The real cost of buying a house in Spain as a foreigner

So you’ve been dreaming of relocating to Spain and have heard that Spain is full of affordable property, whether you are looking for a rural renovation project, a city apartment or a holiday home by the sea.

Yes, it’s true that you can pick up an entire abandoned village in northern Spain or a Valencia property for less than the price of a two-bedroom flat in London.

But even without undertaking major renovation work, you must bear in mind that the sale price of a house obviously isn't the total cost of buying a home.

And if you're a foreigner buying property here you may be understandably wary of hidden costs and charges cropping up, from taxes to agency commissions to legal fees.

So to light the way, we've got a guide to the real costs of buying a house in Spain as a foreigner from real estate expert Graham Hunt of Valencia Property.

READ MORE:

- Property in Spain: What can you buy in Valencia for €150K?

- Property in Spain: The six Spanish villages that cost less than a two-bedroom flat in Madrid or Barcelona

Photo: AFP

Property Tax

This depends on whether you are buying a new home or a second-hand home.

The first, when you buy property on the market for the first time, is subject to VAT which on property in Spain is 10 percent across the board (apart from the Canaries where it is 7percent).

But if you are buying a home that is being resold (as in it isn't the first time the property has gone on the market) then you must pay the transfer tax, known in Spain as Impuesto sobre Transmisiones Patrimoniales or ITP for short.

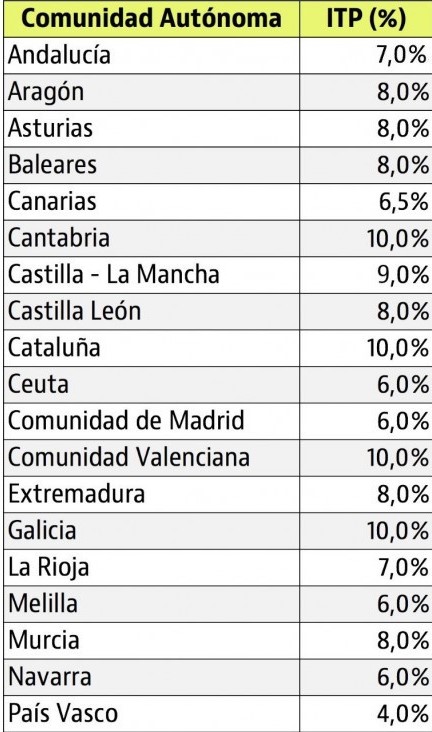

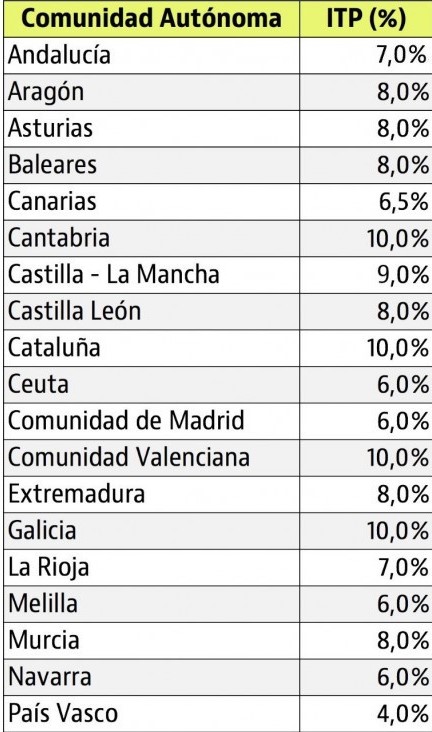

The amount of this tax will depend on the region in which you are buying the property which are set by each of Spain’s 17 autonomous regions.

Across Spain ITP on buying a property ranges from between 4 percent and 10 percent in 2021.

For example in Valencia, the tax is 10 percent across the board for new builds or resale properties.

(In very rare cases you have to pay 21 percent, when the property is considered a business premises – be careful with anything described as a “loft”).

See the rate according to region in chart below:

Data from Idealista.

That tax is usually paid along with the following costs to the notary on completion of purchase.

Beware of being tempted to under-declare the real price of the property, a practice that was once widespread and occasionally sellers will still ask a buyer to do this in an attempt to keep down their own Capital Gains Tax.

Firstly, it is illegal and authorities have been clamping down on it by chasing people to pay tax equivalent to the average price of such a property regardless of what you declare you have paid for it.

Secondly, when you come to selling the property down the line it could massively increase your own Capital Gains Tax.

Registry, Notary and Gestor costs

You pay the Notary to make sure there are no debts on the property and that all of the previously checked paperwork – work that should have been carried out by your lawyer (see below) - is still valid on the day of sale.

