EXPLAINED: How choosing the right region in Spain can save you thousands in inheritance tax

Spain's huge regional disparities in inheritance tax laws mean foreigners should think carefully about where they live and invest, even if they’re non-residents. We speak to an international lawyer about how to ‘play the game’ and save thousands of euros.

Spain’s inheritance or succession tax, known as “impuesto de sucesiones” is complex and controversial, but it’s very important to understand how it works in order to avoid any unfortunate financial surprises when a loved one with a connection to Spain passes away.

Spanish inheritance tax is decided by the Spanish State but all of the country’s 17 regions have the right to change these rules to make them more beneficial or detrimental to heirs, with the general trend being towards the former fortunately.

The State succession tax rates will differ depending on how much is inherited, ranging from 7.65 percent on the first €7,933 up to 34 percent on €797,555+.

There are many factors to consider, such as which category heirs and other beneficiaries fall into, or the fact that in Spain the spouse of the deceased is subject to inheritance tax (not the case in the UK and many other countries).

But in this article the focus is on how choosing the right region to live in and/or invest in Spain is crucial when it comes to a family’s inheritance.

"You can play with this a lot and save a lot of money," Alejandro del Campo, partner at DMS Consulting in Mallorca, told The Local in a nutshell.

‘Insane differences between regions’

