English Actually: Memoirs of an English teacher in Spain

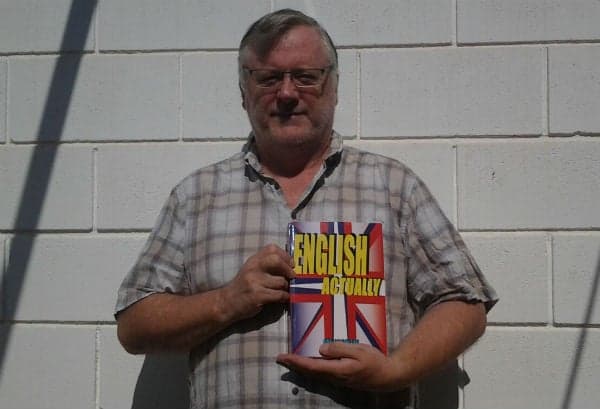

For forty years, Bob Yareham (who was born in Hackney North in 1954) has taught English as a foreign language, mainly in Valencia, a challenge that involves explaining, for what seems like the millionth time, that “yes, ‘bare’ is pronounced like ‘bear’ and ‘queue’ is no different from ‘q’.

Too, two and to are the same too my friend, and ‘if I were’ is not really the simple past, it’s the subjunctive, which exasperatingly doesn’t actually exist in English.

A double negative is positive for the 30,000th time, and I don’t care if Sir Mick Jagger can’t get no satisfaction.

Those 40 years haven’t all been a bed of roses (a pretty uncomfortable metaphor when you consider all the thorns).

I can remember very clearly the first time I became aware of the English language as an objective reality. It was in the summer of 1978 in Reading when I noticed that a lot of English verbs suddenly adopt an –ed at the end when you’re talking about the past.

It was I suppose unfortunate that this moment of blinding clarity should have come ten minutes into my first ever lesson as a teacher of English as a foreign language, and not before.

Fortunately, people can be kind, even students, and I was helped through the rest of the lesson, and the rest of the course in fact, by the intelligent suggestions and observations of the very people who were paying serious money to learn from me; as if ‘native speaker’ were a bonafide profession.

Speaking a language fluently doesn’t necessarily mean that you have the slightest idea of how it works, but languages have structure, and they have history, and their words and expressions tell stories.

I’ve been teaching English for some time now since that day in 1978, and I think I might be getting better.

READ ALSO: The things I miss most about teaching in Madrid

The English language is a thing of great beauty and it still manages to surprise and delight me. I’ve become a bit of an etymologist over the years, and one of those insufferable bores at parties who interrupts a perfectly interesting conversation that actually has a topic to say: “did you know…..?” and then prattles on about how Wednesday has a D in it because it was originally Woden’s day, or that ‘sandwich’ is actually an eponym actually.

Being born English has been a happy accident for me, allowing me to earn a reasonable living without ever having had to actually possess talent or develop any practical skills other than those of dissembling, subterfuge and obfuscation.”

The book inevitably contains references to my classes and contains some classic student errors such as “the chicken we eat today is not as good as the chicken that ate my parents”.

In the book you can discover why we ‘boycott’ an event, whether or not strawberries contain straw and why breakfast is a ‘fast’ food.

I describe learning English as something like trying to ‘put a saddle on a swarm of angry bees’.

For those who enjoy English, or for the vast majority who grudgingly accept its importance, this is the book for you. English need no longer be a mystery, it can become a conundrum instead.

English Actually reveals a number of secrets, such as why a windfall is called a windfall, why a grapefruit, which looks nothing like a grape actually does, or how nicotine is related to an obscure French diplomat.

You could of course look these things up in any etymology dictionary, but that would be cheap and unadventurous.

‘Actually’ is in reality a false friend, looking as it does like the Spanish word ‘actualmente’ but meaning something different. False friends are great fun, and are responsible for many Spaniards having unpleasant surprises when they ask innocently for preservatives or “something for a constipation” in a British Chemist’s.

Bob Yareham has published various methodological books on teaching English as well as a book about English language films Made in Spain and the disturbing presence of dragons in Valencian architecture.

His latests, English Actually, is available in paperback or as an e-book, and is published by the Valencian publisher Obrapropia. Order your copy here.

Contact the author: [email protected]

Comments

See Also

Too, two and to are the same too my friend, and ‘if I were’ is not really the simple past, it’s the subjunctive, which exasperatingly doesn’t actually exist in English.

A double negative is positive for the 30,000th time, and I don’t care if Sir Mick Jagger can’t get no satisfaction.

Those 40 years haven’t all been a bed of roses (a pretty uncomfortable metaphor when you consider all the thorns).

I can remember very clearly the first time I became aware of the English language as an objective reality. It was in the summer of 1978 in Reading when I noticed that a lot of English verbs suddenly adopt an –ed at the end when you’re talking about the past.

It was I suppose unfortunate that this moment of blinding clarity should have come ten minutes into my first ever lesson as a teacher of English as a foreign language, and not before.

Fortunately, people can be kind, even students, and I was helped through the rest of the lesson, and the rest of the course in fact, by the intelligent suggestions and observations of the very people who were paying serious money to learn from me; as if ‘native speaker’ were a bonafide profession.

Speaking a language fluently doesn’t necessarily mean that you have the slightest idea of how it works, but languages have structure, and they have history, and their words and expressions tell stories.

I’ve been teaching English for some time now since that day in 1978, and I think I might be getting better.

READ ALSO: The things I miss most about teaching in Madrid

The English language is a thing of great beauty and it still manages to surprise and delight me. I’ve become a bit of an etymologist over the years, and one of those insufferable bores at parties who interrupts a perfectly interesting conversation that actually has a topic to say: “did you know…..?” and then prattles on about how Wednesday has a D in it because it was originally Woden’s day, or that ‘sandwich’ is actually an eponym actually.

Being born English has been a happy accident for me, allowing me to earn a reasonable living without ever having had to actually possess talent or develop any practical skills other than those of dissembling, subterfuge and obfuscation.”

The book inevitably contains references to my classes and contains some classic student errors such as “the chicken we eat today is not as good as the chicken that ate my parents”.

In the book you can discover why we ‘boycott’ an event, whether or not strawberries contain straw and why breakfast is a ‘fast’ food.

I describe learning English as something like trying to ‘put a saddle on a swarm of angry bees’.

For those who enjoy English, or for the vast majority who grudgingly accept its importance, this is the book for you. English need no longer be a mystery, it can become a conundrum instead.

English Actually reveals a number of secrets, such as why a windfall is called a windfall, why a grapefruit, which looks nothing like a grape actually does, or how nicotine is related to an obscure French diplomat.

You could of course look these things up in any etymology dictionary, but that would be cheap and unadventurous.

‘Actually’ is in reality a false friend, looking as it does like the Spanish word ‘actualmente’ but meaning something different. False friends are great fun, and are responsible for many Spaniards having unpleasant surprises when they ask innocently for preservatives or “something for a constipation” in a British Chemist’s.

Bob Yareham has published various methodological books on teaching English as well as a book about English language films Made in Spain and the disturbing presence of dragons in Valencian architecture.

His latests, English Actually, is available in paperback or as an e-book, and is published by the Valencian publisher Obrapropia. Order your copy here.

Contact the author: [email protected]

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.