You pay the property registry to make sure the property is transferred into your name correctly after the purchase

You pay the Gestor to do the legwork to make sure that all of the papers from the Notary’s office get to the right places in the time period allowed and the above taxes get paid correctly.

All of these costs are made in one payment at the Notary’s office or in the days following the sale to the account provided by the Notary. The Notary makes sure that all payments are made correctly from that single amount and that the tax is paid within the 30 day time period allowed. At the end of the process the Notary or your lawyer will inform you that you can come in and pick up the finalized paperwork where all of the costs will be attached in detail.

The costs of these services usually come to just under 1percent of the sale price.

Find your dream home in Spain on The Local's Property page, with hundreds of listings available

Estate Agency Commission

Photo: AFP

Again this varies from region to region and often from estate agent to estate agent. But as a guide, estate agencies in Valencia typically charge 3 percent to both parties, buyer and seller.

Sometimes you may be told you don’t have to pay anything to the agent, but believe me you do… The cost of the estate agent will be factored into the sale price and the agency isn’t working for you in those cases.

They are doing everything they can to maximise the price received for the owner, the person paying them. Inevitably you finish up paying a higher price in those cases.

Equally, if you are buying from a developer many times there will not be an agency fee, developers attract estate agencies by offering them higher commissions or in some cases developers have their own agency to sell their promotions.

The only exceptions to this is if you are buying properties directly from a bank. Banks also have their own estate agencies now. Generally they are worse than useless, unable to find keys, unable to answer questions regarding the property, unable to get an answer to any offer you might make and crucially not doing any searches to help you purchase safely as they are working for the owner, the bank. Many people find that after buying from a bank and trusting the bank there are legal issues to the property which haven’t been sorted because the property came into the bank’s hands originally through a flawed repossession process.

READ ALSO:

- How to stop squatters from moving into your empty home in Spain

- EXPLAINED: How Brexit will affect your plans to buy a property in Spain

Legal Fees For Conveyancing

Let’s get this straight, you should be using an independent lawyer when buying property in Spain. Always.

The Notary checks the paperwork again on the day of the signing but your lawyer should be checking all the paperwork is in order before you put down any money as a deposit. If you don’t take this step then you might well wave goodbye to your deposit.

Legal costs can be anything from €800 for simple conveyancing but most lawyers charge up to the maximum allowed cost of 1 percent on purchases over 100k, they will also have a minimum on lower cost properties.

Architect and Survey Costs

If you are buying a villa then it is advisable to get a surveyor or architect round to check out the property for issues. This cost comes before you make a deposit and is paid upfront. This cost can be anything from €400 for a basic walkthrough report up to thousands for larger villas and a full report. Spanish architects provide this service but we also have RICS Surveyors who can do a full report. Ask for details.

Mortgage Fees and Valuations

If you are purchasing a property with a mortgage then you will have fees to cover from the bank for giving you the mortgage Read more about thise fees HERE .

The good news is that mortgage lenders now have to cover the costs of supplying the mortgage deeds at the notary, a cost previously placed on the buyer.

However you may have to get a mortgage using a broker. This is generally a good idea as they work with all of the banks and will get you a much better deal generally than you will be able to get yourself walking into a bank off the street

Interest rates are really low currently so getting a mortgage may well be a good idea even when you don’t particularly need one. It can help you to cover the fees involved in purchase at a very low interest rate. Fees for the service of a mortgage broker start at around €495 Euros and it is paid upfront after you get your pre approval from an initial study.

Remember too that you will be asked to pay the fee for the valuation by the bank in order to give you the mortgage and that is a percentage of the valuation but standard valuations cost around €300-400. You will be asked to deposit this money before the valuer goes around to visit the property.

READ ALSO:

- How Spain's new mortgage laws could affect homeowners

- Where in Spain is it easiest and hardest to repay a mortgage?

Bank Costs

To complete the purchase of a property in Spain you take along a bank draft to the Notary’s office and swap it for the keys with the owner. This bank draft will cost you money and that amount can be a lot, anything up to 1 percent or more in some banks.

You can avoid the vast majority of this cost by arranging beforehand to use the services of a Currency Company to transfer your money into the bank and making sure the bank are clear about how much they will charge for the drawing up of the drafts.

To sum up:

In total a typical purchase of property in Spain will cost you whatever you pay plus between 10 and 15 percent depending on the regional set property tax.

Your ongoing costs such as property taxes, community fees, council taxes for rubbish collection etc… are really low meaning once you stump up the money for the initial cost your ongoing costs are low so make sure to factor in both areas into your calculations.