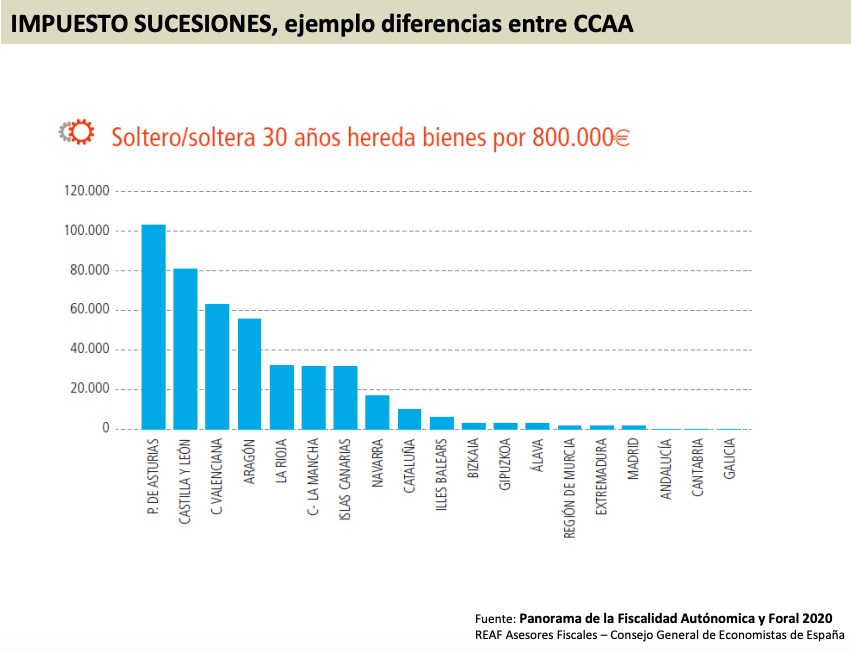

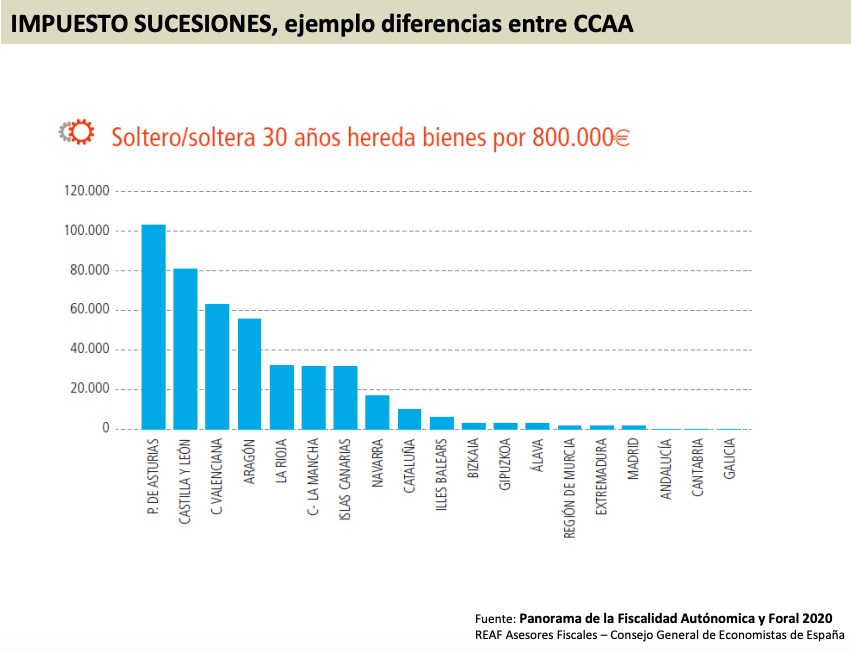

Del Campo, who has a large portfolio of foreign clients at his firm, explains how "for example for a ‘modest’ inheritance of €800,000 from a father to a direct relative, such as to a son, the differences between regions can be insane, and even more so for larger inheritances".

According to information from Spain’s Council of Economists and Fiscal Advisors (REAF), in 2020 the region with the highest inheritance tax is Asturias, where a thirty-year-old single person would have to pay over €100,000 in inheritance tax on assets worth €800,000.

The other regions with high inheritance tax in Spain are Castilla y León, the Valencia region, and Aragón, where an heir with the same specifications listed above would have to pay between €55,000 and €80,000.

On the lower end of the graph are regions such as Galicia, Cantabria, Andalucía, Madrid, Murcia, Extremadura and the Basque Country, which have virtually scrapped inheritance tax or introduced tax allowances to counteract it.

These conditions are subject to change every year and there are other factors at play that can sway the situation in favour or against the beneficiary.

The Canary Islands and La Rioja are the regions where succession tax increased the most from 2019 to 2020, whereas Galicia is where it has dropped the most (currently zero).

How can foreigners who live or have property in Spain reduce their family’s inheritance tax?

“Taking into account all these important regional differences, you can play with the ‘rules of the game’ regarding inheritance tax for residents and non-residents,” del Campo argues.

Case 1

“For example, if a British son or daughter becomes a resident in Spain and his/her father residing in the United Kingdom dies and leaves him/her a fortune in inheritance, whether money and real estate in the UK (in this case the father did not have property in Spain), that son or daughter will have to pay inheritance tax in Spain for all the assets he or she inherits anywhere in the world,” del Campo explains.

“If that son our daughter is living in a region in Spain with a high Inheritance tax then they will be rinsed financially speaking.

“They have to pay either high State inheritance tax - up to 34 percent on inheritances between direct relatives, even if the father was a non-resident - or potentially the expensive regulations of that region where the heir lives.

“As the father did not have property in Spain, the regulations of the region in Spain in which the direct descendant lives must be applied.”

“In that case, the advice for that family is that if the son or daughter becomes a resident in a region in Spain with expensive inheritance tax, then the father will do his heir a great favour if they buy a property in a cheap region, for example Madrid or Andalusia.

“Whether it’s buying an apartment or opening a bank account in one of those cheap regions - either will work.

"In this case upon the death of the father, the regulations of the Spanish region where the father had more assets when he died will apply and not the region in which the son lives.”

Case 2

“If the son or daughter comes to live in a cheap region of Spain in terms of inheritance tax, then it’s best if the father doesn't have property in Spain, or if he does, to have it in that same region or another cheaper inheritance tax region.”

Case 3

“Another scenario is a British father residing in Spain, with a great fortune in Spain and/or somewhere else in the world.

“It will be better for his heirs if he chooses to live in a cheap inheritance tax region (Madrid, Andalusia for example) because upon his death those inheritance regulations from his cheap region will apply, and it will not matter if your children or heirs live in Spain - in an expensive or cheap community - or anywhere else in the world.”

