What's on in Spain: June 2018

Summer has officially arrived, and Spaniards are celebrating around the country with a month of fiestas, music and sport. From a wine battle in rural La Rioja to a music festival in a 15th century monastery, The Local has rounded up some of the highlights.

San Juan bonfires, June 23rd

Photo: AFP

The beginning of summer is celebrated around Spain from June 23rd with several nights of roaring fires, food and drink. Every region has its own San Juan traditions, but the biggest of these events takes place in Alicante, where people flock to the streets for a huge fiesta of music, dancing and fireworks.

Madrid Orgullo, June 28th-July 8th

Photo: AFP

The famous parade isn’t until July 8th, but Spain’s biggest gay pride event kicks off on June 28th, with a schedule of art and cultural events, sporting activities and open air concerts all taking place in and around the Chueca neighbourhood of Madrid.

Batalla del Vino, La Rioja June 29th

Photo: AFP

On the morning of June 29th, to celebrate the feast of San Pedro, participants gather in the town of Haro in La Rioja to soak each other with thousands of litres of wine, in a tradition that dates back to the sixth century when pilgrims to the region would indulge in a feast after mass with copious amounts of wine.

Granada International Festival of Music and Dance, June 22nd-July 8th

Dating back to the late 19th century, this historic event takes in performances in breathtaking venues from symphonic orchestras, ballet troupes and theatre companies in the Andalusian city of Granada.

UVA festival, Ronda, Andalusia June 8th-11th

Beautiful Ronda. Photo: sepavone/Depositphotos

This hidden gem of a house and disco festival in the picturesque city of Ronda takes place in Descalzos Viejos, a stunning converted fifteenth century monastery, and its capacity of just 500 people makes for an intimate and unique experience missing from more popular festivals.

Sónar, Barcelona, June 14th-16th

LCD Soundsystem are playing this year. Sonar. Photo: Sonar

Barcelona’s world renowned festival of cutting edge electronic music returns on June 14th, celebrating its 25th birthday with performances from some of the world’s leading forward-thinking artists. Headliners this year include Gorillaz, Richie Hawtin and Thom Yorke. Be sure too to look out for the legendary ‘Off-Sónar’parties that occur around the city every year to coincide with the festival.