Other areas of Spain have a different initial tax on purchase as the tax on resale properties is levied at a regional level and this can vary from an exceptional 4% in certain regions for social housing up to 11% for luxury properties in other areas such as Extremadura.

While Valencia has a flat rate of 10 percent, the Balearic and Canary Islands have bands from 6 percent to 10 percent depending on the value of the property.

In some areas of Spain the seller pays the agency fees meaning it is factored into the price. We have heard of 8-10 percent of the price going to the agencies in other areas and an exceptional 12 percent in one case.

Remember as a buyer even if you are not being charged directly by the agent, they are not working for you and YOU PAY THIS!

If you are going to use an agency always use a buyers’ agent rather than an agent who says they are not charging you anything. It’s worth it.

Graham Hunt is a real estate agent and relocation expert based in Valencia. Originally from just outside Liverpool he came to Spain as a student and never left. Read more at his blog or follow him on Twitter. If you want him to show you around some properties in Valencia, drop him a line.

READ MORE:

- Buying a property in Spain: What to do and what to avoid

- Property: Where in Spain are house prices expected to fall?

Comments

See Also

Yes, it’s true that you can pick up an entire abandoned village in northern Spain or a Valencia property for less than the price of a two-bedroom flat in London.

But even without undertaking major renovation work, you must bear in mind that the sale price of a house obviously isn't the total cost of buying a home.

And if you're a foreigner buying property here you may be understandably wary of hidden costs and charges cropping up, from taxes to agency commissions to legal fees.

So to light the way, we've got a guide to the real costs of buying a house in Spain as a foreigner from real estate expert Graham Hunt of Valencia Property.

READ MORE:

- Property in Spain: What can you buy in Valencia for €150K?

- Property in Spain: The six Spanish villages that cost less than a two-bedroom flat in Madrid or Barcelona

Photo: AFP

Property Tax

This depends on whether you are buying a new home or a second-hand home.

The first, when you buy property on the market for the first time, is subject to VAT which on property in Spain is 10 percent across the board (apart from the Canaries where it is 7percent).

But if you are buying a home that is being resold (as in it isn't the first time the property has gone on the market) then you must pay the transfer tax, known in Spain as Impuesto sobre Transmisiones Patrimoniales or ITP for short.

The amount of this tax will depend on the region in which you are buying the property which are set by each of Spain’s 17 autonomous regions.

Across Spain ITP on buying a property ranges from between 4 percent and 10 percent in 2021.

For example in Valencia, the tax is 10 percent across the board for new builds or resale properties.

(In very rare cases you have to pay 21 percent, when the property is considered a business premises – be careful with anything described as a “loft”).

See the rate according to region in chart below:

Data from Idealista.

That tax is usually paid along with the following costs to the notary on completion of purchase.

Beware of being tempted to under-declare the real price of the property, a practice that was once widespread and occasionally sellers will still ask a buyer to do this in an attempt to keep down their own Capital Gains Tax.

Firstly, it is illegal and authorities have been clamping down on it by chasing people to pay tax equivalent to the average price of such a property regardless of what you declare you have paid for it.

Secondly, when you come to selling the property down the line it could massively increase your own Capital Gains Tax.

Registry, Notary and Gestor costs

You pay the Notary to make sure there are no debts on the property and that all of the previously checked paperwork – work that should have been carried out by your lawyer (see below) - is still valid on the day of sale.

You pay the property registry to make sure the property is transferred into your name correctly after the purchase

You pay the Gestor to do the legwork to make sure that all of the papers from the Notary’s office get to the right places in the time period allowed and the above taxes get paid correctly.

All of these costs are made in one payment at the Notary’s office or in the days following the sale to the account provided by the Notary. The Notary makes sure that all payments are made correctly from that single amount and that the tax is paid within the 30 day time period allowed. At the end of the process the Notary or your lawyer will inform you that you can come in and pick up the finalized paperwork where all of the costs will be attached in detail.

The costs of these services usually come to just under 1percent of the sale price.

Find your dream home in Spain on The Local's Property page, with hundreds of listings available

Estate Agency Commission

Photo: AFP

Again this varies from region to region and often from estate agent to estate agent. But as a guide, estate agencies in Valencia typically charge 3 percent to both parties, buyer and seller.

Sometimes you may be told you don’t have to pay anything to the agent, but believe me you do… The cost of the estate agent will be factored into the sale price and the agency isn’t working for you in those cases.