READ ALSO:

-

Five things you need to know about inheritance tax in Spain

-

What does a gestor do and why you'll probably need one in Spain

A silver lining for British non-residents in Spain as Brexit approaches

The Local recently wrote about how non-resident Britons who let out properties in Spain could see their IRNR tax triple after Brexit as they will no longer be considered EU residents by Spanish tax authorities.

It’s a measure considered “absurd and unfair” by del Campo, but at least the same will not apply to inheritance tax once the Brexit transition period is officially over on December 31st 2020.

“The European Court of Justice put an end to the brutal discrimination relating to Spanish inheritance tax, since inheritance tax for non-residents (whether the deceased or the heir, or both), were up to 34 percent and they couldn’t apply for regional tax benefits,” he told The Local.

In 2018 Spain’s Supreme Court published a ruling confirming that these Spanish succession and gift tax rules breached the free movement of capital protected by the EU Treaty with regard to non-residents.

“This means that when the British become non-EU for tax purposes, they will still be able to apply for these important benefits in the Spanish Inheritance Tax,” del Campo explains.

A couple looks at the view of Barcelona. Photo: Tiburi/Pixabay

A couple looks at the view of Barcelona. Photo: Tiburi/Pixabay

“This applies whether it is an inheritance from a father residing in the United Kingdom for a son who’s a resident in Spain, or an inheritance from a father who’s a resident in Spain for a son residing in the UK.

“And also if it is an inheritance of assets located in Spain (for example, real estate) between family members all residing in the United Kingdom”.

If you are fluent in Spanish and understand the country’s tax system, you can read in detail about 2020’s regional tax differences in Spain here.

Otherwise if you have a connection to Spain – whether it’s assets, you live there or one of your heirs does – consider contacting an English-speaking fiscal advisor with experience helping international clients to get help for your particular situation.

READ ALSO:

-

Brexit: The money matters Brits in Spain need to consider

-

Brexit: How much money will Britons in Spain need to be legally resident?

.

Comments

See Also

Spain’s inheritance or succession tax, known as “impuesto de sucesiones” is complex and controversial, but it’s very important to understand how it works in order to avoid any unfortunate financial surprises when a loved one with a connection to Spain passes away.

Spanish inheritance tax is decided by the Spanish State but all of the country’s 17 regions have the right to change these rules to make them more beneficial or detrimental to heirs, with the general trend being towards the former fortunately.

The State succession tax rates will differ depending on how much is inherited, ranging from 7.65 percent on the first €7,933 up to 34 percent on €797,555+.

There are many factors to consider, such as which category heirs and other beneficiaries fall into, or the fact that in Spain the spouse of the deceased is subject to inheritance tax (not the case in the UK and many other countries).

But in this article the focus is on how choosing the right region to live in and/or invest in Spain is crucial when it comes to a family’s inheritance.

"You can play with this a lot and save a lot of money," Alejandro del Campo, partner at DMS Consulting in Mallorca, told The Local in a nutshell.

‘Insane differences between regions’

Del Campo, who has a large portfolio of foreign clients at his firm, explains how "for example for a ‘modest’ inheritance of €800,000 from a father to a direct relative, such as to a son, the differences between regions can be insane, and even more so for larger inheritances".

According to information from Spain’s Council of Economists and Fiscal Advisors (REAF), in 2020 the region with the highest inheritance tax is Asturias, where a thirty-year-old single person would have to pay over €100,000 in inheritance tax on assets worth €800,000.

The other regions with high inheritance tax in Spain are Castilla y León, the Valencia region, and Aragón, where an heir with the same specifications listed above would have to pay between €55,000 and €80,000.

On the lower end of the graph are regions such as Galicia, Cantabria, Andalucía, Madrid, Murcia, Extremadura and the Basque Country, which have virtually scrapped inheritance tax or introduced tax allowances to counteract it.

These conditions are subject to change every year and there are other factors at play that can sway the situation in favour or against the beneficiary.

