t bought.

Photo: Bill Oxford/Unsplash

Photo: Bill Oxford/Unsplash

Cons

Lack of information

Usually homebuyers at public auctions won’t be be able to see the property’s interior before bidding, which is risky by any account.

Although the Spanish government’s auction website publishes all the registration information, you can’t see if someone is occupying the property, if they have outstanding debts with the neighbourhood community, or if the price is adjusted to market rates.

You’ll need to do some true investigative work on your own if you want to find out more before bidding.

It’s worth talking to neighbours to gather intel about the state of the property, as you won’t get prior access legally, as well as comparing the price of the property to that of the other properties in the area to establish a maximum bid.

Also request extra information from the registry to verify that there are no outstanding charges for non-payment of the IBI property tax or the community of owners' fee (these can be cancelled by the court if informed of them).

Inflexible payment and lending

Another added problem of buying a property at auction is that you have to complete the payment of the remaining value of the property within the time frame set by the court and, in the event that you need financing from the bank, this process is not necessarily immediate and can put you under a lot of pressure.

Nor can you apply for a mortgage beforehand as these aren’t usually granted on an asset that’s subject to public bidding. Although it is legally possible, it’s a complex process and banks usually don’t want the risks that it entails.

READ MORE:

- The real cost of buying a house in Spain as a foreigner

- How not to buy a house in Spain: The top five pitfalls to avoid

- What's the process for buying a property in Spain?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.