They are doing everything they can to maximise the price received for the owner, the person paying them. Inevitably you finish up paying a higher price in those cases.

Equally, if you are buying from a developer many times there will not be an agency fee, developers attract estate agencies by offering them higher commissions or in some cases developers have their own agency to sell their promotions.

The only exceptions to this is if you are buying properties directly from a bank. Banks also have their own estate agencies now. Generally they are worse than useless, unable to find keys, unable to answer questions regarding the property, unable to get an answer to any offer you might make and crucially not doing any searches to help you purchase safely as they are working for the owner, the bank. Many people find that after buying from a bank and trusting the bank there are legal issues to the property which haven’t been sorted because the property came into the bank’s hands originally through a flawed repossession process.

READ ALSO:

- How to stop squatters from moving into your empty home in Spain

- EXPLAINED: How Brexit will affect your plans to buy a property in Spain

Legal Fees For Conveyancing

Let’s get this straight, you should be using an independent lawyer when buying property in Spain. Always.

The Notary checks the paperwork again on the day of the signing but your lawyer should be checking all the paperwork is in order before you put down any money as a deposit. If you don’t take this step then you might well wave goodbye to your deposit.

Legal costs can be anything from €800 for simple conveyancing but most lawyers charge up to the maximum allowed cost of 1 percent on purchases over 100k, they will also have a minimum on lower cost properties.

Architect and Survey Costs

If you are buying a villa then it is advisable to get a surveyor or architect round to check out the property for issues. This cost comes before you make a deposit and is paid upfront. This cost can be anything from €400 for a basic walkthrough report up to thousands for larger villas and a full report. Spanish architects provide this service but we also have RICS Surveyors who can do a full report. Ask for details.

Mortgage Fees and Valuations

If you are purchasing a property with a mortgage then you will have fees to cover from the bank for giving you the mortgage Read more about thise fees HERE .

The good news is that mortgage lenders now have to cover the costs of supplying the mortgage deeds at the notary, a cost previously placed on the buyer.

However you may have to get a mortgage using a broker. This is generally a good idea as they work with all of the banks and will get you a much better deal generally than you will be able to get yourself walking into a bank off the street

Interest rates are really low currently so getting a mortgage may well be a good idea even when you don’t particularly need one. It can help you to cover the fees involved in purchase at a very low interest rate. Fees for the service of a mortgage broker start at around €495 Euros and it is paid upfront after you get your pre approval from an initial study.

Remember too that you will be asked to pay the fee for the valuation by the bank in order to give you the mortgage and that is a percentage of the valuation but standard valuations cost around €300-400. You will be asked to deposit this money before the valuer goes around to visit the property.

READ ALSO:

- How Spain's new mortgage laws could affect homeowners

- Where in Spain is it easiest and hardest to repay a mortgage?

Bank Costs

To complete the purchase of a property in Spain you take along a bank draft to the Notary’s office and swap it for the keys with the owner. This bank draft will cost you money and that amount can be a lot, anything up to 1 percent or more in some banks.

You can avoid the vast majority of this cost by arranging beforehand to use the services of a Currency Company to transfer your money into the bank and making sure the bank are clear about how much they will charge for the drawing up of the drafts.

To sum up:

In total a typical purchase of property in Spain will cost you whatever you pay plus between 10 and 15 percent depending on the regional set property tax.

Your ongoing costs such as property taxes, community fees, council taxes for rubbish collection etc… are really low meaning once you stump up the money for the initial cost your ongoing costs are low so make sure to factor in both areas into your calculations.

Other areas of Spain have a different initial tax on purchase as the tax on resale properties is levied at a regional level and this can vary from an exceptional 4% in certain regions for social housing up to 11% for luxury properties in other areas such as Extremadura.

While Valencia has a flat rate of 10 percent, the Balearic and Canary Islands have bands from 6 percent to 10 percent depending on the value of the property.

In some areas of Spain the seller pays the agency fees meaning it is factored into the price. We have heard of 8-10 percent of the price going to the agencies in other areas and an exceptional 12 percent in one case.

Remember as a buyer even if you are not being charged directly by the agent, they are not working for you and YOU PAY THIS!

If you are going to use an agency always use a buyers’ agent rather than an agent who says they are not charging you anything. It’s worth it.

Graham Hunt is a real estate agent and relocation expert based in Valencia. Originally from just outside Liverpool he came to Spain as a student and never left. Read more at his blog or follow him on Twitter. If you want him to show you around some properties in Valencia, drop him a line.

READ MORE:

- Buying a property in Spain: What to do and what to avoid

- Property: Where in Spain are house prices expected to fall?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.