The Canary Islands and La Rioja are the regions where succession tax increased the most from 2019 to 2020, whereas Galicia is where it has dropped the most (currently zero).

How can foreigners who live or have property in Spain reduce their family’s inheritance tax?

“Taking into account all these important regional differences, you can play with the ‘rules of the game’ regarding inheritance tax for residents and non-residents,” del Campo argues.

Case 1

“For example, if a British son or daughter becomes a resident in Spain and his/her father residing in the United Kingdom dies and leaves him/her a fortune in inheritance, whether money and real estate in the UK (in this case the father did not have property in Spain), that son or daughter will have to pay inheritance tax in Spain for all the assets he or she inherits anywhere in the world,” del Campo explains.

“If that son our daughter is living in a region in Spain with a high Inheritance tax then they will be rinsed financially speaking.

“They have to pay either high State inheritance tax - up to 34 percent on inheritances between direct relatives, even if the father was a non-resident - or potentially the expensive regulations of that region where the heir lives.

“As the father did not have property in Spain, the regulations of the region in Spain in which the direct descendant lives must be applied.”

“In that case, the advice for that family is that if the son or daughter becomes a resident in a region in Spain with expensive inheritance tax, then the father will do his heir a great favour if they buy a property in a cheap region, for example Madrid or Andalusia.

“Whether it’s buying an apartment or opening a bank account in one of those cheap regions - either will work.

"In this case upon the death of the father, the regulations of the Spanish region where the father had more assets when he died will apply and not the region in which the son lives.”

Case 2

“If the son or daughter comes to live in a cheap region of Spain in terms of inheritance tax, then it’s best if the father doesn't have property in Spain, or if he does, to have it in that same region or another cheaper inheritance tax region.”

Case 3

“Another scenario is a British father residing in Spain, with a great fortune in Spain and/or somewhere else in the world.

“It will be better for his heirs if he chooses to live in a cheap inheritance tax region (Madrid, Andalusia for example) because upon his death those inheritance regulations from his cheap region will apply, and it will not matter if your children or heirs live in Spain - in an expensive or cheap community - or anywhere else in the world.”

READ ALSO:

- Five things you need to know about inheritance tax in Spain

- What does a gestor do and why you'll probably need one in Spain

A silver lining for British non-residents in Spain as Brexit approaches

The Local recently wrote about how non-resident Britons who let out properties in Spain could see their IRNR tax triple after Brexit as they will no longer be considered EU residents by Spanish tax authorities.

It’s a measure considered “absurd and unfair” by del Campo, but at least the same will not apply to inheritance tax once the Brexit transition period is officially over on December 31st 2020.

“The European Court of Justice put an end to the brutal discrimination relating to Spanish inheritance tax, since inheritance tax for non-residents (whether the deceased or the heir, or both), were up to 34 percent and they couldn’t apply for regional tax benefits,” he told The Local.

In 2018 Spain’s Supreme Court published a ruling confirming that these Spanish succession and gift tax rules breached the free movement of capital protected by the EU Treaty with regard to non-residents.

“This means that when the British become non-EU for tax purposes, they will still be able to apply for these important benefits in the Spanish Inheritance Tax,” del Campo explains.

A couple looks at the view of Barcelona. Photo: Tiburi/Pixabay

A couple looks at the view of Barcelona. Photo: Tiburi/Pixabay

“This applies whether it is an inheritance from a father residing in the United Kingdom for a son who’s a resident in Spain, or an inheritance from a father who’s a resident in Spain for a son residing in the UK.

“And also if it is an inheritance of assets located in Spain (for example, real estate) between family members all residing in the United Kingdom”.

If you are fluent in Spanish and understand the country’s tax system, you can read in detail about 2020’s regional tax differences in Spain here.

Otherwise if you have a connection to Spain – whether it’s assets, you live there or one of your heirs does – consider contacting an English-speaking fiscal advisor with experience helping international clients to get help for your particular situation.

READ ALSO:

- Brexit: The money matters Brits in Spain need to consider

- Brexit: How much money will Britons in Spain need to be legally resident?

.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.