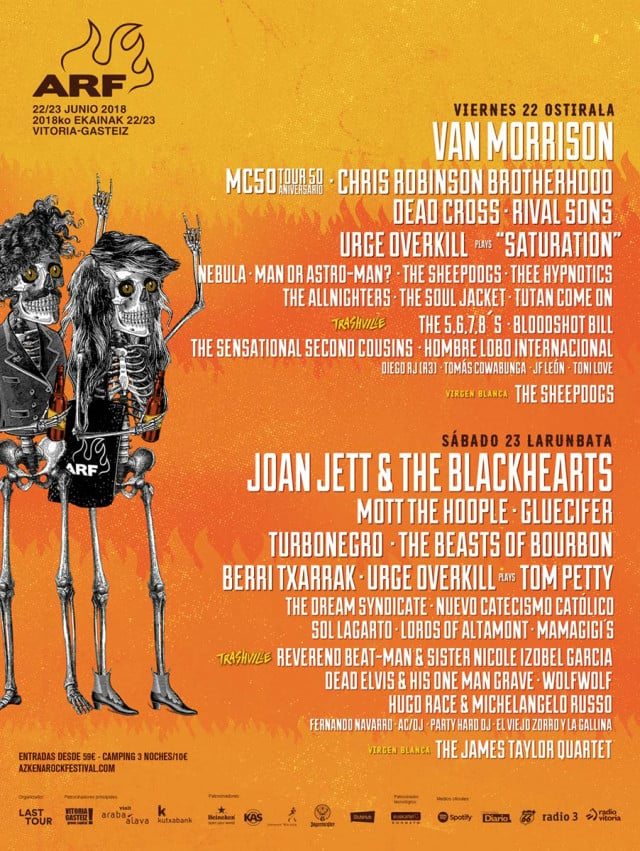

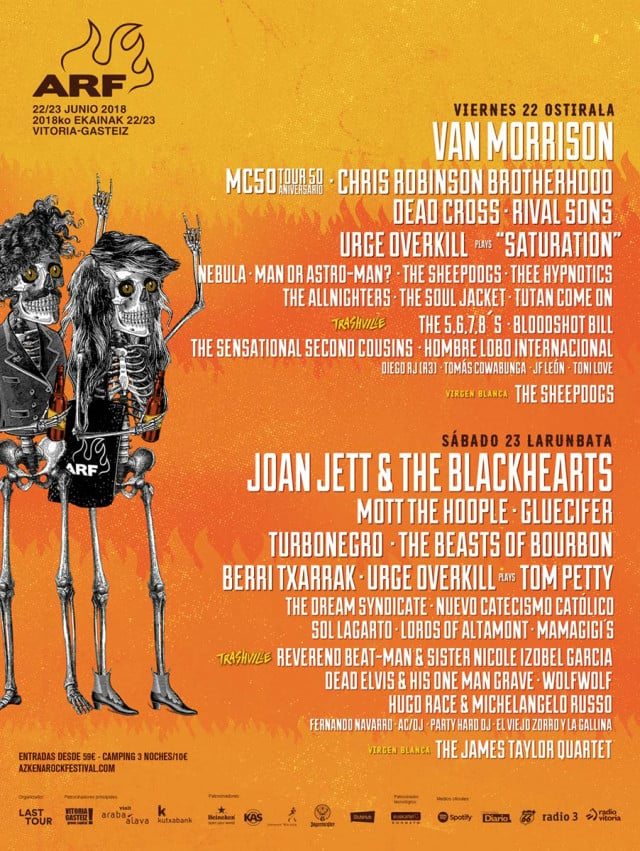

Azkena Rock Festival, Basque Country. June 22nd-23rd

The annual two-day rock music festival in the Basque Country has consistently offered stellar line-ups, with this year’s roster including Van Morrison, Joan Jett & the Blackhearts and Mott the Hoople.

SPORT

The “Quebrantahuesos”, Sabiñánigo in Aragon June 23rd

This year Sabiñánigoin northern Spain plays host to the Quebrantahuesos, a 205km bike race through the punishing mountain passages of the Pyrenees. The name translates to “bone breaker”, an appropriate description for the brutal conditions of Spain’s biggest Gran Fondo.

Catalan Motorcycle Grand Prix, Barcelona, June 15th-17th

Photo: AFP

Fans of MotoGP should head to Barcelona on June 15th, where the Gran Premi Monster Energy de Catalunya takes place at the revered Circuit de Barcelona-Catalunya just north of the city.

List compiled by Rory Jones

READ ALSO: Ten things that only happen in Spain when summer arrives

Comments

See Also

San Juan bonfires, June 23rd

Photo: AFP

The beginning of summer is celebrated around Spain from June 23rd with several nights of roaring fires, food and drink. Every region has its own San Juan traditions, but the biggest of these events takes place in Alicante, where people flock to the streets for a huge fiesta of music, dancing and fireworks.

Madrid Orgullo, June 28th-July 8th

Photo: AFP

The famous parade isn’t until July 8th, but Spain’s biggest gay pride event kicks off on June 28th, with a schedule of art and cultural events, sporting activities and open air concerts all taking place in and around the Chueca neighbourhood of Madrid.

Batalla del Vino, La Rioja June 29th

Photo: AFP

On the morning of June 29th, to celebrate the feast of San Pedro, participants gather in the town of Haro in La Rioja to soak each other with thousands of litres of wine, in a tradition that dates back to the sixth century when pilgrims to the region would indulge in a feast after mass with copious amounts of wine.

Granada International Festival of Music and Dance, June 22nd-July 8th

Dating back to the late 19th century, this historic event takes in performances in breathtaking venues from symphonic orchestras, ballet troupes and theatre companies in the Andalusian city of Granada.

UVA festival, Ronda, Andalusia June 8th-11th

Beautiful Ronda. Photo: sepavone/Depositphotos

This hidden gem of a house and disco festival in the picturesque city of Ronda takes place in Descalzos Viejos, a stunning converted fifteenth century monastery, and its capacity of just 500 people makes for an intimate and unique experience missing from more popular festivals.

Sónar, Barcelona, June 14th-16th

LCD Soundsystem are playing this year. Sonar. Photo: Sonar

Barcelona’s world renowned festival of cutting edge electronic music returns on June 14th, celebrating its 25th birthday with performances from some of the world’s leading forward-thinking artists. Headliners this year include Gorillaz, Richie Hawtin and Thom Yorke. Be sure too to look out for the legendary ‘Off-Sónar’parties that occur around the city every year to coincide with the festival.

Azkena Rock Festival, Basque Country. June 22nd-23rd

The annual two-day rock music festival in the Basque Country has consistently offered stellar line-ups, with this year’s roster including Van Morrison, Joan Jett & the Blackhearts and Mott the Hoople.

SPORT

The “Quebrantahuesos”, Sabiñánigo in Aragon June 23rd

This year Sabiñánigoin northern Spain plays host to the Quebrantahuesos, a 205km bike race through the punishing mountain passages of the Pyrenees. The name translates to “bone breaker”, an appropriate description for the brutal conditions of Spain’s biggest Gran Fondo.

Catalan Motorcycle Grand Prix, Barcelona, June 15th-17th

Photo: AFP

Fans of MotoGP should head to Barcelona on June 15th, where the Gran Premi Monster Energy de Catalunya takes place at the revered Circuit de Barcelona-Catalunya just north of the city.

List compiled by Rory Jones

READ ALSO: Ten things that only happen in Spain when summer arrives

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.